FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Financial Statements from the End-of-Period Spreadsheet

Demo Consulting is a consulting firm owned and operated by Jesse Flatt. The following end-of-period spreadsheet was prepared for the year ended August 31, 20Y9:

| Demo Consulting | ||||||||

| End-of-Period Spreadsheet | ||||||||

| For the Year Ended August 31, 20Y9 | ||||||||

| Unadjusted | Adjusted | |||||||

| Adjustments | Trial Balance | |||||||

| Account Title | Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | ||

| Cash | 12,470 | 12,470 | ||||||

| 29,690 | 29,690 | |||||||

| Supplies | 3,150 | 2,640 | 510 | |||||

| Land | 25,240 | 25,240 | ||||||

| Office Equipment | 23,750 | 23,750 | ||||||

| 3,300 | 1,570 | 4,870 | ||||||

| Accounts Payable | 8,020 | 8,020 | ||||||

| Salaries Payable | 390 | 390 | ||||||

| Common Stock | 10,000 | 10,000 | ||||||

| 20,280 | 20,280 | |||||||

| Dividends | 3,860 | 3,860 | ||||||

| Fees Earned | 80,610 | 80,610 | ||||||

| Salary Expense | 21,670 | 390 | 22,060 | |||||

| Supplies Expense | 2,640 | 2,640 | ||||||

| Depreciation Expense | 1,570 | 1,570 | ||||||

| Miscellaneous Expense | 2,380 | 2,380 | ||||||

| 122,210 | 122,210 | 4,600 | 4,600 | 124,170 | 124,170 |

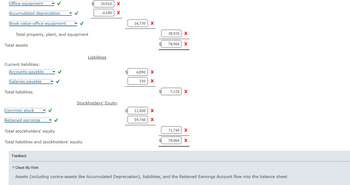

Transcribed Image Text:Office equipment

Accumulated depreciation

Book value-office equipment

Total property, plant, and equipment

Total assets

Current liabilities:

Accounts payable

Salaries payable

Total liabilities

Common stock

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

Feedback

20,910 X

-4,180 X

Liabilities

Stockholders' Equity

16,730 X

6,890 X

330 X

12,000 X

59,740 X

$

38,920 X

78,960 X

7,220 X

71,740 X

78,960 X

✓ Check My Work

Assets (including contra-assets like Accumulated Depreciation), liabilities, and the Retained Earnings Account flow into the balance sheet.

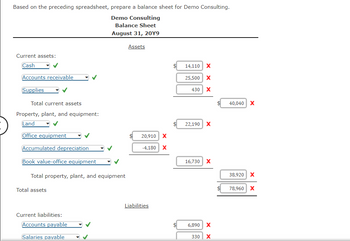

Transcribed Image Text:Based on the preceding spreadsheet, prepare a balance sheet for Demo Consulting.

Demo Consulting

Balance Sheet

August 31, 20Y9

Current assets:

Cash

Accounts receivable

Supplies

✓

Total current assets

Property, plant, and equipment:

Land

Office equipment

Accumulated depreciation

Book value-office equipment

✓

Total assets

Total property, plant, and equipment

Current liabilities:

Accounts payable

Salaries payable

✓

Assets

20,910 X

-4,180 X

Liabilities

14,110 X

25,500 X

430 X

22,190 X

16,730 X

6,890 X

330 X

40,040 X

38,920 X

78,960 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please help me provide complete and correct answer for all requirements with all working for all parts answer in text please answer correct please remember answer all requirements or skip /leave for other expert thanks million thanks please double underline need answer for all requirements or skip please do not waste time or question by giving incomplete or incorrect answer please no copy paste from other answerarrow_forward23. Prepare closing entries rom the following end-of period spreadsheet. Austin Entergrises Fadof Peried Spreadsheet For the Year Eaded December JI Adnted Trial Balance Credit Income Statement Debt Balance Sheet Deb 26.500 7000 Account Titie Crede Debit Crede 26,500 7,000 1,000 18300 Cash Accounts Receivable Supplies Equipment Accumalated Depr 18.500 5.000 5.000 Accoures Payabie Wages Payable Common Stock Retained arnings Dividends Eees Earmed Wages Eapense Rest Esgeme Depreciation Eapense Toals Net omeLo) 11,000 100 6.000 2.000 1000 1,000 6.000 2.000 2.000 2,000 59.500 59.500 19,000 7.000 3.00 19000 7000 3.300 .500 .500 29,500 20.0 59.500 5.000 25,000 20.000arrow_forwardit View History M faith@.. tems 37.66% ··· Bookmarks Window AOL Ma.... B E C eBook U Sales Mail - F... Cost of goods sold Help Operating income Expenses: Selling expenses Administrative expenses The following multiple-step, income statement was prepared for Carlsbad Company contains errors: CARLSBAD COMPANY Income Statement For the Year Ended February 28, 2018 Delivery expense Total expenses Other expense: Interest revenue Gross profit R V Portal h... Check My Work 10 more Check My Work uses remaining. % G Chapter... B v2.cengagenow.com Prepare a corrected income statement for Carlsbad Company for the year ended February 28, 2018. Carlsbad Company Income Statement 6 $ 1,800,000 1,350,000 112,500 H C Cengag.. 9,495,000 (5,962,500) $3,532,500 (3,262,500) 270,000 90,000 $180,000 All work saved. N MacBook Pro ** W Activity... 8 M FA 9 K Save and Exit Submit Assignment for Grading 1arrow_forward

- The following selected data were taken from the financial statements of Vidahill incarrow_forwardHome Insert Page Layout Formulas Data Review View Help - 10 - A A Insert v Σ Arial ab General EXDelete v BIU $- % 9 0 0 Conditional Format as Cell Sort & Formatting Table - Styles v Format v Filter oard Font Alignment Number Styles Cells Editing fr C D H. The following amounts summarize the financial position of Little Black Dog Inc. on May 31, 2021: В F G IJK L M N O P Q R S V W Assets Liabilities Shareholders' Equity %D Cash + Accounts Computers + + Supplies + Land Accounts + Note Salaries + Interest Common + Retained Receivable (net) Payable Payable Payable Payable Shares Earnings Balance 1820 700 70 8400 5600 2800 2590 During June 2021, the business completed these transactions: June 1: Received cash of $6300 and issued common shares. June 1: Bought two computers for a total of $5600 by paying $1400 down and signing a note payable for the rest. Interest of 5% to be paid with the note payable on June 1, 2022. The computers are expected to last 5 years. June 5: Performed services for…arrow_forwardIn the account below, calculate the balance for September 16, 20-. Then perform the forwarding procedures required to start a new account page. 3. Account: A/R – Manitoba Equipment Co. No. 211 Date(2021) PARTICULARS P.R. DEBIT CREDIT Dr/Cr BALANCE Aug 15 J22 1,600 00 Sep 4 J26 825 00 16 Ј30 176 00 Асcount: No. Date2021) PARTICULARS P.R. DEBIT CREDIT Dr/Cr BALANCEarrow_forward

- Please answer within the format with detailed working, please answer in text form (without image)arrow_forwardAccounting Homeworkarrow_forwardWeygandt, Accounting Principles, 13th Edition, Custom WileyPLUS Course for Bronx Community College Help I System Announcements CALCULATOR PRINTER VERSION 4 ВАСК NEX Exercise 9-04 a-f (Part Level Submission) At the beginning of the current period, Cheyenne had balances in Accounts Receivable of $286,000 and in Allowance for Doubtful Accounts of $9,900 (credit). During the period, had net credit sales of $890,000 and collections of $845,500. It wrote off as uncollectible accounts receivable of $6,000. However, a $4,000 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $24,800 at the end of the period. (Omit cost of goods sold entries. (a - d) (a) Prepare the entries to record sales and collections during the period. (b) Prepare the entry to record the write-off of uncollectible accounts during the period. (c) Prepare the entries to record the recovery of the uncollectible account during the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education