Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

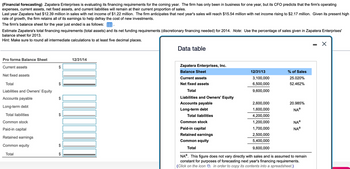

Transcribed Image Text:(Financial forecasting) Zapatera Enterprises is evaluating its financing requirements for the coming year. The firm has only been in business for one year, but its CFO predicts that the firm's operating

expenses, current assets, net fixed assets, and current liabilities will remain at their current proportion of sales.

Last year Zapatera had $12.39 million in sales with net income of $1.22 million. The firm anticipates that next year's sales will reach $15.54 million with net income rising to $2.17 million. Given its present high

rate of growth, the firm retains all of its earnings to help defray the cost of new investments.

The firm's balance sheet for the year just ended is as follows:

Estimate Zapatera's total financing requirements (total assets) and its net funding requirements (discretionary financing needed) for 2014. Note: Use the percentage of sales given in Zapatera Enterprises'

balance sheet for 2013.

Hint: Make sure to round all intermediate calculations to at least five decimal places.

Pro forma Balance Sheet

Current assets

Net fixed assets

Total

Liabilities and Owners' Equity

Accounts payable

Long-term debt

Total liabilities

Common stock

Paid-in capital

Retained earnings

Common equity

Total

EA

SA

$

SA

GA

12/31/14

Data table

Zapatera Enterprises, Inc.

Balance Sheet

Current assets

Net fixed assets

Total

Liabilities and Owners' Equity

Accounts payable

Long-term debt

Total liabilities

Common stock

Paid-in capital

Retained earnings

Common equity

Total

12/31/13

3,100,000

6,500,000

9,600,000

2,600,000

1,600,000

4,200,000

1,200,000

1,700,000

2,500,000

5,400,000

9,600,000

% of Sales

25.020%

52.462%

20.985%

NAa

NAa

NAa

NA. This figure does not vary directly with sales and is assumed to remain

constant for purposes of forecasting next year's financing requirements.

(Click on the icon in order to copy its contents into a spreadsheet.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Baghibenarrow_forwardHalliford Corporation expects to have earnings this coming year of $2.879 per share. Halliford plans to retain all of its earnings for the next two years. Then, for the subsequent two years, the firm will retain 48% of its earnings. It will retain 18% of its earnings from that point onward. Each year, retained earnings will be invested in new projects with an expected return of 22.9% per year. Any earnings that are not retained will be paid out as dividends. Assume Halliford's share count remains constant and all earnings growth comes from the investment of retained earnings. If Halliford's equity cost of capital is 9.7%, what price would you estimate for Halliford stock? The stock price will be $. (Round to the nearest cent.)arrow_forwardThe Podrasky Corporation is considering a $250 million expansion (capital expenditure) program next year. The company currently has $400 million in net fixed assets on its books. Next year, the company expects to earn $70 million after interest and taxes. The company also expects to maintain its present level of dividends, which is $20 million. If the expansion program is accepted, the company expects its inventory and accounts receivable each to increase by approximately $25 million next year. Long-term debt retirement obligations total $9 million for next year, and depreciation is expected to be $75 million. The company does not expect to sell any fixed assets next year. The company maintains a cash balance of $5 million, which is sufficient for its present operations. If the expansion is accepted, the company feels it should increase its year-end cash balance to $7 million because of the increased level of activities. For planning purposes, assume no other cash flow changes for next…arrow_forward

- Dyrdek Enterprises has equity with a market value of $10.9 million and the market value of debt is $3.60 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.7 percent. The new project will cost $2.22 million today and provide annual cash flows of $581,000 for the next 6 years. The company's cost of equity is 11.11 percent and the pretax cost of debt is 4.89 percent. The tax rate is 21 percent. What is the project's NPV? Multiple Choice $230,173 $375,414 $237,180 $219,241 $512,072arrow_forwardGood Time Company is a regional chain department store. It will remain in business for one more year. The probability of a boom year is 50 percent and the probability of a recession is 50 percent. It is projected that the company will generate a total cash flow of $126 million in a boom year and $78 million in a recession. The company's required debt payment at the end of the year is $75 million. The market value of the company's outstanding debt is $58 million. The company pays no taxes. What is the expected rate of return on the company's debt? O 34.5% O O 29.3% O 100%arrow_forwardMars Corporation is interested in estimating the expected rate of sales growth sustainability and additional financing needed to support improvements fast sales next year. Last year, revenue was $5.5 million; net profit is $500,000; investment in assets is $2,500,000; payables and accruals are $1,000,000; and shareholder equity at the end of the year is $1,500,000 (that is, the equity at the beginning of the year of $1,000,000 plus retained earnings of $500,000). The business does not pay dividends and does not expect to pay dividends in the future. a.Compute forecasted sales and changes in sales first. What is your estimate of the funds additions needed next year to support the upgrade sales by 20 percent? Also include the interpretation of the results of the calculationsarrow_forward

- Steber Packaging Inc. expects sales next year of $42 million. Of this total, 30 percent is expected to be for cash and the balance will be on credit, payable in 30 days. Operating expenses are expected to total $27 million. Accelerated depreciation is expected to total $8 million, although the company will only report $4 million of depreciation on its public financial reports. The marginal tax rate for Steber is 34 percent. Current assets now total $28 million and current liabilities total $15 million. Current assets are expected to increase to $33 million over the coming year. Current liabilities are expected to increase to $17 million. Compute the projected after-tax operating cash flow for Steber during the coming year. Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to two decimal places. $ millionarrow_forwardGood Time Company is a regional chain department store. It will remain in business for one more year. The probability of a boom year is 70 percent and the probability of a recession is 30 percent. It is projected that the company will generate a total cash flow of $186 million in a boom year and $77 million in a recession. The company's required debt payment at the end of the year is $111 million. The market value of the company's outstanding debt is $84 million. The company pays no taxes. a. What payoff do bondholders expect to receive in the event of a recession? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the promised return on the company's debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the expected return on the company's debt? (Do not round intermediate calculations and…arrow_forwardDyrdek Enterprises has equity with a market value of $12.6 million and the market value of debt is $4.45 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.9 percent. The new project will cost $2.56 million today and provide annual cash flows of $666,000 for the next 6 years. The company's cost of equity is 11.79 percent and the pretax cost of debt is 5.06 percent. The tax rate is 24 percent. What is the project's NPV? Multiple Choice $208,195 $194,561 $536,049 $183,363 $364,858arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education