FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

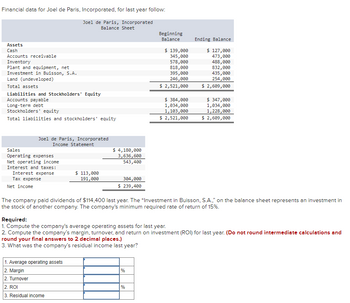

Transcribed Image Text:Financial data for Joel de Paris, Incorporated, for last year follow:

Joel de Paris, Incorporated

Balance Sheet

Assets

Cash

Accounts receivable

Inventory

Plant and equipment, net

Investment in Buisson, S.A.

Land (undeveloped)

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Long-term debt

Stockholders' equity

Total liabilities and stockholders' equity

Joel de Paris, Incorporated

Income Statement

Sales

Operating expenses

Net operating income

Interest and taxes:

Interest expense

Tax expense

Net income

$ 113,000

191,000

$ 4,180,000

3,636,600

543,400

1. Average operating assets

2. Margin

2. Turnover

2. ROI

3. Residual income

304,000

$ 239,400

Beginning

Balance

%

$ 139,000

345,000

578,000

818,000

395,000

246,000

$ 2,521,000

%

$ 384,000

1,034,000

1,103,000

$ 2,521,000

The company paid dividends of $114,400 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an investment in

the stock of another company. The company's minimum required rate of return of 15%.

Ending Balance

$ 127,000

473,000

488,000

832,000

435,000

254,000

$ 2,609,000

Required:

1. Compute the company's average operating assets for last year.

2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Do not round intermediate calculations and

round your final answers to 2 decimal places.)

3. What was the company's residual income last year?

$ 347,000

1,034,000

1,228,000

$ 2,609,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Similar questions

- Hw.24.arrow_forwardBased on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable and inventory from 2022 to 2024. (Round answers to 1 decimal place, eg 13.5% or 13.5.) 2023 Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover Days to sell inventory Debt to equity Return on assets 2022 Return on equity % 2022 % % 2022 :1 :1 times days times days 56 2023 % % % 2023 times days times days 2024 Based on the above information, analyze the company's use of leverage from 2022 to 2024. (Round answers to 1 decimal place, eg 15.1%) % 2024 % % % 2024arrow_forwardFinancial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Balance Sheet Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity Joel de Paris, Incorporated Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense Tax expense Net income $ 115,000 191,000 1. Average operating assets 2. Margin 2. Turnover 2. ROI 3. Residual income Beginning Balance $ 125,000 347,000 579,000 799,000 407,000 251,000 $ 2,508,000 $ 5,049,000 4,291,650 757,350 $385,000 967,000 1,156,000 $ 2,508,000 306,000 $ 451,350 % % Ending Balance $ 137,000 484,000 489,000 780,000 The company paid dividends of $347,350 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of another company.…arrow_forward

- Give answer with explanationarrow_forwardHw.120.arrow_forwardHere are simplified financial statements for Phone Corporation in 2020: Net sales Cost of goods sold Other expenses INCOME STATEMENT (Figures in $ millions) Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 21%) Net income Dividends Assets Cash and marketable securities Receivables Inventories Other current assets BALANCE SHEET (Figures in $ millions) Total current assets Net property, plant, and equipment Other long-term assets. Total assets Liabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 13,600 4,310 4,162 2,668 $2,460 718 $1,750 368 a. Return on equity (use average balance sheet figures) b. Return on assets (use average balance sheet figures) c. Return on capital (use average balance sheet figures) d. Days in inventory (use start-of-year balance sheet…arrow_forward

- The balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional Information for 2024: 1. Net Income is $150,600. 2. Sales on account are $1,215,500. (All sales are credit sales.) 3. Cost of goods sold is $973,400. Complete this question by entering your answers in the tabs below. a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity 2024 19.9 % 13.9 % %6 $208,600 60,000 86,000 3,100 times %6 390,000 390,000 700,000 580,000 (338,000) (178,000)…arrow_forwardWilmington Corporation's liabilities to equity ratio in Year 7 ? Wilmington Corporation's total debt to equity ratio in Year 7? Wilmington Corporation's times interest earned ratio in Year 7 ? Wilmington Corporation's cash flow from operations to total debt ratio in Year 7?arrow_forwardSubject- accountingarrow_forward

- Financial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporated Balance Sheet Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity Joel de Paris, Incorporated Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense Tax expense Net income $ 150,000 110,000 Beginning Balance $ 140,000 450,000 $ 120,000 530,000 320,000 380,000 680,000 620,000 280,000 250,000 180,000 170,000 $ 2,020,000 $ 2,100,000 $ 360,000 1,500,000 160,000 $ 2,020,000 $ 4,050,000 3,645,000 405,000 260,000 $ 145,000 Ending Balance $ 310,000 1,500,000 290,000 $ 2,100,000 The company paid dividends of $15,000 last year. The “Investment in Buisson, S.A.," on the balance sheet represents an investment in the stock of another company. The…arrow_forwardSeven metrics The following data were taken from the financial statements of Woodwork Enterprises Inc. for the current fiscal year. Assuming that there are no intangible assets. Property, plant, and equipment (net) Liabilities: Current liabilities Mortgage note payable, 10%, ten-year note issued two years ago Total liabilities Stockholders' equity: Preferred $2 stock, $100 par (no change during year) Common stock, $10 par (no change during year) Retained earnings: Balance, beginning of year Net income Preferred dividends Common dividends Balance, end of year Total stockholders' equity Sales Check My Work $1,440,000 566,000 $27,000 179,000 $225,000 1,125,000 $2,006,000 206,000 $1,800,000 $1,350,000 $1,350,000 1,350,000 1,800,000 $4,500,000 $13,614,650 Previousarrow_forwardConsider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATIONIncome Statement Sales $ 42,900 Costs 33,900 Taxable income $ 9,000 Taxes (21%) 1,890 Net income $ 7,110 Dividends $ 2,509 Addition to retained earnings 4,601 The balance sheet for the Heir Jordan Corporation follows. HEIR JORDAN CORPORATIONBalance Sheet Assets Liabilities and Owners’ Equity Current assets Current liabilities Cash $ 2,250 Accounts payable $ 4,000 Accounts receivable 5,100 Notes payable 8,000 Inventory 8,000 Total $ 12,000 Total $ 15,350 Long-term debt $ 22,000 Owners’ equity Fixed assets Common stock and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education