Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

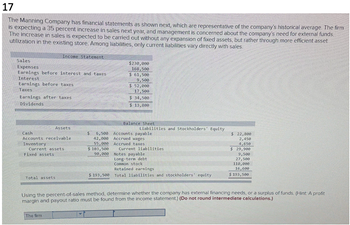

Transcribed Image Text:17

The Manning Company has financial statements as shown next, which are representative of the company's historical average. The firm

is expecting a 35 percent increase in sales next year, and management is concerned about the company's need for external funds.

The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset

utilization in the existing store. Among liabilities, only current liabilities vary directly with sales.

Sales

Expenses

Earnings before interest and taxes

Interest

Earnings before taxes

Taxes

Earnings after taxes

Dividends.

Income Statement:

Cash

Accounts receivable.

Inventory

Fixed assets

Assets

Current assets

Total assets

The firm

$230,000

168,500

$ 61,500

9,500

$ 52,000

17,500

$ 34,500

$ 13,800

Balance Sheet

Liabilities and Stockholders' Equity

$6,500

42,000 Accrued wages

55,000

Accrued taxes

$ 103,500

90,000

Accounts payable

Current liabilities

Notes payable

Long-term debt

Common stock

Retained earnings

$ 193,500 Total liabilities and stockholders' equity

$ 22,800

2,450

4,650

$ 29,900

9,500

27,500

110,000

16,600

$ 193,500

Using the percent-of-sales method, determine whether the company has external financing needs, or a surplus of funds. (Hint: A profit

margin and payout ratio must be found from the income statement.) (Do not round intermediate calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 7arrow_forwardQuantitative Problem: Beasley Industries' sales are expected to increase from $4 million in 2017 to $5 million in 2018, or by 25%. Its assets totaled $2 million at the end of 2017. Beasley is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2017, current liabilities are $750,000, consisting of $120,000 of accounts payable, $350,000 of notes payable, and $280,000 of accrued liabilities. Its profit margin is forecasted to be 4%, and its dividend payout ratio is 70%. Using the AFN equation, forecast the additional funds Beasley will need for the coming year. Round your answer to the nearest dollar. Do not round intermediate calculations.$ The AFN equation assumes that ratios remain constant. However, firms are not always operating at full capacity so adjustments need to be made to the existing asset forecast. Excess capacity adjustments are changes made to the existing asset forecast because the firm is not operating at full capacity. For…arrow_forwardWhich of the following statements is TRUE? When EBIT and total assets both increase by 25%, the basic earnings power will also increase O a. An increase in the quick ratio over time means that the company's liquidity position is improving. O b. approximately by 25%. A lower than the industry's average inventory turnover ratio means that the company turns over or sells O C. and replaces its inventory more times per year. A higher than industry average P/E ratio indicates the company's stock must be overvalued. d.arrow_forward

- Solve this onearrow_forwardQuantitative Problem: Beasley Industries' sales are expected to increase from $5 million in 2017 to $6 million in 2018, or by 20%. Its assets totaled $3 million at the end of 2017. Beasley is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2017, current liabilities are $790,000, consisting of $140,000 of accounts payable, $400,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 4%, and its dividend payout ratio is 60%. Using the AFN equation, forecast the additional funds Beasley will need for the coming year. Do not round intermediate calculations. Enter your answer in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round your answer to the nearest dollar.arrow_forwardWhich of the following is the most correct? A. In reference to the time value of money, the present value is always labeled as t=1 B. Negative MVAs indicate that a company's executives are managing the expenses well C. Nominal rates, or annual percentage rates, always equal the effective annual rate D. A strong ROE always indicates a strong year for a company E. Firms should generally try to minimize their days' sales outstanding in order to access their receivables at fast rates.arrow_forward

- Quantitative Problem 1: Beasley Industries' sales are expected to increase from $4 million in 2017 to $5 million in 2018, or by 25%. Its assets totaled $2 million at the end of 2017. Beasley is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2017, current liabilities are $720,000, consisting of $140,000 of accounts payable, $350,000 of notes payable, and $230,000 of accrued liabilities. Its profit margin is forecasted to be 4%, and its dividend payout ratio is 50%. Using the AFN equation, forecast the additional funds Beasley will need for the coming year. Do not round intermediate calculations. Enter your answer in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round your answer to the nearest dollararrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education