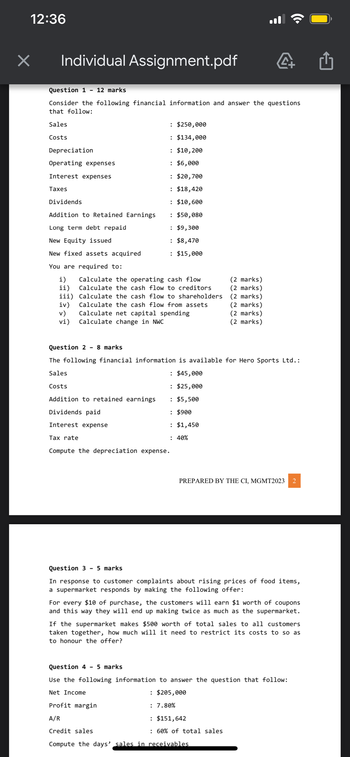

12:36 × Individual Assignment.pdf Question 1 Consider the following financial information and answer the questions that follow: Sales Costs Depreciation Operating expenses Interest expenses Taxes 12 marks Dividends Addition to Retained Earnings Long term debt repaid New Equity issued New fixed assets acquired You are required to: i) ii) iii) iv) v) vi) Tax rate : $250,000 : $134,000 : $10,200 : $6,000 : $20,700 : $18,420 : $10,600 : $50,080 : $9,300 : $8,470 : $15,000 Calculate the operating cash flow Calculate the cash flow to creditors Calculate the cash flow to shareholders Calculate the cash flow from assets Calculate net capital spending Calculate change in NWC Question 2 8 marks The following financial information is available for Hero Sports Ltd.: Sales Costs Addition to retained earnings Dividends paid Interest expense : $45,000 : $25,000 : $5,500 : $900 : $1,450 : 40% Compute the depreciation expense. (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) PREPARED BY THE CI, MGMT2023 2 Question 3 - 5 marks In response to customer complaints about rising prices of food items, a supermarket responds by making the following offer: For every $10 of purchase, the customers will earn $1 worth of coupons and this way they will end up making twice as much as the supermarket. If the supermarket makes $500 worth of total sales to all customers taken together, how much will it need to restrict its costs to so as to honour the offer? Question 4 - 5 marks Use the following information to answer the question that follow: Net Income Profit margin A/R Credit sales Compute the days' sales in receivables : $205,000 : 7.80% : $151,642 : 60% of total sales

12:36 × Individual Assignment.pdf Question 1 Consider the following financial information and answer the questions that follow: Sales Costs Depreciation Operating expenses Interest expenses Taxes 12 marks Dividends Addition to Retained Earnings Long term debt repaid New Equity issued New fixed assets acquired You are required to: i) ii) iii) iv) v) vi) Tax rate : $250,000 : $134,000 : $10,200 : $6,000 : $20,700 : $18,420 : $10,600 : $50,080 : $9,300 : $8,470 : $15,000 Calculate the operating cash flow Calculate the cash flow to creditors Calculate the cash flow to shareholders Calculate the cash flow from assets Calculate net capital spending Calculate change in NWC Question 2 8 marks The following financial information is available for Hero Sports Ltd.: Sales Costs Addition to retained earnings Dividends paid Interest expense : $45,000 : $25,000 : $5,500 : $900 : $1,450 : 40% Compute the depreciation expense. (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) PREPARED BY THE CI, MGMT2023 2 Question 3 - 5 marks In response to customer complaints about rising prices of food items, a supermarket responds by making the following offer: For every $10 of purchase, the customers will earn $1 worth of coupons and this way they will end up making twice as much as the supermarket. If the supermarket makes $500 worth of total sales to all customers taken together, how much will it need to restrict its costs to so as to honour the offer? Question 4 - 5 marks Use the following information to answer the question that follow: Net Income Profit margin A/R Credit sales Compute the days' sales in receivables : $205,000 : 7.80% : $151,642 : 60% of total sales

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

It looks like you may have submitted a graded question that, per our Honor Code, experts cannot answer. We've credited a question to your account.

Your Question:

Transcribed Image Text:12:36

×

Individual Assignment.pdf

Question 1

Consider the following financial information and answer the questions

that follow:

Sales

Costs

Depreciation

Operating expenses

Interest expenses

Taxes

12 marks

Dividends

Addition to Retained Earnings

Long term debt repaid

New Equity issued

New fixed assets acquired

You are required to:

i)

ii)

iii)

iv)

v)

vi)

Tax rate

: $250,000

: $134,000

: $10,200

: $6,000

: $20,700

: $18,420

: $10,600

: $50,080

: $9,300

: $8,470

: $15,000

Calculate the operating cash flow

Calculate the cash flow to creditors

Calculate the cash flow to shareholders

Calculate the cash flow from assets

Calculate net capital spending

Calculate change in NWC

Question 2 8 marks

The following financial information is available for Hero Sports Ltd.:

Sales

Costs

Addition to retained earnings

Dividends paid

Interest expense

: $45,000

: $25,000

: $5,500

: $900

: $1,450

: 40%

Compute the depreciation expense.

(2 marks)

(2 marks)

(2 marks)

(2 marks)

(2 marks)

(2 marks)

PREPARED BY THE CI, MGMT2023 2

Question 3 - 5 marks

In response to customer complaints about rising prices of food items,

a supermarket responds by making the following offer:

For every $10 of purchase, the customers will earn $1 worth of coupons

and this way they will end up making twice as much as the supermarket.

If the supermarket makes $500 worth of total sales to all customers

taken together, how much will it need to restrict its costs to so as

to honour the offer?

Question 4 - 5 marks

Use the following information to answer the question that follow:

Net Income

Profit margin

A/R

Credit sales

Compute the days' sales in receivables

: $205,000

: 7.80%

: $151,642

: 60% of total sales

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning