Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

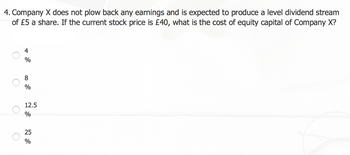

Transcribed Image Text:4. Company X does not plow back any earnings and is expected to produce a level dividend stream

of £5 a share. If the current stock price is £40, what is the cost of equity capital of Company X?

O

4

%

8

%

12.5

%

25

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 7. Dividend discount model (S4.3) Company Y does not plow back any earnings and is expected to produce a level dividend stream of $5 a share. If the current stock price is $40, what is the cost of equity?arrow_forward6. Matilda Industries pays a dividend of £2.10 per share and is expected to pay this amount indefinitely. If Matilda's cost of equity capital is 9%, which of the following would be closest to Matilda's share price? A. £14.00 B. £18.66 C. £23.33 D. £29.16arrow_forwardSuppose that investors cumulatively short-sell 6 million shares of a stock and the share price appreciates from $200 to $1100. In the meantime, the stock pays a dividend of $20 per share. What is the total amount of loss that the short sellers suffer from their position? You can ignore shorting fees and assume all interest rates are zero). A. $5.5 billion B. $7.3 billion C. $6.1 billion O D. $4.3 billionarrow_forward

- 2arrow_forward$44 a share, what is the company's cost of equity? 2. Calculating Cost of Equity Hoolahan Corporation's common stock nas a beta of .87. If the risk-free rate is 3.6 percent and the expected return on the market is 11 percent, what is the company's cost of equity capital? 01arrow_forwardCompany X does not plow back any earnings and is expected to produce a level of dividend stream of $5 a share. If the current stock price is $40, what is the market capitalization rate?arrow_forward

- The Cost of Equity and Flotation Costs Messman Manufacturing will issue common stock to the public for $30. The expected dividend and the growth in dividends are $3.00 per share and 5%, respectively. If the flotation cost is 10% of the issue’s gross proceeds, what is the cost of external equity, re?arrow_forward8. I need help with finance home work question asap please A stock that currently sells for $150 has a required return of 11.45% and dividend yield of 3%. What dividend per share amount is expected to be paid next?arrow_forwardIS The Drogon Co. just issued a dividend of $3.52 per share on its common stock. The company is expected to maintain a constant 48 percent growth rate in its dividends indefinitely. If the stock sells for $55 a share, what is the company's cost of equity? Suggested Formula(s): Required return: D₁ R -g D₁ = Do x (1+g) Select one: O A 12.24% OB. 6.71% OC 11.51% OD. 11.20% OE 12.39% Oarrow_forward

- A company currently reported dividend of $12. It is expected that will reinvest 50% of its earnings perpetually. The return on equity of the company is 20% and remains unchanged in the future. Suppose the cost of equity of the company is 13%, what is the fair price of the stock based on the dividend discount model? A. $200 В. S220 C. $400 D. $440arrow_forwardH5. Show All Step by step calculationarrow_forwardA company just paid a $3.00 dividend, expected to grow at 1.8% indefinitely. If the firm's stock can be sold for $19.25 per share with a $1.00 flotation, what is the cost of common equity? O 15.81% O 14.42% O 25.75% O 13.28%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning