Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

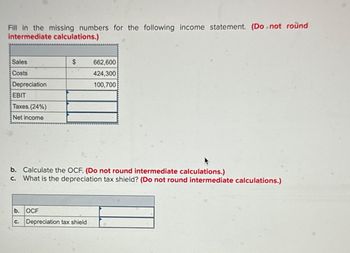

Transcribed Image Text:Fill in the missing numbers for the following income statement. (Do not round

intermediate calculations.)

Sales

Costs

Depreciation

EBIT

Taxes (24%)

Net income

b.

b. Calculate the OCF. (Do not round intermediate calculations.)

c. What is the depreciation tax shield? (Do not round intermediate calculations.)

C.

$

OCF

662,600

424,300

100,700

Depreciation tax shield

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- K 1. Given the following information for Sookie’s Cookies Co., calculate the depreciation expense: sales = $86,616; costs = $55,374; addition to retained earnings = $791; dividends paid = $1,498; interest expense = $349; tax rate = 26 percent. (Hint: Build the Income Statement and fill in the missing pieces until you get to the depreciation expense. You may have to work from bottom up.)arrow_forwardCalculate the net profit from the following? Net sales OMR 100000, Cost of goods sold OMR 40000, Rent received OMR 20000, Salaries OMR 10000, Insurance OMR 6000 and Depreciation OMR 8000. a. OMR 16000 b. OMR 60000 c. OMR 56000 d. OMR 66000arrow_forwardCalculate the operating cash flow for Initech. (Assume that depreciation is tax deductible.) Initech Corp. Income Statement ($000's) Revenue Cost of Goods Sold SG&A Depreciation Expense. EBIT Interest Expense Income Before Taxes Taxes Net Income: $100,000 64,798 16,202 4,739 14,260 7,230 7,030 2,108 $4,922arrow_forward

- a. Fill in the missing numbers in the following income statement: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g. 32. Sales Costs Depreciation EBIT Taxes (21%) Net income $ 544,300 349,300 97,300 b. What is the OCF? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32. b. OCF c. Depreciation tax shield c. What is the depreciation tax shield? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32.arrow_forwardUse the following information to answer this question: Bayside, Incorporated 2021 Income Statement ($ in thousands) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income Cash Accounts received Inventory Total Net fixed assets Total assets 2020 $ 150 1,150 1,825 $ 3,125 3,860 $ 6,985 $ 6,270 4,640 400 $ 1,230 46 $ 1,184 249 $935 Bayside, Incorporated 2020 and 2021 Balance Sheets ($ in thousands) 2021 $ 255 990 2,140 $ 3,385 3,680 $ 7,065 Total liabilities & equity Accounts payable Long-term debt Common stock Retained earnings BOLSA- How many dollars of sales were generated from every dollar of fixed assets during 2021? دا 2020 $1,735 890 3,400 960 $ 6,985 2021 $ 1,805 690 3,360 1,210 $ 7,065arrow_forwardces a. Fill in the missing numbers in the following income statement: Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g. 32. Sales Costs Depreciation EBIT Taxes (23%) Net income 594,000 366,800 116,900 b. What is the OCF? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32. c. What is the depreciation tax shield? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32. b. OCF c. Depreciation tax shieldarrow_forward

- Given the following information for Sookie’s Cookies Co., calculate the depreciation expense: sales = $96,581; costs = $67,448; addition to retained earnings = $1,079; dividends paid = $329; interest expense = $1,641; tax rate = 37 percent. (Hint: Build the Income Statement and fill in the missing pieces until you get to the depreciation expense. You may have to work from bottom up.)arrow_forward3) ( Below table shows the calculations for an after-tax analysis of a machine purchase alternative. EOY ВТСР Depreciation Deduction Тахable Income АТCF Income Таxes - 20,000 16,000 16,000 16,000 16,000 16,000 18,000 3,000 3,000 3,000 3,000 3,000 3,000 13,000 13,000 13,000 13,000 13,000 15,000 - 6,500 - 6,500 - 6,500 - 6,500 - 6,500 - 7,500 - 20,000 9,500 9,500 9,500 9,500 9,500 1 3 4 6. 10,500 a) Find answers to the below questions What are the cost basis (price) and "annual revenues less expenses"? What is the terminal market value (or salvage value)? What is the income tax rate? i. ii. iii. iv. What is the method used for depreciation deduction? What is the book value at the end of useful life? V. b) Calculate the equivalent present worth (PW) and the equivalent annual worth (AW) at an after-tax MARR of 11%.arrow_forwardAsset impairment charge is non-cash charge that is deductible for taxes. It is considered one-time in nature. · Income tax rate 25% (this is the same rate for income from all locations in this analysis). Create Income statement to determine if worthy of a purchase?arrow_forward

- Just for clarification purposes, is the 50 000 a sunken cost and should it have been accounted for in the cash flow? The question states 800 000 after tax, but the adjustments were taken into account hence the after tax is 760 000. Please clarify.arrow_forwardPresented here is information for Sheridan Company. Income tax expense Casualty loss Loss from the sale of land Sales returns and allowances Interest revenue $15,000 Other expenses and losses $ 1,480 1,900 860 1,080 Sales revenue Rent expense Interest expense Dividend revenue Income tax payable Calculate the amount reported as "Other expenses and losses". 9040 $95,500 1,720 2,700 1,500 4,800arrow_forwardUse the following information from separate companies a through d: Net Income (Loss) Interest Expense Income Taxes a. $ 111, 000 $ 59, 940 $ 27, 750 b. 105, 600 25, 344 38,016 c. 94, 350 25, 475 39, 627 d . 114, 100 4,564 54,768 Compute times interest earned. Which company indicates the strongest ability to pay interest expense as it comes due?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education