Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ces

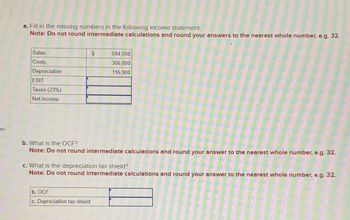

a. Fill in the missing numbers in the following income statement:

Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g. 32.

Sales

Costs

Depreciation

EBIT

Taxes (23%)

Net income

594,000

366,800

116,900

b. What is the OCF?

Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32.

c. What is the depreciation tax shield?

Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32.

b. OCF

c. Depreciation tax shield

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Similar questions

- First solve your NI = Sales - COGS - Operating expenses - depreciation- interest- taxes Then subtract current year - prior year for AR, inventory, AP and accruals At last- NI + current year depreciation - changes in AR - changes in inventory + changes in AP + Changes in Accruals Don't do the subtraction for depreciation, you're using the current year for that onearrow_forwardPlease do not give solution in image format thankuarrow_forwardDo not give answer in imagearrow_forward

- When I add the information from the attached to here, why I am not getting the net incom $341. Please see attached partial income statement Revenue COGS Operating expenses (SG&A + Restructuring + Investment income + Interest expense) Income taxes Income (net earnings)arrow_forwardWhat I Can Do Given the following amount of the expenses and revenue, solve for the profit using the formula discussed earlier. Explain your computation. Paid Rent : 2,500.00 Paid utility fees : 4,679.18 Supplies : 10,789.86 Delivery cost : 589.00 Employees' salary A. : 450.00 (15days) (4 persons) B. : 650.00 (15days) (1 person) Income : 104,596.50arrow_forwardplease answer the following 2 questions: 7. Any decrease in Liability should be .. a) It depends on the circumstances b) Dedected from Net Income c) Added to Net Income d) None of the above. 8. The increase in Accounts Receivable should be deducted from the net income. a) True b) Falsearrow_forward

- Use the following information from separate companies a through d: Net Income (Loss) Interest Expense Income Taxes a. $ 111, 000 $ 59, 940 $ 27, 750 b. 105, 600 25, 344 38,016 c. 94, 350 25, 475 39, 627 d . 114, 100 4,564 54,768 Compute times interest earned. Which company indicates the strongest ability to pay interest expense as it comes due?arrow_forwardNot use ai please don'tarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please do not give solution in image format thankuarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardThe following comparative information is available for Wildhorse Company for 2025. Sales revenue Cost of goods sold Operating expenses (including depreciation) Depreciation Cash paid for inventory purchases Your answer is partially correct. Net income $ eTextbook and Media * Your answer is incorrect. LIFO eTextbook and Media Net cash provided by operating activities * Your answer is incorrect. Determine net income under each approach. Assume a 30% tax rate. 18,200 Quality of earnings ratio Touthook and Media LIFO $92,000 35,000 26,000 LIFO 9,000 14,705 FIFO $92,000 Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis. 31,800 26,000 9,000 2.14 14,705 FIFO 23,940 LIFO Calculate the quality of earnings ratio under each approach. (Round answers to 2 decimal places, e.g. 5.15.) 39,005 FIFO FIFO 0.95 22,750arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education