FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

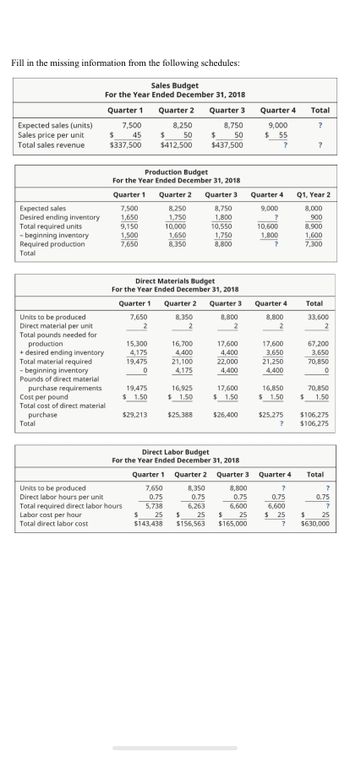

Transcribed Image Text:Fill in the missing information from the following schedules:

Sales Budget

For the Year Ended December 31, 2018

Quarter 1

Quarter 2

Quarter 3

7,500

8,250

Expected sales (units)

Sales price per unit

$

45

$ 50

$

8,750

50

$437,500

Total sales revenue

$337,500

$412,500

Production Budget

For the Year Ended December 31, 2018

Quarter 1 Quarter 2

Quarter 3

Expected sales

7,500

8,250

8,750

1,650

1,750

1,800

Desired ending inventory

Total required units

9,150

10,000

10,550

1,500

1,650

1,750

- beginning inventory

Required production

Total

7,650

8,350

8,800

Direct Materials Budget

For the Year Ended December 31, 2018

Quarter 1

Quarter 2 Quarter 3

7,650

8,800

8,350

2

2

2

Units to be produced

Direct material per unit

Total pounds needed for

production

15,300

16,700

17,600

4,175

4,400

4,400

19,475

21,100

22,000

+ desired ending inventory

Total material required

- beginning inventory

Pounds of direct material

0

4,175

4,400

19,475

16,925

17,600

$ 1.50

$ 1.50

$ 1.50

purchase requirements

Cost per pound

Total cost of direct material

purchase

$29,213

$25,388

$26,400

Total

Direct Labor Budget

For the Year Ended December 31, 2018

Quarter 1 Quarter 2 Quarter 3

Units to be produced

7,650

8,350

8,800

Direct labor hours per unit

0.75

0.75

0.75

Total required direct labor hours

5,738

6,263

6,600

Labor cost per hour

$

25

$

25

$

25

Total direct labor cost

$143,438

$156,563

$165,000

Quarter 4

9,000

$ 55

?

Quarter 4

9,000

?

10,600

1,800

?

Quarter 4

8,800

2

17,600

3,650

21,250

4,400

16,850

$ 1.50

$25,275

?

Quarter 4

?

0.75

6,600

$ 25

?

Total

?

?

Q1, Year 2

8,000

900

8,900

1,600

7,300

Total

33,600

2

67,200

3,650

70,850

0

70,850

1.50

$

$106,275

$106,275

Total

?

0.75

?

$ 25

$630,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fill in the missing information from the following schedules: Sales Budget For the Year Ending Dec. 31, 2018 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Expected sales (units) 7,600 8,300 8,700 9,100 fill in the blank 1 Sales price per unit $45 $50 $50 $56 Total sales revenue $342,000 $415,000 $435,000 $fill in the blank 2 $fill in the blank 3 Production Budget For the Year Ending Dec. 31, 2018 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Q1, Year 2 Expected sales 7,600 8,300 8,700 9,100 7,900 Desired ending inventory 1,660 1,740 1,820 fill in the blank 4 900 Total required units 9,260 10,040 10,520 10,680 8,800 Less: Beginning inventory 1,520 1,660 1,740 1,820 1,580 Required production 7,740 8,380 8,780 fill in the blank 5 7,220 Total fill in the blank 6 Direct Materials Budget For the Year Ending Dec. 31, 2018 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Units to be produced 7,740…arrow_forwardjarrow_forwardPlease avoid images in solution thankuarrow_forward

- Required information [The following information applies to the questions displayed below] Phoenix Company's 2019 master budget included the following fixed budget report. It is based on an expected production and sales volume of 15,000 units. Sales Cost of goods sold Direct materials Direct labor PHOENIX COMPANY Fixed Budget Report For Year Ended December 31, 2019 Machinery repairs (variable cost) Depreciation Plant equipment (straight-line) Utilities ($30, 000 is variable) Plant management salaries Gross profit $3,150,000 $ 915,000 225,000 45,000 300,000 195,000 200,000 1,880,000 1,270,000 Selling expenses 75,000 Shipping 90,000 Sales salary (fixed annual amount) 236,000 400,000 General and administrative expenses Advertising expense 150,000 Salaries 241,000 Entertainment expense Income from operations 75,000 466,000 $ 404, 000 Packaging 3. The company's business conditions are improving. One possible result is a sales volume of 18,000 units. The company president is confident that…arrow_forwardXYZ Inc. is preparing its annual budgets for the year ending December 31, 2025. Product JB 50 Product JB 60 Sales Budget: Anticipated volume in units 677,000 345,000 Unit Selling Price $23 $45 Production budget: Desired ending finished goods units 65,000 21,500 Beginning finished good units 54.300 10,750 Prepare the Production Budget for the year.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- How do I prepare the selling and administrative expense budget for the quarter ended March 31, 20X1?arrow_forwardFor 20Y6, Raphael Frame Company prepared the sales budget that follows. At the end of December 20Y6, the following unit sales data were reported for the year: Unit Sales 8" x 10" 12" x 16" Frame Frame East 24,440 14,910 Central 6,222 4,018 West 5,432 3,060 Raphael Frame Company Sales Budget For the Year Ending December 31, 20Y6 Unit Unit Sales Selling Product and Area Volume Price Total Sales 8" x 10" Frame: East 23,500 $24 $564,000 Central 6,100 24 146,400 West 5,600 24 134,400 Total 35,200 $844,800 12" x 16" Frame: East 14,200 $34 $482,800 Central 4,100 34 139,400 West 3,000 34 102,000 Total 21,300 $724,200 Total revenue from sales $1,569,000arrow_forwardplease step by step answer.arrow_forward

- Don't provide answer in image formatarrow_forwardQuarter 1 Quarter 2 Quarter 3 Quarter 4 Total Units to be produced 7,680 8,480 8,860 8,860 33,880 Direct material per unit 2 2 2 2 2 Total pounds needed for production 15,360 16,960 17,720 17,720 67,760 Add: Desired ending inventory 4,240 4,430 4,430 3,600 3,600 Total material required 19,600 21,390 22,150 21,320 71,360 Less: Beginning inventory 4,240 4,430 4,430 Pounds of direct material purchase requirements 19,600 17,150 17,720 16,890 71,360 Cost per pound $1.50 $1.50 $1.50 $1.50 $1.50 Total cost of direct material purchase $29,400 $25,725 $26,580 $25,335 $107,040 Total $107,040 Direct Labor Budget For the Year Ending Dec. 31, 2018 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Units to be produced 7,680 8,480 8,860 Direct labor hours per unit 0.75 0.75 0.75 0.75 0.75 Total required direct labor hours 5,760 6,360 6,645 6,645 Labor cost per hour $25 $25 $25 $25 $25 Total direct labor cost $144,000 $159,000 $166,125 $ $635,250arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education