FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

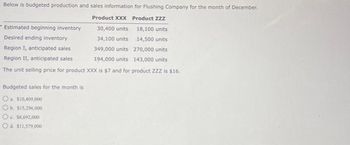

Transcribed Image Text:Below is budgeted production and sales information for Flushing Company for the month of December.

Product XXX Product Zzz

30,400 units

18,100 units

* Estimated beginning inventory

Desired ending inventory

34,100 units

14,500 units

Region 1, anticipated sales

349,000 units

270,000 units

Region II, anticipated sales

194,000 units

143,000 units

The unit selling price for product XXX is $7 and for product ZZZ is $16.

Budgeted sales for the month is

O $10,409,000

Ob $15,296,000

O c. $6,692,000

Od $11,579,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the following informaiton for Greg's Games for the month of June: Budgeted Cost of Goods Sold =$38,000; Desired Ending Merchandise Inventory =$48,000; Beginning Merchandise Inventory = $33,000. Calculate the budgeted purchases for the company in June. A. $43,000 B. $33,000 C. $53,000 D. $38,000arrow_forwardBelow is budgeted production and sales information for Flushing Company for the month of December. Product XXX Product ZZZ Estimated beginning inventory 29,100 units 19,100 units Desired ending inventory 36,900 units 14,000 units Region I, anticipated sales 306,000 units 279,000 units Region II, anticipated sales 187,000 units 146,000 units The unit selling price for product XXX is $5 and for product ZZZ is $14.Budgeted sales for the month is a.$4,590,000 b.$8,415,000 c.$9,027,000 d.$12,852,000arrow_forwardBelow is budgeted production and sales information for Flushing Company for the month of December. Product XXX Product ZZZ Estimated beginning inventory 30,600 units 19,700 units Desired ending inventory 35,200 units 14,300 units Region I, anticipated sales 339,000 units 277,000 units Region II, anticipated sales 184,000 units 142,000 units The unit selling price for product XXX is $4 and for product ZZZ is $14. Budgeted production for product XXX during the month is a.558,200 units b.523,000 units c.518,400 units d.527,600 unitsarrow_forward

- Below is budgeted production and sales information for Flushing Company for the month of December. Product XXX Product ZZZ Estimated beginning inventory 31,700 units 19,300 units Desired ending inventory 35,200 units 14,600 units Region I, anticipated sales 332,000 units 251,000 units Region II, anticipated sales 194,000 units 140,000 units The unit selling price for product XXX is $5 and for product ZZZ is $13. Budgeted production for product XXX during the month is a.529,500 units b.522,500 units c.526,000 units d.561,200 unitsarrow_forwardThe following budgeted production and sales information is for Flushing Company for the month of December: Product XXX Product ZZZ Estimated beginning inventory 28,200 units 19,800 units Desired ending inventory 35,000 units 15,300 units Region I, anticipated sales 302,000 units 253,000 units Region II, anticipated sales 196,000 units 141,000 units The unit selling price for product XXX is $7 and for product ZZZ is $15. Budgeted production for product XXX during the month is a. 504,800 units b. 498,000 units c. 533,000 units Od. 491,200 unitsarrow_forwardHow do I prepare the selling and administrative expense budget for the quarter ended March 31, 20X1?arrow_forward

- Production and sales estimates for March for Robin Co. are as follows: Estimated inventory ( units), March 117,100 Desired inventory (units), March 31 19,700 Expected sales volume ( units): Area M 6,500 Area L 9,300 Area O 7, 100 Unit sales price $17 Budgeted production for March is a. 42, 600 b. 22,900 c. 59,700 d. 25,500arrow_forwardFunction: SUM; Formula: Subtract, Multiply; Cell Referencing Using Excel to Prepare a Production Budget PROBLEM Paige Company estimates that following unit sales and desired inventory level for the four quarters of the year ending December 31, 2022. Quarter 1 sales Quarter 2 sales Quarter 3 sales Quarter 4 sales Desired ending finished goods inventory based on next quarter's expected unit sales Unit selling price 10,000 14,000 15,000 18,000 25% $ 70.00 Prepare a production budget by quarters for the first 6 months of 2022. Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to the Problem area or this work area as indicated. Use the SUM function with cell referencing for totals. Paige Company Production Budget For the Six Months Ending June 30, 2022 Quarter 1 10,000 Expected unit sales Add: Desired ending finished goods units Total required units Less: Beginning finished goods units Required production…arrow_forwardRelevant data from the Poster Company’s operating budgets are: Quarter 1 Quarter 2 Sales $208,470 $211,539 Direct material purchases 115,290 120,832 Direct labor 75,205 73,299 Manufacturing overhead 25,400 25,400 Selling and administrative expenses 33,400 33,400 Depreciation included in selling and administrative 1,400 1,100 Collections from customers 215,391 240,154 Cash payments for purchases 114,300 119,253 Additional data:Capital assets were sold in January for $9,000 and $4,600 in May.Dividends of $4,400 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $58,000. Use this information to prepare a cash budget for the first two quarters of the year: If an amount box does not require an entry, leave it blank. The Poster Company Cash Budget For the First Two Quarters Quarter 1 Quarter 2 Beginning Cash Balance $fill in the blank 2 $fill in the blank 3 Add: Cash Receipts Collections from…arrow_forward

- Production Budget Healthy Measures Inc. produces a Bath and Gym version of its popular electronic scale. The anticipated unit sales for the scales by sales region are as follows: Bath Scale Gym Scale Northern Region unit sales 26,900 37,000 Southern Region unit sales 29,100 30,600 Total 56,000 67,600 The finished goods inventory estimated for March 1, for the Bath and Gym scale models is 1,300 and 2,200 units, respectively. The desired finished goods inventory for March 31 for the Bath and Gym scale models is 900 and 2,400 units, respectively. Prepare a production budget for the Bath and Gym scales for the month ended March 31. For those boxes in which you must enter subtracted or negative numbers use a minus sign.arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education