ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

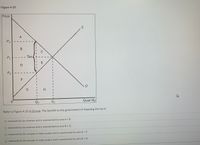

Transcribed Image Text:Figure 4-25

Price

A

P3

Тах

P1

E

P2

F

D

Quantity

Q2

Q1

Refer to Figure 4-25 4-25.png. The benefit to the government of imposing the tax is

measured by tax revenue and is represented by area A + B.

O measured by tax revenue and is represented by area B+ D.

measured by the net gain in total surplus and is represented by area D + E.

measured by the net gain in total surplus and is represented by area B + D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Figure 8-5 Price Pa P₁ P₂ O d. $8 B Price D 2 F -Tax ● a. D+EX b. C+E C. B+C d. A Figure 8-5 G 92 C Refer to Figure 8-5. Assume the tax was levied on the consumer. Which area represents the reduction in consumer surplus? E 9₂ D Quantityarrow_forwardSuppose the demand curve for a good is highly elastic and the supply curve is highly inelastic. If the government taxes this good, O buyers and sellers will each share 50 percent of the burden, regardless of the elasticities of the demand and supply curves. sellers will bear a larger share of the tax burden. the distribution of the burden will depend upon whether the buyers or the sellers are required to send the tax to the government. buyers will bear a larger share of the tax burden.arrow_forwardCHECK OUT IMAGE PLSarrow_forward

- #25, #26, #27arrow_forward1. Consider the market for candy bars given below. Suppose that the government imposes a tax of $2 per candy bar in this market. Show on the graph and calculate the following: Price 5 $4.50 $4 $3.50 Supply 53 $2.50 $2 $1.50 $1 Demand S0.50 400 800 1200 1600 2000 2400 2800 3200 3600 4000 Candy Bars A. The quantity the market will produce with the tax. B. The government revenue from the tax. C. The deadweight loss from the tax. D. The consumer surplus with the tax. E. The producer surplus with the tax.arrow_forwardConsumer and Producer surplus Stax P $100 $70 $50 $45 $X $5 D 40 60 Assume an excise tax that has caused a decrease in Supply as shown on the graph above Show all work. а. How much is the tax per- unit b. How much is the value of X (intercept of the green line). How do you describe what that value is? C. How much is the consumer surplus before the tax? d. How much is producer surplus before the tax? е. How much is the consumer surplus after the tax? f. How much is producer surplus after the tax? g. How much is the deadweight loss as a result of the taxarrow_forward

- Only typed answerarrow_forwardThe market supply and demand for a product are shown in the diagram below. Now supose the government imposes a per-unit tax of $1 on producers. (i) What happens to total revenue received by producers after they pay the tax to the government? Explain. (ii) Will producer surplus increase, decrease, or stay the same? (iii) Will total surplus increase, decrease, or stay the same? Explain.arrow_forward7.7 pleaase explainarrow_forward

- Question 14 In the long run, both supply and demand tend to become more elastic. This suggests that, in the long run, the government will likely reduce tax rates. deadweight loss from a tax will be less than it is in the short run. deadweight loss from a tax will be greater than it is in the short run. deadweight loss from a tax will be zero. O revenue generated from the tax will increase.arrow_forward1. The demand for the product S is Q = 500 – 8P and its supply is Q = 200 + 4P. The good is currently untaxed, but the government needs to raise tax by taxing per unit of the good. a. Calculate excess burden for the product S. b. Calculates marginal excess burden for the product S? %3D The exact amount of the tax is not specified.arrow_forwardIf there is a $3 tax, what is the equilibrium price buyers pay, the price sellers receive, and the quantity? If there is a $3 tax, what is the CS, PS, tax revenue, TS, and deadweight loss? Include graph!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education