Algebra and Trigonometry (6th Edition)

6th Edition

ISBN: 9780134463216

Author: Robert F. Blitzer

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

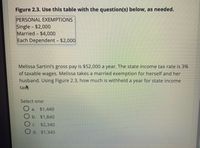

Transcribed Image Text:Figure 2.3. Use this table with the question(s) below, as needed.

PERSONAL EXEMPTIONS

Single - $2,000

Married - $4,000

Each Dependent - $2,000

Melissa Sartini's gross pay is $52,000 a year. The state income tax rate is 3%

of taxable wages. Melissa takes a married exemption for herself and her

husband. Using Figure 2.3, how much is withheld a year for state income

tax

Select one:

a. $1,440

O b. $1,840

O c. $2,340

d. $1,340

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Is the following problem a percent increase problem or a percent decrease problem? Pat earns $10 per hour. She will be getting a 5% pay raise next year. What will be her new hourly pay?arrow_forward2. Franklin was smart and bought all of his textbooks for college used. This way, he saved 30% on the original price of the textbooks. If the books would have originally cost $315 dollars, how much did Franklin pay? After a 30% discount is removed, what percentage of the original cost remains? How much did Franklin pay?arrow_forwardQuestion 16 Calculate the tax amount for the following? Purchase of $450 if tax rate is 8% Purchase of $800 if tax rate is 12%arrow_forward

- Rer 6. Payments of $117.45 per month are made for 3 years. What is the total amount paid? a. $4227.84 b. $4228.20 c. $4212.00 d. $1409.40arrow_forward7. Mrs. Smith is a car sales agent. She is paid a monthly salary of $700 plus commission. Last month she sold a car valued at $23,000, earning a 15% commission on sale. How much was her total pay for the month? [3] Answerarrow_forwardImagine that you are helping out a friend by taking care of their dog for the month of December while they are away taking care of family members. Your friend offers to compensate you by giving you a penny on Dec. 1, 2¢ on Dec. 2, 4¢ on Dec. 3, etc. Does this seem like a good deal? Before you answer, complete the chart below that would give your compensation through Dec. 14. Use dollars for the units. Date Compensation 1-Dec 0.01 2-Dec 0.02 3-Dec 4-Dec 5-Dec 6-Dec 7-Dec 8-Dec 9-Dec 10-Dec 11-Dec 12-Dec 13-Dec 14-Decarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning

Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning

Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON

Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press

Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education

College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:9781305657960

Author:Joseph Gallian

Publisher:Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:9781285463247

Author:David Poole

Publisher:Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:9780135163078

Author:Michael Sullivan

Publisher:PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:9780980232776

Author:Gilbert Strang

Publisher:Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:9780077836344

Author:Julie Miller, Donna Gerken

Publisher:McGraw-Hill Education