Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

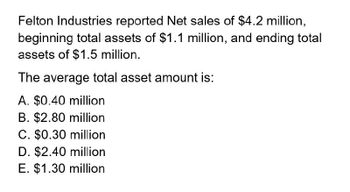

Transcribed Image Text:Felton Industries reported Net sales of $4.2 million,

beginning total assets of $1.1 million, and ending total

assets of $1.5 million.

The average total asset amount is:

A. $0.40 million

B. $2.80 million

C. $0.30 million

D. $2.40 million

E. $1.30 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- MCQarrow_forwardCarlisle Corporation reported net sales of $4.25 million and beginning total assets of $1.10 million and ending total assets of $1.65 million. The average total asset amount is: ?arrow_forwardBB Corporation reported Net sales of $4.12 million and beginning total assets of $1.08 million and ending total assets of $1.52 million. The average total asset amount is__. A. $0.39 million B. $2.85 million C. $0.32 million D. $2.48 million E. $1.30 million answerarrow_forward

- Tatye Corporation reported Net sales of $4.6 million and average Total assets of $1.1 million. The Total asset turnover is:arrow_forwardGeneral accountingarrow_forwardFlask Company reports net sales of $4,343 million; cost of goods sold of $2,808 million; net income of $283 million; and average total assets of $2,150. Compute its total asset turnover. Multiple Choice 0.13. 0.77. 1.31. 2.02. 1.55.arrow_forward

- Right Company reported beginning and ending total assets of $36,000 and $30,000, respectively. Its net sales revenue for the year were $26,070. What was Right's asset turnover ratio? A. 0.87 OB. 1.27 OC. 0.79 OD. 0.72arrow_forwardCalculating the Average Total Assets and the Return on Assets The income statement, statement of retained earnings, and balance sheet for Santiago Systems are as follows: Santiago Systems Income Statement For the Year Ended December 31, 20X2 Amount Percent Net sales $5,345,000 100.0% Less: Cost of goods sold (3,474,250) 65.0 Gross margin $1,870,750 35.0 Less: Operating expenses (1,140,300) 21.3 Operating income $730,450 13.7 Less: Interest expense (27,000) 0.5 Income before taxes Less: Income taxes (40%)* $703,450 13.2 (281,380) 5.3 Net income $422,070 7.9 * Includes both state and federal taxes.arrow_forwardCrafty Inc. reported the following financial data. Sales, $180,000; operating expenses $160,000; average operating assets, $150,000; total liabilities, $98,000. The company requires a minimum 12% return on investments. What is the asset turnover ratio? O.133 O.18 O 1.2 O .111arrow_forward

- The Huntzicker Company reported gross sales of $850,000, sales return and allowances of $5,000 and sales discounts of $5,000. The company has average total assets of $500,000, of which $250,000 is property, plant, and equipment. What is the company's asset turnover ratio? a. 1.68 times b. 1.72 times c. 0.59 times d. 1.8 timesarrow_forwardDundee Co. reported the following for the current year: net sales of $80,000; cost of goods sold of $60,000; beginning balance of total assets of $115,000; and ending balance of total assets of $85,000. Compute total asset turnover. Round to one decimal.arrow_forwardAMT. Inc.'s net income for this quarter is $500,000. The publicized return on assets (ROA) is 34.5 % . Estimate the firm's total asset to the closet possible. a. $1,500,000 c. $2,450,000 b. $ 1,450,000 d. $2,005,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College