ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

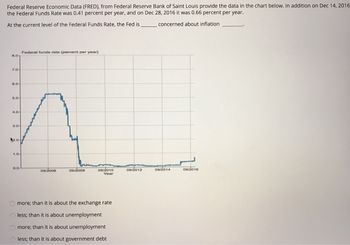

Transcribed Image Text:Federal Reserve Economic Data (FRED), from Federal Reserve Bank of Saint Louis provide the data in the chart below. In addition on Dec 14, 2016-

the Federal Funds Rate was 0.41 percent per year, and on Dec 28, 2016 it was 0.66 percent per year.

At the current level of the Federal Funds Rate, the Fed is.

concerned about inflation

6.0

7.0-

6.0

5.0

4.0

3.0-

2.0

1.0

0.0-

Federal funds rate (percent per year)

09/2006

09/2008

09/2010

Year

more; than it is about the exchange rate

less; than it is about unemployment

more; than it is about unemployment

less; than it is about government debt

09/2012

09/2014

09/2016

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- With a current inflation rate of 1.8%, Real GDP = $23,450, and Potential Real GDP = $22,900, what is the appropriate Federal Funds Rate According to the Fed?arrow_forwardSuppose that in 1980, the U.S. inflation rate was 14 percent and the unemployment rate reached 7.6 percent. Suppose that the target rate of inflation was 3 percent back then and the full-employment rate of unemployment was 5.5 percent at that time. What value does the Taylor Rule predict for the Fed's target interest rate? Instructions: Enter your answer rounded to 2 decimal places. percentarrow_forwardSuppose that the next FOMC meeting is coming up in a few days and the official inflation and output gap numbers have just been released. The current federal funds rate is 1.25%, the long-term fed funds rate target is 3.25%, and the inflation rate target is 2%. According to the release, inflation is currently at 1.25 percent and the output gap is -0.5 percentage points. Given the information above, the expected federal funds rate is _____ percent.arrow_forward

- Solve with detailsarrow_forwardSuppose that the Fed want to lower the inflation rate. Discuss what policy instruments the Fed can use besides raising interest on reserves.arrow_forwardWhat variables will the FOMC continue to monitor in determining the appropriate stance of monetary policy? The next meeting of the FOMC will take place on July 26, 2023. Do you predict that the Committee will raise or lower interest rates or continue to keep rates constant at this meeting? Why? Explain your reasoning. cite sources pleasearrow_forward

- INTEREST RATE (Percent) 18 15 2 so 3 0 0 20 Money Supply Money Demand 40 60 80 MONEY (Billions of dollars) 100 120 Money Demand Money Supply Following the price level increase, the quantity of money demanded at the initial interest rate of 9% will be supplied by the Fed at this interest rate. As a result, individuals will attempt to will bonds and other interest-bearing assets, and bond issuers will realize that they equilibrium is restored in the money market at an interest rate of % than the quantity of money their money holdings. In order to do so, they interest rates untilarrow_forwardSuppose that actual inflation is 2.5 percent, the Fed's inflation target is 2 percentage points, and unemployment rate is 2.5 (which is 1.5 percent below the Fed's full-employment target of 4 percent). According to the Taylor Rule, what value will the Fed want to set for its targeted interest rate?arrow_forwardSuppose that in 1980, the U.S. inflation rate was 14 percent and the unemployment rate reached 7.6 percent. Suppose that the target rate of inflation was 3 percent back then and the full-employment rate of unemployment was 6 percent at that time. What value does the Taylor Rule predict for the Fed's target interest rate? Instructions: Enter your answer rounded to 2 decimal places. 18.95 percentarrow_forward

- Please graphically show and explain how the Fed raises interest rate before 2008 and after 2015 respectively.arrow_forward10. Suppose that the equilibrium real federal funds rate is 2.5% and the target inflation rateis 2.5%. If the current inflation is 6.25% and the output gap is -2.3%, use the Taylorrule to find the federal funds rate that the Fed should choose. Show your work.arrow_forward1. It is often said that the Federal Reserve Board typically cares more about inflation and less about unemployment than the administration. If this is true, why might presidents often worry about what the Fed might do to interest rates?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education