FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:FBbbed by

Suppose Italian Grill restaurant is considering whether to (1) bake bread for its restaurant in-house or (2) buy the bread from a local bakery. The chef estimates that variable costs of

making each loaf include $0.56 of ingredients, $0.21 of variable overhead (electricity to run the oven), and $0.75 of direct labor for kneading and forming the loaves. Allocating fixed

overhead (depreciation on the kitchen equipment and building) based on direct labor, Italian Grill assigns $0.99 of fixed overhead per loaf. None of the fixed costs are avoidable. The

local bakery would charge $1.84 per loaf.

Read the requirements.

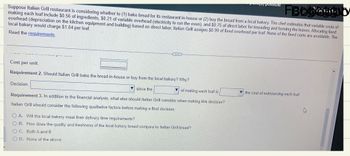

Cost per unit

Requirement 2. Should Italian Grill bake the bread in-house or buy from the local bakery? Why?

Decision:

...

since the

of making each loaf is

Requirement 3. In addition to the financial analysis, what else should Italian Grill consider when making this decision?

Italian Grill should consider the following qualitative factors before making a final decision:

OA. Will the local bakery meet their delivery time requirements?

OB. How does the quality and freshness of the local bakery bread compare to Italian Grill bread?

OC. Both A and B

OD. None of the above

es possible

the cost of outsourcing each loaf.

Transcribed Image Text:Suppose Italian Grill restaurant is considering whether to (1) bake bread for its restaurant in-house or (2) buy the bread from a local bakery. The chef estimates that variable costs of

making each loaf include $0.56 of ingredients, $0.21 of variable overhead (electricity to run the oven), and $0.75 of direct labor for kneading and forming the loaves. Allocating fixed

overhead (depreciation on the kitchen equipment and building) based on direct labor, Italian Grill assigns $0.99 of fixed overhead per loaf. None of the fixed costs are avoidable. The

local bakery would charge $1.84 per loaf.

Read the requirements.

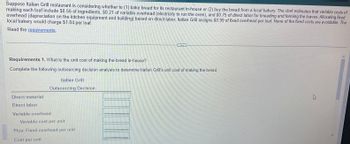

Requirements 1. What is the unit cost of making the bread in-house?

Complete the following outsourcing decision analysis to determine Italian Grill's unit cost of making the bread.

Direct material

Direct labor

Italian Grill

Outsourcing Decision

Variable overhead

Variable cost per unit

Plus: Fixed overhead per unit

Cost per unit

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Windu Enterprises uses a manufacturing process that is very labor intensive to manufacture its multicolored laser vegetable slicers. Windu is considering a change to a more automated manufacturing process. The cost structure information for Windu's options are listed below. Windu sells its only product for $25 per unit. Costs Fixed Manufacturing Costs Variable Manufacturing Cost per unit Current Method $180,000 $15 Automated Method $240,000 $13 Required. 1. Compute the breakeven points for both production methods 2. Compute the point of indifference for these two production methods (i.e. at what number of units of production will income be equal for both methods?) 3. Calculate the Operating Leverage Factor for both methods at the point of indifference + 4. If Windu's management intends to produce and sell 35,000 units, which production method should they use? 5. By how much per unit (nearest $.01) would the current method's variable cost need to decrease in order for management to be…arrow_forwardAIP 10.7 Overhead Costs from a New Factory Karsten is one of the premier carpet manufacturers in the world. It manufactures carpeting for both residential and commercial applications. Home sales and commercial sales each account for about 50 percent of total revenues. The firm is organized into three departments: Manu facturing, Residential Sales, and Commercial Sales. Manufacturing is a cost center and the two sales departments are profit centers. The full cost of each roll of carpeting produced (including fully absorbed overhead) is transferred to the sales department ordering the carpet. The evaluation of the sales departments includes the fully absorbed cost of each roll as the transfer price. The current manufacturing plant is operating at capacity. A new plant is being built that will more than double capacity. Within two years, management believes that its businesses will grow such that most of the excess capacity will be eliminated. When the new plant comes online, the plan is…arrow_forwardSuppose Country Cafe restaurant is considering whether to (1) bake bread for its restaurant in-house or (2) buy the bread from a local bakery. The chef estimates that variable costs of making each loaf include $0.44 of ingredients, $0.28 of variable overhead (electricity run the oven), and $0.72 of direct labor for kneading and forming the loaves. Allocating fixed overhead (depreciation in the kitchen equipment and building) bases on the direct labor, County Cafe l assigns $1.05 of fixed overheard per loaf. None of the fixed costs are avoidable. The local bakery would charge $1.72 per loaf. Requirements 1. What is the unit cost of making the bread in-house? Complete the following outsourcing decision analysis to determine Country Cafe's unit cost of making the breadarrow_forward

- I could use a hand with thisarrow_forwardFix the wrong parts, please.arrow_forwardOficina Bonita Company manufactures office furniture. An unfinished desk is produced for $34.75 and sold for $65.75. A finished desk can be sold for $75.50. The additional processing cost to complete the finished desk is $6.45. Prepare a differential analysis. Round your answers to two decimal places. Line Item Description Sell UnfinishedDesks(Alternative 1) Process Further intoFinished Desks(Alternative 2) DifferentialEffects(Alternative 2) Revenues per desk $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Costs per desk fill in the blank 4 fill in the blank 5 fill in the blank 6 Profit (loss) per desk $fill in the blank 7 $fill in the blank 8 $fill in the blank 9 Should the company sell unfinished desks or process further and sell finished desks?Oficina Bonita Company should .arrow_forward

- ficina Bonita Company manufactures office furniture. An unfinished desk is produced for $37.10 and sold for $65.45. A finished desk can be sold for $75.00. The additional processing cost to complete the finished desk is $6.30. Prepare a differential analysis. Round your answers to two decimal places. Differential AnalysisSell Unfinished (Alternative 1) or Process Further into Finished (Alternative 2) Desks Sell UnfinishedDesks(Alternative 1) Process Further intoFinished Desks(Alternative 2) DifferentialEffects(Alternative 2) Revenues per desk $ $ $ Costs per desk Profit (loss) per desk $ $ $ Should the company sell unfinished desks or process further and sell finished desks?Oficina Bonita Company should.arrow_forwardTarget costs, effect of process-design changes on service costs. Solar Energy Systems (SES) sells solar heating systems in residential areas of eastern Pennsylvania. A successful sale results in the homeowner purchasing a solar heating system and obtaining rebates, tax credits, and nancing for which SES completes all the paperwork. The company has identied three major activities that drive the cost of selling heating systems: identifying new contacts (varies with the number of new contacts); traveling to and between appointments (varies with the number of miles driven); and preparing and ling rebates and tax forms (varies with the number of solar systems sold). Actual costs for each of these activities in 2016 and 2017 are:arrow_forwardPlease answer fast i give you upvote.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education