FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

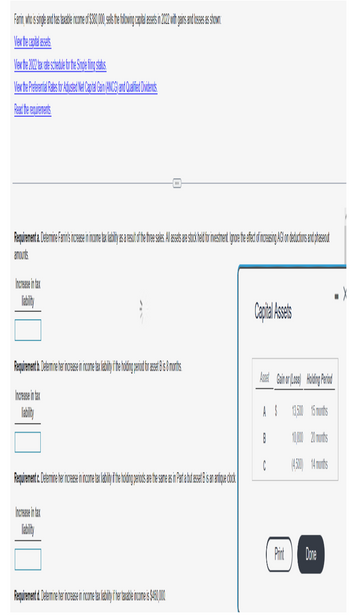

Transcribed Image Text:Farmin, who is single and has taxable income of $380,00, ell the ollowing capital asets in 2012 with gains and losses as shown:

View the capital assets

View the 202 tax rate schedule for the Single filing status.

View the Preferential Rates for Adjusted Net Capital Gain (ANCG) and Qualified Dividends

Read the requirements

Requirement a. Determine Farins increase in income tax facilit as a result of the true sales. llassets are stockhold for investimento ignore the efectof increasing AGC on deductions and phaseout

amounts

Increase in tax

|||

Requirement b. Determine her increase in income tax ab it if he holding period for a set Bis 8 months

Increase in tax

Requirement c. Determine her increase in income tax labiliy if the holding periods are the same as in part a but asset B is an antique clock

Increase in tax

Requirement d. Determine her increase in income tax li biti i te ta ble income is $450,000

Capital Assets

Asset Gainor (Loss) Holding Period

13,500 15 months

10,000 20 months

(4.500) 14 months

AS

B

C

Print Dore

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Smith Family Trust earns $60,000 in eligible dividends during 2020. It allocates $20,000 of income to its beneficiary, Sam Smith Jr. What is the type of income that Sam Smith Jr. will report on his tax returns? Answer options: An eligible dividend Trust income A return of capital Capital gainsarrow_forwarda. Determine D'Lake, Green, Divot, recognized gain or loss upon formation of Slicenhook. b. What is D'Lake, Green, Divot, initial tax basis in Slicenhook on January 2, 2022? c. Prepare Slicenhook's opening tax basis balance sheet as of January 2, 2022. Cash__ Land__ Total__ Liabilities__ Tax Capital: D'Lake__ Green__ Divot__ Total__arrow_forward! Required information [The following information applies to the questions displayed below.] In 2023, Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Input all values as positive. Leave no answer blank. Enter zero if applicable. d. Her AMT base is $422,500, which includes $13,000 of qualified dividends. Description (1) AMT base (2) Dividends taxed at preferential rate (3) Tax on dividends (4) AMT base taxed at regular AMT rates (5) Tax on AMT base taxed at 26% rate (6) Tax on AMT base taxed at 28% rate Tentative minimum tax Amountarrow_forward

- Please Fast Answer and do not give solution in image formatarrow_forwardIn 2020, Mackenzie had employment income of $40,000, property income of $3,000, a business loss of $22,000, an allowable business investment loss of $5,000, income from an RRSP withdrawal of $2,000, and a capital loss of $40,000 on the sale of shares in a public corporation. Mackenzie hopes that the losses will result in a net income for tax purposes of $O. Required: A) Determine Mackenzie's net income for tax purposes in accordance with Section 3 of the Income Tax Act. B) Based on your answer in Part A, explain to Mackenzie why there will or will not be a tax liability this year, assuming that the taxable income will be equal to the net income for tax purposes. C) How would your answer change in Part A if Mackenzie realized a taxable capital gain of $30,000 in 2020?arrow_forwardMemanarrow_forward

- Required information [The following information applies to the questions displayed below.] Henrich is a single taxpayer. In 2023, his taxable income is $530,000. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. b. His $530,000 of taxable income includes $2,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $570,000. Answer is complete but not entirely correct. Income tax Net investment income tax Total tax liability Amount 159,251.75 x 2,000.00 x 161,251.75arrow_forwardkai.4arrow_forwardRequired information [The following information applies to the questions displayed below.] In 2023, Carson is claimed as a dependent on his parents' tax return. His parents report taxable income of $200,000 (married filing jointly). Carson's parents provided most of his support. What is Carson's tax liability for the year in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. Carson is 23 years old at year-end. He is a full-time student and earned $16,400 from his summer internship and part-time job. He also received $5,280 of qualified dividend income Tax liabilityarrow_forward

- Compute the taxable income for 2023 in each of the following independent situations. Click here to access the Exhibits 3.4 and 3.5 to use if required. a. Aaron and Michele, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AGI of $125,000 and itemized deductions of $29,000. AGI Less: Itemized deductions Taxable income b. Sybil, age 40, is single and supports her dependent parents who live with her, as well as her grandfather who is in a nursing home. She has AGI of $80,000 and itemized deductions of $8,000. AGI Less: Standard deduction Taxable income AGI Less: Standard deduction c. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsons who qualify as his dependents. He has AGI of $76,800 and itemized deductions of $10,100. Taxable income $125,000 AGI Less: Standard deduction $80,000 d. Amelia, age 33, is an abandoned spouse who maintains a household for her three dependent children. She has…arrow_forwardMemanarrow_forwardRequired information [The following information applies to the questions displayed below.] Lacy is a single taxpayer. In 2023, her taxable income is $50,800. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. c. Her $50,800 of taxable income includes $7,800 of qualified dividends. Tax liabilityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education