FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

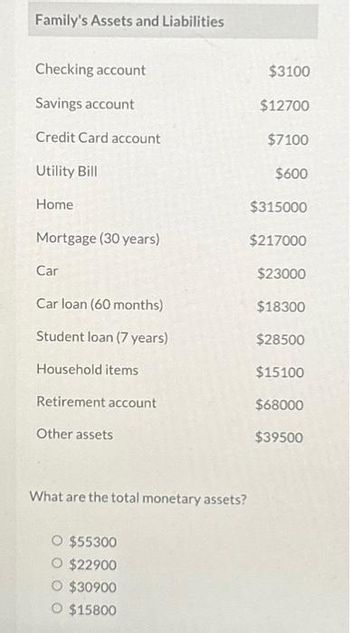

Transcribed Image Text:Family's Assets and Liabilities

Checking account

Savings account

Credit Card account

Utility Bill

Home

Mortgage (30 years)

Car

Car loan (60 months)

Student loan (7 years)

Household items

Retirement account

Other assets

What are the total monetary assets?

O $55300

O $22900

O $30900

O $15800

$3100

$12700

$7100

$600

$315000

$217000

$23000

$18300

$28500

$15100

$68000

$39500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- This amortization table shows the first 3 payments and the last 3 payments on a mortgage. Payment Monthly Interest PrincipalOutstanding number payment paid paid balance $120 000.00 $119 746.95 $119 492.58 $119 236.90 $1735.38 $869.43 $1.01 1 $874.94$621.89 $253.05 2 $874.94$620.58 $254.36 3 $874.94$619.26 $255.68 $874.94 $13.46 $861.48 $874.94 $874.94 238 $8.99 $865.95 $4.51 $870.43 239 240 What is the total interest paid over the life of the mortgage?arrow_forwardYour grandmother closed her bank account from a thrift bank and gotP6, 000, 000 with the 8% annual interest given. She said she has been savingup a same amount each year for 30 years where 8% interest has beenapplied. How much would her annual savings deposits be when her lastdeposit was a year ago? ANS:49, 041.3 show solutionarrow_forwardQUESTION 5 Katharine Bartle will receive an annuity of $4,090.00 every month for 23 years. How much is this cash flow worth to them today if the payments begin today? Assume a discount rate of 5.00%. Oa. $55,398.13 b. $2,119,880.47 c. $672,837.73 Od. $170,156.69arrow_forward

- Andre Castello owns a savings account that is paying 2.5% interest compounded annually His current balance is $7.598.42. How much interest will he earn over 5 years if the rate remains constant? Select one: a. $998.49 b. $8596.91 c. $949.80 d. $882.52arrow_forwardQ2.2: Since the birth of his granddaughter, 15 years ago, Michael has deposited $150 at the beginning of every month into a Registered Education Savings Plan (RESP). The interest rate on the plan was 3.75% compounded monthly for the first 8 years and 4.25% compounded monthly for the next 7 years. a. What was the accumulated value of the RESP at the end of 8 years? b. What was the accumulated value of the RESP at the end of 15 years? c. What was the amount of interest earned over the 15-year period? Kindly keep all the decimals for all the preocedures, DO NOT ROUNDarrow_forwardHeer Don't upload any image pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education