Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

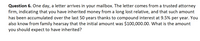

Transcribed Image Text:Question 6. One day, a letter arrives in your mailbox. The letter comes from a trusted attorney

firm, indicating that you have inherited money from a long lost relative, and that such amount

has been accumulated over the last 50 years thanks to compound interest at 9.5% per year. You

also know from family hearsay that the initial amount was $100,000.00. What is the amount

you should expect to have inherited?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Can someone please help? Thank you.arrow_forward2. (a) A college student, Amy, decides to fund a retirement account with $2000 per year for 8 years, with the first deposit made one year from today. The rate of return will be 10%. How much will she have in her account when she retires in 40 years? (b) Amy’s friend, Dacio, decides he will start funding his retirement account 8 years from now (first payment in 9 years). He then will invest $2000 each year for 32 years. If his rate of return is 10%, how much will he have when he retires in 40 years?arrow_forwardLarry purchased an annuity from an insurance company that promises to pay him $6,500 per month for the rest of his life. Larry paid $626,340 for the annuity. Larry is in good health and is 72 years old. Larry received the first annuity payment of $6,500 this month. Use the expected number of payments in Exhibit 5-1 for this problem. Problem 5-59 Part-a (Algo) a. How much of the first payment should Larry include in gross income?arrow_forward

- PLEASE SHOW ALL WORK Richard deposits $ 5400 and got back an amount of $ 6000 after a year. Find the simple interest he got.arrow_forwardY our great aunt put some money in an account for you on the day you were born. This account pays 8% interest per year. On your 21st birthday the account balance was $5033.83. Your Questions: 1) What is the amount of money that your great aunt originally put in the account? 2) What is the amount of money that would be in the account if you left the money there until your 65th birthday?arrow_forwardYou have inherited money from a distant relative, and it will arrive in 4 separate deposits over the course of 6 years as shown below. At the same time, you're receiving an annual salary of $50,000 (an annuity). At the end of the 6th year, how much money will be in your account, if your account has an annual interest rate of 8%? Year 1: $5,000 Year 2:0 Year 3: $6,400 Year 4: $8,000 Year 5:0 Year 6: $7,500 Typed numeric answer will be automatically saved.arrow_forward

- Your grandmother just died and left you $47,500 in a trust fund that pays 6.5% interest. You must spend the money on your college education, and you must withdraw the money in 4 equal installments, beginning immediately. How much could you withdraw today and at the beginning of each of the next 3 years and end up with zero in the account? a. $3,087.50 b. $13,865.38 c. $10,120.08 d. $16,840.23 e. $13,019.14arrow_forwardWhen you were born, your grandparents put $5,000 in to a money market account to help with your college education. The bank gave them a guaranteed interest rate of 6% per year until you turned 18. How much money will be in the account on your 18th birthday if you never withdraw any money until that day? $11,417.20 $54,138.00 $1751.50 $14,271.50arrow_forwardAkeem Joffer hopes to a new cabin on Webb Lake in Maine. Akeem has $13,000 saved today and wants to save $7,000 every year for the next nine years. Assume Akeem can earn 11% on his investments. Compute the amount Akeem expects to have available to purchase the cabin in 9 years. 5. Reggie Hammond has $300,000 in cash located in a suitcase in the trunk of his car.Reggie deposits this amount in Gibraltar Bank. The bank offers a 6.7% annual rate and pays interest quarterly. Reggie hopes to have $1,600,000 at the end of five years. Compute the quarterly savings Reggie must deposit into this account in order to achieve his goal. 6. Billy Ray Valentine promises to pay his friend Louis Winthorpe a deferred annuity of $60,000 beginning in year five and continuing through year eleven plus a three-year deferred annuity of $7,000 that begins in year 15. Interest rate is 8.2 % . Compute the amount Billy Ray needs today to fulfill his obligation to his friendarrow_forward

- Please help if u cant do both skip betterarrow_forwardLarry purchased an annuity from N insurance company that promises to pay him $2,000 per month for the rest of his life. Larry paid $210,240 for the annuity. Larry is in good health and is 72 years old. Larry received the first annuity payment of $2,000 this month. If Larry lives more than 15 years after starting the annuity, how much of each additional payment should be included in gross income?arrow_forwardYour grandfather put some money in an account for you on the day you were born. You are now 16 years old and are allowed to withdraw the money for the first time. The account currently has $5,311 in it and pays an 11% interest rate. a. How much money would be in the account if you left the money there until your 25th birthday? b. What if you left the money until your 65th birthday? c. How much money did your grandfather originally put in the account? a. How much money would be in the account if you left the money there until your 25th birthday? If you left the money there until your 25th birthday, the amount in the account would be $ nearest cent.) (Round to thearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education