FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

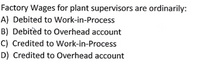

Transcribed Image Text:Factory Wages for plant supervisors are ordinarily:

A) Debited to Work-in-Process

B) Debitèd to Overhead account

C) Credited to Work-in-Process

D) Credited to Overhead account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain it properlyarrow_forwardThe journal entry to record applied factory overhead includes a(n) a.decrease to Work in Process. b.increase to Factory Overhead. c.increase to Wages Payable. d.decrease to Factory Overhead.arrow_forwardWhich of the following statements is true? (You may select more than one answer.)a. The Manufacturing Overhead account is debited when manufacturing overhead isapplied to Work in Process.b. Job cost sheets accumulate the actual overhead costs incurred to complete a job.c. When products are transferred from work in process to finished goods it results ina debit to Finished Goods and a credit to Work in Process.d. Selling expenses are applied to production using a predetermined overhead ratethat is computed at the beginning of the period.arrow_forward

- Name two principal types of cost accounting systems. Which system provides for a separate record of each particular quantity of product that passes through the factory? Which system accumulates the costs for each department or process within the factory? How is product cost information used by managers? Discuss how the predetermined factory overhead rate can be used in job order cost accounting to assist management in pricing jobs. How is a predetermined factory overhead rate calculated? Name three common bases used in calculating the rate. How can activity-based costing be used in service companies?arrow_forwardIn a process cost system total costs are determined when the job is completed. costs are summarized in a job cost sheet. only one work in process account is used. the unit cost is total manufacturing costs for the period divided by the unts produced during the period.arrow_forwardDiscuss the reason why companies use predetermined (factory) overhead rates rather than actual manufacturing overhead costs to apply overhead to jobs? What purpose does that serve?arrow_forward

- How would salaries of supervisors in the factory be classified? Group of answer choices direct labor indirect labor administrative period costarrow_forwardThe journal entry for adjustment of underallocated manufacturing overhead includes a: A) credit to Finished Goods Inventory. B) credit to Manufacturing Overhead. C) debit to Work-in-Process Inventory. D) credit to Cost of Goods Sold.arrow_forwardWhat is the journal entry to apply overhead into production in a job order cost accounting system. Group of answer choices debit work in process, credit factory overhead debit finished goods, credit factory overhead debit factory overhead, credit finished goods debit factory overhead, credit work in processarrow_forward

- Which account is used in the job order cost system to accumulate direct materials, direct labour, and factory overhaed applied to production cost for industrial jobs.arrow_forwardThe cost accountant prepares the cost of production summary by first collecting the period’s production costs from summaries of material requisitions, payroll, and factory overhead analysis sheets. True or False?arrow_forwardThere are standard amounts of factory overhead. Explain the procedures to determine standard amounts of factory overhead at different levels of production.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education