FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

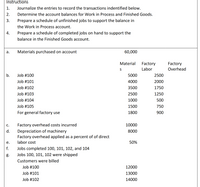

Transcribed Image Text:**Instructions:**

1. **Journalize the entries** to record the transactions identified below.

2. **Determine the account balances** for Work in Process and Finished Goods.

3. **Prepare a schedule** of unfinished jobs to support the balance in the Work in Process account.

4. **Prepare a schedule** of completed jobs on hand to support the balance in the Finished Goods account.

**Transactions:**

a. **Materials purchased on account:** 60,000

b. **Materials and Labor Costs:**

- **Job #100**

- Materials: 5000

- Factory Labor: 2500

- Factory Overhead:

- **Job #101**

- Materials: 4000

- Factory Labor: 2000

- Factory Overhead:

- **Job #102**

- Materials: 3500

- Factory Labor: 1750

- Factory Overhead:

- **Job #103**

- Materials: 2500

- Factory Labor: 1250

- Factory Overhead:

- **Job #104**

- Materials: 1000

- Factory Labor: 500

- Factory Overhead:

- **Job #105**

- Materials: 1500

- Factory Labor: 750

- Factory Overhead:

- **For general factory use:**

- Materials: 1800

- Factory Labor:

- Factory Overhead:

c. **Factory overhead costs incurred:** 10,000

d. **Depreciation of machinery:** 8000

- Factory overhead applied as a percent of direct labor cost: 50%

e. **Jobs completed:** 100, 101, 102, and 104

f. **Jobs 100, 101, 102 were shipped** to customers.

- Customers were billed:

- Job #100: 12000

- Job #101: 13000

- Job #102: 14000

This document provides a structured approach for accounting entries related to manufacturing processes, focusing on materials, labor, overhead, and job completion status for effective financial management.

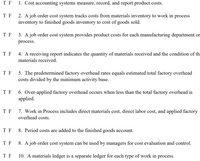

Transcribed Image Text:### True or False Statements on Cost Accounting Systems

1. **Cost accounting systems measure, record, and report product costs.**

- T F

2. **A job order cost system tracks costs from materials inventory to work in process inventory to finished goods inventory to cost of goods sold.**

- T F

3. **A job order cost system provides product costs for each manufacturing department or process.**

- T F

4. **A receiving report indicates the quantity of materials received and the condition of the materials received.**

- T F

5. **The predetermined factory overhead rate equals estimated total factory overhead costs divided by the minimum activity base.**

- T F

6. **Over-applied factory overhead occurs when less than the total factory overhead is applied.**

- T F

7. **Work in Process includes direct materials cost, direct labor cost, and applied factory overhead costs.**

- T F

8. **Period costs are added to the finished goods account.**

- T F

9. **A job order cost system can be used by managers for cost evaluation and control.**

- T F

10. **A materials ledger is a separate ledger for each type of work in process.**

- T F

### Explanation

This set of true or false statements is designed to test your understanding of cost accounting systems, particularly job order costing. The key focus is on cost tracking and management in manufacturing, with emphasis on overhead rates, cost processes, and reporting tools used by managers. Each statement requires careful consideration to determine its truthfulness based on accounting principles and practices.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The adjusting entry to apply factory overhead to the work in process ending inventory includes a.debiting Finished Goods Inventory and crediting Factory Overhead. b.debiting Work in Process Inventory and crediting Factory Overhead. c.debiting Factory Overhead and crediting Finished Goods Inventory. d.debiting Factory Overhead and crediting Work in Process Inventory.arrow_forwardWhich of the following accounts would be debited in the journal entry to record the issuance of direct materials? O A. Cost of Goods Sold O B. Finished Goods Inventory OC. Raw Materials Inventory O D. Work-in-Process Inventoryarrow_forwardThe following events occurred over the course of a year at Coronado Corp., which uses a job order costing system: 1. Direct materials purchases totaled $586,000. Coronado Corp tracks its direct materials separately from its indirect materials. Purchases were made on account. 2. $133,000 of indirect materials were used in production. Coronado uses a separate Supplies Inventory account for indirect materials. 3. $556,000 of direct materials were used in production. 4. The direct labor payroll was $791,000 (credit Wages Payable). 5. Other manufacturing overhead costs incurred during the year totaled $684,000. 6. Coronado applies overhead based on a predetermined overhead rate of $24 per machine hour. The company used 48,000 machine hours during the year. 7. During the year, Coronado transferred goods costing $2,430,000 into the Finished Goods Inventory account. 8. Coronado sold products with a manufacturing cost of $2,398,000 to customers during the year.arrow_forward

- Periodically reviewing all jobs is a subtask of O a. developing job descriptions and job specifications Ob. conducting the job analysis O c. preparing for and introducing the job analysis O d. maintaining and updating job descriptions and job specificationsarrow_forwardWhat journal entry is recorded when a material manager recieves a materials requisiton andthen issues materials (both direct and indirect) for use in the factory?arrow_forwardA cost driver is used to allocate support department expenses. Match each of the following cost drivers with the appropriate department. Clear All Number of work orders Number of employees Number of payroll checks Number of purchase requisitions Payroll Accounting Maintenance President's Office Purchasing Human Resourcesarrow_forward

- Flow of Product Costs through Accounts Assuming a routine manufacturing activity, present Journal entries (account titles only) for each of the following transactions: a. Purchased materlal on account. Description Debit Credit Accounts payable b. Recorded wages payable (for Indirect labor) earned but not paid. Description Debit Credit Wages payable C. Requisitioned both direct material and indirect material. Description Debit Credit Work in process inventory Manufacturing overhead Materials inventory d. Assigned direct and Indirect labor costs. Description Debit Credit Work in process inventory Manufacturing overhead Wages payable e. Recorded factory depreciation and accrued factory property tax. Description Debit Credit Manufacturing overhead Accumulated depreciation-factory Property taxes payable f. Appled manufacturing overhead to production. Description Debit Credit Manufacturing overhead g. Completed work on products. Description Debit Credit Work in process inventory h. Sold…arrow_forwardFor following products and services, indicate whether it is more likely produced in a processoperation (P) or in a job order operation (J). House paintsarrow_forwardPlease help me with all answers thankuarrow_forward

- Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.arrow_forwardPresent the journal entry for (b) manufacturing labor incurred.arrow_forwardJournalize the entries to record the transactions, post to the Raw Materials Inventory account, and determine the ending balance in Raw Materials Inventory.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education