FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:ect

the factory labor costs.

ze the entry to apply factory overhead to production for November.

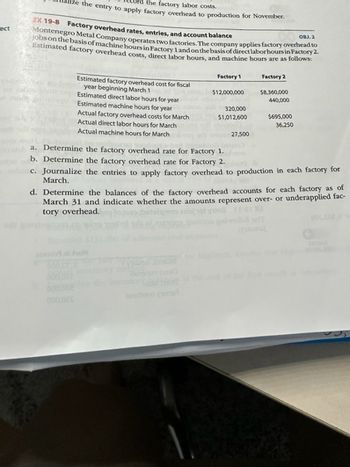

EX 19-8 Factory overhead rates, entries, and account balance

Montenegro Metal Company operates two factories. The company applies factory overhead to

obs on

in Factory 2

Estimated factory overhead costs, direct labor hours, and machine hours are as follows:

Factory 2

$8,360,000

440,000

Estimated factory overhead cost for fiscal

year beginning March 1

Estimated direct labor hours for year

Estimated machine hours for year

Actual factory overhead costs for March

Actual direct labor hours for March

Actual machine hours for March

Factory 1

$12,000,000

320,000

$1,012,600

27,500

$695,000

36,250

OBJ. 2

a. Determine the factory overhead rate for Factory 1.

b. Determine the factory overhead rate for Factory 2.

c. Journalize the entries to apply factory overhead to production in each factory for

March.

d. Determine the balances of the factory overhead accounts for each factory as of

March 31 and indicate whether the amounts represent over- or underapplied fac-

tory overhead.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Entries for Direct Labor and Factory Overhead Townsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as fllows: Job 201 $3,650 Job 202 1,820 Job 203 1,440 Job 204 2,690 Factory supervision 1,250 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $20 per direct labor hour. The direct labor rate is $15 per hour. If required, round final answers to the nearest dollar. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Work in Process Factory Overhead Wages Payablearrow_forwardFactory Overhead Rates, Entries, and Account Balance Eclipse Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: Factory 1 Factory 2 Estimated factory overhead cost for fiscal year beginning August 1 $811,040 $530,100 Estimated direct labor hours for year 9,300 Estimated machine hours for year 21,920 Actual factory overhead costs for August $64,850 $45,960 Actual direct labor hours for August 840 Actual machine hours for August 1,710 a. Determine the factory overhead rate for Factory 1.$fill in the blank d3b49f01b03efcf_1 per machine hour b. Determine the factory overhead rate for Factory 2.$fill in the blank d3b49f01b03efcf_2 per direct labor hour Question Content Area c. Journalize the entries to…arrow_forwardPROVIDE Answerarrow_forward

- Journalize the entry to record the factory labor costs Journalize the entry to apply factory overhead to production for November.arrow_forwardPrepare an income statementarrow_forwardFactory Overhead Rates, Entries, and Account Balance Eclipse Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: Factory 1 Factory 2 Estimated factory overhead cost for fiscal year beginning August 1 $548,880 $835,200 Estimated direct labor hours for year 11,600 Estimated machine hours for year 22,870 Actual factory overhead costs for August $43,790 $71,880 Actual direct labor hours for August 1,040 Actual machine hours for August 1,780 Question Content Area a. Determine the factory overhead rate for Factory 1.$fill in the blank f94b7703c00e013_1 per machine hour b. Determine the factory overhead rate for Factory 2.$fill in the blank f94b7703c00e013_2 per direct labor hour c. Journalize the entries…arrow_forward

- Entries for Costs in a Job Order Cost System Royal Technology Company uses a job order cost system. The following data summarize the operations related to production for March: a. Materials purchased on account, $770,000. b. Materials requisitioned, $680,000, of which $75,800 was for general factory use. c. Factory labor used, $756,000, of which $182,000 was indirect. d. Other costs incurred on account for factory overhead, $245,000; selling expenses, $171,500; and administrative expenses, $110,600. e. Prepaid expenses expired for factory overhead were $24,500; for selling expenses, $28,420; and for administrative expenses, $16,660. f. Depreciation of factory equipment was $49,500; of office equipment, $61,800; and of office building, $14,900. g. Factory overhead costs applied to jobs, $568,500. h. Jobs completed, $1,500,000. i. Cost of goods sold, $1,375,000. Required: Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it…arrow_forwardEclipse Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: Factory 1 Factory 2 Estimated factory overhead cost for fiscal year beginning August 1 $1,337,500 $847,000 Estimated direct labor hours for year 24,200 Estimated machine hours for year 53,500 Actual factory overhead costs for August $108,410 $96,900 Actual direct labor hours for August 2,720 Actual machine hours for August 4,400 Required: a. Determine the factory overhead rate for Factory 1. b. Determine the factory overhead rate for Factory 2. c. Journalize the Aug. 31 entries to apply factory overhead to production in each factory. d. Determine the balances of the factory overhead accounts for each factory as of August 31, and indicate whether the…arrow_forwardFactory Overhead Costs During August, Carrothers Company incurred factory overhead costs as follows: indirect materials, $3,110; indirect labor, $5,660; utilities cost, $1,210; and factory depreciation, $4,040. Journalize the entry to record the factory overhead incurred during August. If an amount box does not require an entry, leave it blank. Factory Overhead Materials Wages Payable Utilities Payable Accumulated Depreciation-Factoryarrow_forward

- Factory Overhead Rate, Entry for Applying Factory Overhead, and Factory Overhead Account Balance The cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be $575,000, and total direct labor costs would be $460,000. During February, the actual direct labor cost totaled $40,000, and factory overhead cost incurred totaled $52,000. a. What is the predetermined factory overhead rate based on direct labor cost? Enter your answer as a whole percent not in decimals. % b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory Overhead-Blending Department? Amount: Debit or Credit? d. Does the balance in part (c) represent overapplied or underapplied factory overhead?arrow_forwardFactory Overhead Rates, Entries, and Account Balance Sundance Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: Factory 1 Factory 2 Estimated factory overhead cost for fiscal year beginning March 1 $454,140 $1,155,000 Estimated direct labor hours for year 15,000 Estimated machine hours for year 15,660 Actual factory overhead costs for March $36,260 $99,790 Actual direct labor hours for March 1,350 Actual machine hours for March 1,220 Determine the balances of the factory overhead accounts for each factory as of March 31, and indicate whether the amounts represent overapplied factory overhead or underapplied factory overhead. Factory 1 $ Debit Underapplied Factory 2 $ Credit Overappliedarrow_forwardApplying Overhead; Journal Entries; T-accounts Dillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,800,000 in manufacturing overhead cost at an activity level of 240,000 machine-hours. The company spent the entire month of January working on a large order for 16,000 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: a. Raw materials purchased on account, $325,000. b. Raw materials used in production, $290,000 (80% direct materials and 20% indirect materials). c. Labor cost accrued in the factory, $180,000 (one-third direct labor and two-thirds indirect labor). d. Depreciation recorded on factory equipment, $75,000. e. Other manufacturing overhead costs incurred on account,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education