Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

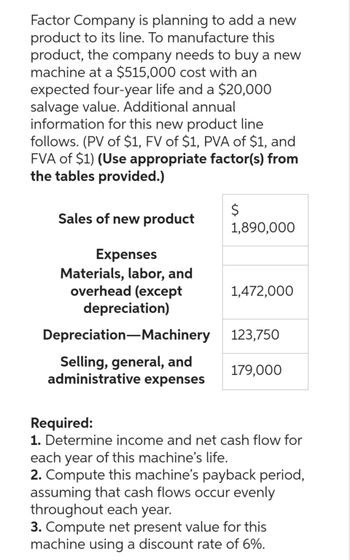

Transcribed Image Text:Factor Company is planning to add a new

product to its line. To manufacture this

product, the company needs to buy a new

machine at a $515,000 cost with an

expected four-year life and a $20,000

salvage value. Additional annual

information for this new product line

follows. (PV of $1, FV of $1, PVA of $1, and

FVA of $1) (Use appropriate factor(s) from

the tables provided.)

Sales of new product

Expenses

Materials, labor, and

overhead (except

depreciation)

Depreciation Machinery

Selling, general, and

administrative expenses

Ś

1,890,000

1,472,000

123,750

179,000

Required:

1. Determine income and net cash flow for

each year of this machine's life.

2. Compute this machine's payback period,

assuming that cash flows occur evenly

throughout each year.

3. Compute net present value for this

machine using a discount rate of 6%.

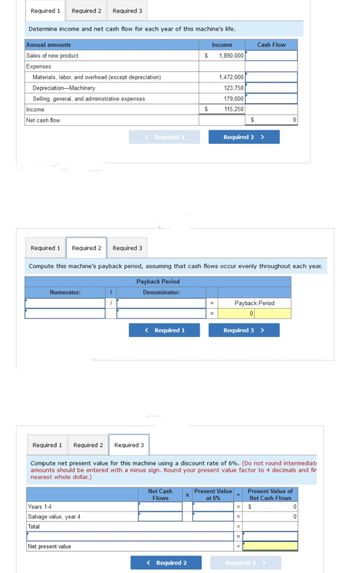

Transcribed Image Text:Required 1 Required 2 Required 3

Determine income and net cash flow for each year of this machine's life.

Annual amounts

Sales of new product

Expenses

Materials, labor, and overhead (except depreciation)

Depreciation Machinery

Selling, general, and administrative expenses

Income

Net cash flow

Required 1 Required 2 Required 3

Numerator:

Years 1-4

Salvage value, year 4

Total

1

1

Net present value

< Required 1

Required 3

< Required 1

Net Cash

Flows

$

Compute this machine's payback period, assuming that cash flows occur evenly throughout each year.

Payback Period

Denominator:

X

$

< Required 2

Income

1,890,000

=

1,472,000

123,750

179,000

115,250

Required 1 Required 2

Compute net present value for this machine using a discount rate of 6%. (Do not round intermediat

amounts should be entered with a minus sign. Round your present value factor to 4 decimals and fir

nearest whole dollar.)

$

Required 2 >

Cash Flow

Present Value

at 6%

Payback Period

0

Required 3 >

=

0

Required 3

Present Value of

Net Cash Flows

$

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- AI - E H E AutoSave Normal Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) 11 - A A Aav A E E AaBbCcDc AaBbCcDc AaBbC AABBCCC AaB AAB6CCC AaBbCcDa O Find - A Copy Paste S Replace В IUvab х, х* А I Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 1. 2 4 7 Use the following information to answer the next 3 questions Kite Corp. manufactures custom cabinets and uses a job-order costing system. The company had two jobs in process at the beginning of October: Job No. 64 with a total beginning cost of $56,700 and Job No. 65 with a total beginning cost of $83,300. The company applies manufacturing overhead on the basis of machine hours. Budgeted overhead and machine activity for the year were anticipated to be $3,021,000 and 57,000 machine hours. The company worked on four…arrow_forwardZarrow_forwardim having trouble with vlookup in excelarrow_forward

- O PowerPoint O from Towards a O Mail - Edjouline X E Content - ACG: X * CengageNOWv. x D (58) YouTube v2 cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inpro. Q < * * C WouTube O Maps ANKSHEET Entries for Notes Receivable Spring Designs & Decorators issued a 120-day, 4% note for $60,000, dated April 13 to Jaffe Furniture Company on account. Assume a 360-day year when calculating LANKSHEET interest. LGO a. Determine the due date of the note. LGO b. Determine the maturity value of the note. cl. Journalize the entry to record the receipt of the note by Jaffe Furniture. c2. Journalize the entry to record the receipt of payment of the note at maturity. If an amount box does not require an entry, leave it blank. 24 068 s: 912 items Previous Next 回习 9 O 11:49arrow_forwardPlease avoid answers in image format thank youarrow_forwardPlease do not give image formatarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease don't provide handwrittin solution....arrow_forwardCan you explain what I might be missing throughly please? I have it correct but it claims that it's not complete. What am I missing?arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardI need this in text not imagesarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education