ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

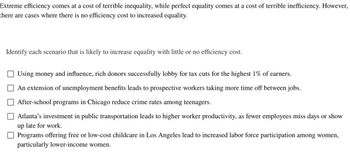

Transcribed Image Text:Extreme efficiency comes at a cost of terrible inequality, while perfect equality comes at a cost of terrible inefficiency. However,

there are cases where there is no efficiency cost to increased equality.

Identify each scenario that is likely to increase equality with little or no efficiency cost.

Using money and influence, rich donors successfully lobby for tax cuts for the highest 1% of earners.

An extension of unemployment benefits leads to prospective workers taking more time off between jobs.

After-school programs in Chicago reduce crime rates among teenagers.

Atlanta's investment in public transportation leads to higher worker productivity, as fewer employees miss days or show

up late for work.

Programs offering free or low-cost childcare in Los Angeles lead to increased labor force participation among women,

particularly lower-income women.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You have already saved $55. You earn $9 per hour at your job. You are saving for a bicycle that costs $199. Which inequality represents the possible numbers of hours you need to work to buy the bicycle?arrow_forwardExplain why majority rule respects the preferencesof the median voter rather than those of the averagevoter.arrow_forwardEach part neededarrow_forward

- Poverty is measured by the number of people who fall below a certain level of income—called the poverty line—that defines the income one needs for a basic standard of living. The official definition of the poverty line traces back to Group of answer choices A)The Great Depression B)Mollie Orshansky, whose idea was to define a poverty line based on the cost of a healthy diet. C)1953 and the ability to pay for housing and food. D)The 1965 cost of providing food, housing, and transportation.arrow_forwardConsider a society consisting of two people. Jacques earns an income of $100,000 per year and Kyoko earns an income of $30,000 per year. The government is considering a redistribution plan that would impose a 25% tax on Jacques's income and give the revenue to Kyoko. Without any incentive distortion, Jacques would retain $75,000 and Kyoko would end up with $55,000. However, let us assume that since Jacques will not receive all the income he earns, he decides to work less and earn an income of only $90,000, of which 25%×$90,000=$22,50025%×$90,000=$22,500 will be owed in taxes. With the redistribution plan, Jacques will take home an income of . The $22,500 that Jacques pays in taxes will be transferred by the government to Kyoko. Let us assume that since Kyoko now receives payment from the government, she will not work as many hours and will earn an income from work of only $29,000 instead of her initial $30,000. With the redistribution plan, Kyoko's total income…arrow_forwardGDP per capita does not account for distribution; consequently, economic growth may actually reduce inequality equalityarrow_forward

- Suppose the teacher for your course, "Principles of Economics" is a libertarian and adheres strictly by its principles in running your economics class. What policies would you expect your teacher to institute? Policies a Libertarian Would Enforce Policies a Libertarian Would Not Enforce The teacher, seeing grade inequality, decides to give points from the best student's test to the worst's students test. The teacher decides to give everyone in the class an A. The teacher punishing a student for cheating on her income equality and poverty homework assignment. Grade the class on a curve to ensure even grade distribution. When proctoring a test, your teacher requires all students to be given the test face down and all turn over your tests at the same time so that no one has a time advantage.arrow_forwardThe theory of distributive justice that I found to be the most convincing was the Utilitarianism theory. In current times there is a large amount of economic inequality. It states in the textbook, "The top 0.1 percent of American families owns 22 percent of the nation’s wealth–exactly the same share as the bottom 90 percent" (Shaw, 2017, p. 85). The Utilitarianism theory believes that there should be a greater equality of income. They believe that if there was a more equal distribution of income, then the happiness of that population would vastly increase. The textbook mentions that countries that have a more equal distribution of income tend to have lower rates of infant mortality, life expectancy, malnutrition, obesity, teenage pregnancy, economic insecurity, personal anxiety, and other measures, in comparison to countries that have a larger income inequality, such as the United States (Shaw, 2017, p. 92). It is even believed that income equality can promote economic growth (Shaw,…arrow_forwardSummarize a media outreach strategy for Economic Inequality.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education