FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

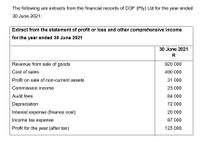

Transcribed Image Text:The following are extracts from the financial records of COF (Pty) Ltd for the year ended

30 June 2021:

Extract from the statement of profit or loss and other comprehensive income

for the year ended 30 June 2021

30 June 2021

R

Revenue from sale of goods

920 000

Cost of sales

490 000

Profit on sale of non-current assets

31 000

Commission income

23 000

Audit fees

84 000

Depreciation

72 000

Interest expense (finance cost)

20 000

Income tax expense

87 000

Profit for the year (after tax)

123 000

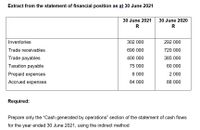

Transcribed Image Text:Extract from the statement of financial position as at 30 June 2021

30 June 2021

30 June 2020

R

R

Inventories

302 000

292 000

Trade receivables

690 000

720 000

Trade payables

400 000

385 000

Taxation payable

75 000

60 000

Prepaid expenses

8 000

2 000

Accrued expenses

84 000

88 000

Required:

Prepare only the "Cash generated by operations" section of the statement of cash flows

for the year ended 30 June 2021, using the indirect method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Please complete the statement of cashflows as required below: A comparative balance sheet and an income statement for Burgess Company are given below: Burgess CompanyComparative Balance Sheet(dollars in millions) Ending Balance Beginning Balance Assets Current assets: Cash and cash equivalents $ 44 $ 91 Accounts receivable 690 633 Inventory 675 630 Total current assets 1,409 1,354 Property, plant, and equipment 1,555 1,529 Less accumulated depreciation 800 666 Net property,plant, and equipment 755 863 Total assets $ 2,164 $ 2,217 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 270 $ 165 Accrued liabilities 185 165 Income taxes payable 87 77 Total current liabilities 542 407 Bonds payable 440 650 Total liabilities 982 1,057 Stockholders' equity: Common stock 170 170 Retained earnings 1,012 990 Total stockholders' equity 1,182 1,160 Total liabilities and stockholders' equity $…arrow_forwardRequired information Exercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 [The following information applies to the questions displayed below.) The following financial statements and additional information are reported. IKIBAN INCORPORATED Comparative Balance Sheets At June 30 Assets Cash Accounts receivable, net Prepaid expenses Inventory Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity 2021 2020 $ 95,500 95,000 $ 64,000 83,800 71,000 116,500 6,400 9,400 280,700 260,900 144,000 (37,000) $ 387,700 $ 45,000 8,000 135,000 (19,000) $ 376,900 $ 60,000 19,000 7,800 5,400 58,400 86,800 50,000 80,000 108,400 166,800 260,000 180,000 19,300 30,100 $ 387,700 $ 376,900 Sales IKIBAN INCORPORATED Income Statement For…arrow_forwardCalculate cash balances based on the information provided in the chart below and show me how you did it Pro Forma Cash Flow Cash Received Cash from Operations Cash Sales $24,198 $100,099 $122,460 Cash from Receivables $46,108 $217,218 $342,905 Subtotal Cash from Operations $70,306 $317,317 $465,366 Additional Cash Received Sales Tax, VAT, HST/GST Received $0 $0 $0 New Current Borrowing $0 $0 $0 New Other Liabilities (interest-free) $0 $0 $0 New Long-term Liabilities $0 $40,000 $0 Sales of Other Current Assets $0 $0 $0 Sales of Long-term Assets $0 $0 $0 New Investment Received $0 $0 $0 Subtotal Cash Received $70,306 $357,317 $465,366 Expenditures Year 1 Year 2 Year 3 Expenditures from Operations Cash Spending $167,000 $225,200 $229,200 Bill Payments $75,294 $124,114 $152,785 Subtotal Spent on Operations $242,294 $349,314 $381,985 Additional Cash Spent Sales Tax,…arrow_forward

- GDM Equipment, Inc. reported the following data for 2025: View the data. Compute GDM Equipment, Inc.'s net cash provided by operating activities-indirect method. (Use a minus sign or parentheses for amounts that result in a decrease in cash.) GDM Equipment, Inc. Statement of Cash Flows (Partial) Year Ended December 31, 2025 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Net Cash Provided by (Used for) Operating Activities Data ... Income Statement: Net Income Depreciation Expense $ 46,000 9,500 Balance Sheet: Increase in Accounts Receivable 8,000 Decrease in Accounts Payable 3,000 Print Done - ☑arrow_forwardConsider the following information from the Income Statement of Production Ltd. on 31st December 2022 (accounting year-end): Operating profit equals £30,000 and depreciation expense equals £2,000. In addition, consider the following information from the Statement of Financial Position of Production Ltd.: Trade Receivables Trade Payables 31st December 2021 31st December 2022 £ £ 2,500 9,000 32,000 12,000 Additional information: • Tax paid on cash during the current accounting year amounts to £12,500 • Gain on asset disposal equals £1,000. Considering all the previous information from Production Ltd., which of the following statements is true on 31st December 2022? O a. Production Ltd. shows a negative net cash flow from operating activities which equals -£8,000. O b. Production Ltd. shows a positive net cash flow from operating activities which equals £3,000. O c. The net cash flow from operating activities equals £0 O d. None of the answers is true.arrow_forwardRize Kamishiro Corp. uses the direct method to prepare its statement of cash flows. Rize Kamishiro's trial balances at December 31, 2021 and 2022 are as follows: 12/31/22 12/31/21 Debits Cash P35,000 33,000 31,000 100,000 4,500 P32,000 30,000 47,000 95,000 Accounts receivable Inventory Property, plant and equipment Unamortized bond discount Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense 5,000 380,000 172,000 151,300 250,000 141,500 137,000 4,300 20,400 P756,700 2,600 61,200 P976,100 Credits Allowance for uncollectible accounts P1,300 P1,100 Accumulated depreciation Trade accounts payable Income taxes payable Deferred tax liability 8% callable bonds payable Share capital Share premium Retained earnings 16,500 15,000 25,000 21,000 5,300 45,000 50,000 17,500 27,100 4,600 20,000 40,000 7,500 64,600 778,700 P976,100 9,100 44,700 Sales 538,800 P756,700 • Rize Kamishiro purchased P5,000 in equipment during 2022. • Rize Kamishiro…arrow_forward

- Current Attempt in Progress Lee Enterprises reports the following information: Net income Depreciation expense Increase in accounts payable Increase in accounts receivable $5180000 $3979520. $5180000. $6380480. $5706480. 704480 159000 337000 Lee should report cash provided by operating activities ofarrow_forward23. Help me selecting the right answer. Thank youarrow_forwardGiven the financial data for New Electronic World, Inc. (NEW), compute the following measures of cash flows for the NEW for the year ended December 31, 2021 Required: Compute for the operating cash flow Compute for the free cash flowarrow_forward

- Please help.arrow_forwardPrepare the cash flows from operating activities section of the company’s 2018 statement of cash flows using the indirect methodarrow_forwardHamburger Heaven's income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Income Statement Sales Revenue $1,860 Expenses: Cost of Goods Sold 850 Depreciation Expense Salaries and Wages Expense Rent Expense 150 450 200 Insurance Expense 75 Interest Expense Utilities Expense 45 Net Income 35 Selected Balance Sheet Accounts Current Year Prior Year 72 Inventory Accounts Receivable 55 355 400 Accounts Payable Salaries/Wages Payable Utilities Payable Prepaid Rent Prepaid Insurance 225 260 39 25 25 10 14 TIP: Prepaid Rent decreased because the amount taken out of Prepaid Rent (and subtracted from net income as Rent Expense) was more than the amount paid for rent in cash during the current year. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education