FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

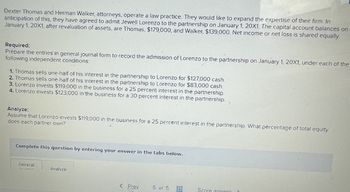

Transcribed Image Text:Dexter Thomas and Herman Walker, attorneys, operate a law practice. They would like to expand the expertise of their firm. In

anticipation of this, they have agreed to admit Jewell Lorenzo to the partnership on January 1, 20X1. The capital account balances on

January 1, 20X1, after revaluation of assets, are Thomas, $179,000, and Walker, $139,000. Net income or net loss is shared equally.

Required:

Prepare the entries in general journal form to record the admission of Lorenzo to the partnership on January 1, 20X1, under each of the

following independent conditions:

1. Thomas sells one-half of his interest in the partnership to Lorenzo for $127,000 cash.

2. Thomas sells one-half of his interest in the partnership to Lorenzo for $83,000 cash.

3. Lorenzo invests $119,000 in the business for a 25 percent interest in the partnership.

4. Lorenzo invests $123,000 in the business for a 30 percent interest in the partnership.

Analyze:

Assume that Lorenzo invests $119,000 in the business for a 25 percent interest in the partnership. What percentage of total equity

does each partner own?

Complete this question by entering your answer in the tabs below.

General

Analyze

< Prev

5 of 5

Score answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Matthew and Hein sell to Melges a 1/3 interest in the Matthew - Hein partnership. Melges will pay Matthew and Hein each $141400 for admission into the organization. Before this transaction, Matthew and Hein show capital balances of $209000 each. The journal entry to record the admission of Melges will O show a credit to Melges, Capital for $282800. O show a debit to Hein, Capital for $141400. show a debit to Cash for $282800. O not show a debit to Cash.arrow_forwardSubject: acountingarrow_forwardPlease help answering the attached question with steps on how you solved the problem.arrow_forward

- The Pen, Evan, and Torves Partnership has asked you to assist in winding-up its business affairs. You compile the following information: 1. The partnership's trial balance on June 30, 20X1, is Cash Accounts Receivable (net) Inventory Plant and Equipment (net) Accounts Payable Pen, Capital Evan, Capital Torven, Capital Total Debit $ 7,200 38,000 27,000 98,400 Profit and loss percentages Preliquidation capital balances $170,600 2. The partners share profits and losses as follows: Pen, 50 percent; Evan, 25 percent; and Torves, 25 percent. 3. The partners are considering an offer of $112,000 for the firm's accounts receivable, inventory, and plant and equipment as of June 30. The $112,000 will be paid to creditors and the partners in installments, the number and amounts of which are to be negotiated. Decrease LAPs to next highest Credit Required: Prepare a cash distribution plan as of June 30, 20X1, showing how much cash each partner will receive if the partners accept the offer to sell…arrow_forwardNeeds help with LETTER E. thank youarrow_forwardRequired information [The following information applies to the questions displayed below.] The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $13,000, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land (§1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses $ 70,000 8,000 (38,000) (9,000) (14,000) (3,000) 2,000 (2,000) Note: Negative amounts should be indicated by a minus sign. c. What do you believe Gary's share of self-employment income (loss) to be reported on his year 1 Schedule K-1 should be, assuming G&P is an LLC and Gary spends 2,000 hours per year working there full time? Self-employment income (loss)arrow_forward

- Jerry and Sherry own and operate a partnership. Jerry's capital balance is $50,000 and Sherry's is $55,000. Jerry and Sherry decided to admit a new partner, Allison, to their partnership. By the terms of their partnership agreement, Jerry and Sherry share income/ loss equally, Allison intends to contribute $40,000 to receive a Twenty-five percent interest in the partnership. Required: a. Revalue the partnership assets b. Determine the total equity of the partnership after the new partner is admitted c. Determine the new partner's share of the total equity d. Determine the bonus resulting from Allison's equity of her contribution e. Make journal entries to rccord Allison's admission to the partnershiparrow_forwardRequired information [The following information applies to the questions displayed below.] Ramer and Knox began a partnership by investing $88,000 and $132,000, respectively. During its first year, the partnership earned $255,000. Prepare calculations showing how the $255,000 income is allocated under each separate plan for sharing income and loss. 3. The partners agreed to share income by giving a $69,000 per year salary allowance to Ramer, a $43,000 per year salary allowance to Knox, 10% interest on their initial capital investments, and the remaining balance shared equally. Net income is $255,000. Note: Enter all allowances as positive values. Enter losses as negative values. Net Income Salary allowances Interest allowances Total salary and interest Balance of income Balance allocated equally Balance of income Shares of the partners Ramer Saved Knox Totalarrow_forwardD.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddle AS i Required information [The following information applies to the questions displayed below.] Juan Diego began the year with a tax basis in his partnership interest of $52,200. During the year, he was allocated $20,880 of partnership ordinary business income, $73,080 of §1231 losses, and $31,320 of short-term capital losses and received a cash distribution of $52,200. Note: Do not round intermediate calculations. b. If any deductions or losses are limited, what are the carryover amounts, and what is their character? [Hint. See Regulations §1.704- 1(d).] §1231 losses Short-term capital losses @ 2 F2 J # 3 F3 $ 4 Q Search F4 % 5 F5 PrtScn F8 8 Home ▼ F9 9 End F10 0 PgUp FIarrow_forward

- Please help me with all answers thankuarrow_forward! Required information [The following information applies to the questions displayed below.] The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $18,700, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land (§1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses $ 85,000 6,350 (33,500) (16,800) (12,100) (5,000) 5,000 (5,100) Note: Negative amounts should be indicated by a minus sign. c. What do you believe Gary's share of self-employment income (loss) to be reported on his year 1 Schedule K-1 should be, assuming G&P is an LLC and Gary spends 2,000 hours per year working there full time? Self-employment income (loss)arrow_forwardCan I please get help with this question?(6.5) Ries, Bax, and Thomas invested $48,000, $64,000, and $72,000, respectively, in a partnership. During its first calendar year, the firm earned $416,100. Required: Prepare the entry to close the firm’s Income Summary account as of its December 31 year-end and to allocate the $416,100 net income under each of the following separate assumptions. 3. The partners agreed to share income and loss by providing annual salary allowances of $39,000 to Ries, $34,000 to Bax, and $46,000 to Thomas; granting 10% interest on the partners’ beginning capital investments; and sharing the remainder equally.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education