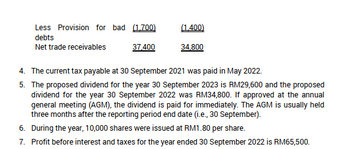

Statement of Cash Flow -

|

Prominent Sdn Bhd |

||

|

Statement of Cash Flow |

||

|

For the Year Ended September 30, 2022 |

||

|

Cash Flow from Operating Activities: |

||

|

Profit before interest and taxes |

65,500 |

|

|

Adjustments for non cash Items: |

||

|

|

9,800 |

|

|

Loss on Sale of an Assets |

700 |

10,500 |

|

Changes in |

||

|

Increase in Inventory |

(8300) |

|

|

Decrease in Trade Receivable |

2,600 |

|

|

Increase in Trade Payable |

1,400 |

(4300) |

|

Cash Flow from Operations |

71,700 |

|

|

Less: Tax Paid |

(15700) |

|

|

Less: Interest Paid |

(2000) |

|

|

Net Cash Flow from Operating Activities |

54,000 |

|

|

Cash Flow from Investing Activities: |

||

|

Sale of an Assets |

3,500 |

|

|

Net Cash Flow from Investing Activities |

3,500 |

|

|

Cash Flow from Financing Activities: |

||

|

Dividend Paid |

(34800) |

|

|

Issuance of Share Capital |

18,000 |

|

|

Repayment of Bank Loan |

(32000) |

|

|

Net Cash Flow from Financing Activities |

(48800) |

|

|

Net Change in Cash |

8,700 |

|

|

Cash Balance, Beginning |

8,600 |

|

|

Cash Balance, Ending |

17,300 |

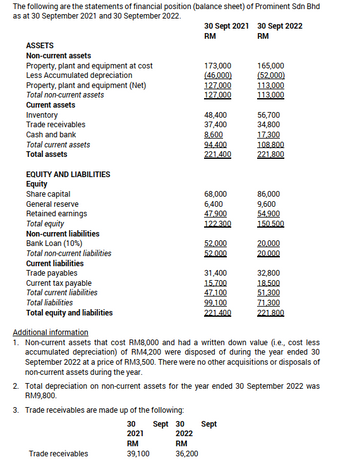

Explain why profit should be reconciled to net operating

this question to explain your answer.

Step by stepSolved in 2 steps

- Cash Flows from (Used for) Operating Activities The income statement disclosed the following items for the year: Depreciation expense $44,100 Gain on disposal of equipment 25,740 Net income 339,800 The changes in the current asset and liability accounts for the year are as follows: Increase(Decrease) Accounts receivable $6,870 Inventory (3,910) Prepaid insurance (1,470) Accounts payable (4,660) Income taxes payable 1,470 Dividends payable 1,030 Question Content Area a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. blankStatement of Cash Flows (partial) Cash flows from (used for) operating activities: $- Select - Adjustments to reconcile net income to net cash flows from (used for) operating activities: - Select -…arrow_forwardParagraph Styles Section V: SCF Question 4 Identify the most significant cash outflow and inflow activity from Investing activities for the current year. Description of Activity Amount Click here to enter Cash outflow: (Hint: an outflow represents investing to support the long-term success of a compány.) text. 21 ${Student Frist Name} Olson Fall Arnica Mulder Click here to enter Cash inflow: text.arrow_forwardPronghorn Inc. Cash Flow Statement For the Year Ended on 31 December 2020 Cash Flow from Operating Activities: Net Income $47,200 Adjustments to reconcile net income to net cash flows from (used for) operating activities: Add: Depreciation 9200 Changes in current operating assets and liabilities: Add: Increase in Accounts Payable 6480 Less: Increase in Accounts Receivable (4480) Net Cash Provided by Operating Activities (A) $58,400 Cash Flow from Investing Activities: Purchase of Equipment $(18,480) Net Cash Used by Investing Activities (B) $(18,480) Cash Flow from Financing Activities: Payment of Dividends $(27,680 ) Proceeds from Issuance of Common Stock 19,760 Net Cash Used by Financing Activities (C) $(7,920) Net Increase/Decrease in Cash (A+B+C) $32,000 Add Cash Balance on 1/1/2020 14480 Cash Balance on 31/12/2020 $46,480 I dont have the right spacing for this layout. what I have looks like this: Cash Flows…arrow_forward

- Fitz Company reports the following information. Selected Annual Income Statement Data Net income Depreciation expense Amortization expense Gain on sale of plant assets Cash flows from operating activities Selected Year-End Balance Sheet Data $ 373,000 Accounts receivable decrease 49,400 Inventory decrease 8,300 Prepaid expenses increase 6,700 Accounts payable decrease Salaries payable increase Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Changes in current operating assets and liabilities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash $ 60,400 42,500 6,400 8,800 1,700 $arrow_forwardProvide tablearrow_forwardChanges in Current Operating Assets and Liabilities Blue Circle Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year 2 Dec. 31, Year 1 Accounts receivable $20,300 $25,000 Inventory 85,100 76,000 Accounts payable 18,100 22,100 Dividends payable 24,000 23,000 Adjust net income of $104,000 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education