FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

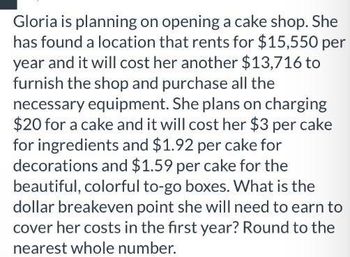

Transcribed Image Text:Gloria is planning on opening a cake shop. She

has found a location that rents for $15,550 per

year and it will cost her another $13,716 to

furnish the shop and purchase all the

necessary equipment. She plans on charging

$20 for a cake and it will cost her $3 per cake

for ingredients and $1.92 per cake for

decorations and $1.59 per cake for the

beautiful, colorful to-go boxes. What is the

dollar breakeven point she will need to earn to

cover her costs in the first year? Round to the

nearest whole number.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Amna, an inventor, has developed an exciting new process for producing an infinite supply of energy from salt water. Amna believes that she can sell her invention to a major oil company. Amna is asking for a Royalty of $6.5 Million dollars, payable at the end of year one and then increasing at the rate of 5.5% per year forever. If an appropriate discount rate is 16%, how much should Amna accept if the company wants to pay her a lump sum amount today?a. $33.3 Millionb. There is no correct answer given.c. $60 Milliond. $40 Millionarrow_forwardASAP EGG is a life coaching and fitness coaching firm. They are considering an investment in a customer relationship management platform. The project involves $225,000 in first costs and is expected to generate net savings (in actual dollars) of $65,000 per year over its 5-year life. They forecast. A. EGG wants to buy a walk-in humidor in 5 years. How much money does EGG have to deposit in an investment account each year if their account earns 12% and they will see a price inflation of 8% per year? It currently costs $680.58. B. If inflation were 0% then how much do they have to save per year to be able to buy the humidor in 5 years?arrow_forwardA new homeowner, Ms. Dee Young, needs to decide whether to install R-11 or R-19 insulation in the attic of her new home. The insulated area is 1,550 square feet. The upgrade from R-11 to R-19 insulation costs $0.05 per square foot. The upgraded insulation is expected to save Ms. Dee Young approximately 440 kilowatt hours of energy usage per year. The planning horizon is 22 years and electricity costs $0.10/kWh. MARR is 11% per year. Based on a future worth analysis, is the upgrade to R-19 insulation economically justified? The future worth of R-19 insulation is $ ? Carry all interim calculations to 5 decimal places and then round your final answer to 2 decimal places. The tolerance is +0.15.arrow_forward

- Mike and Terri estimate that they want to buy a house for $186,000.00, and they need to make a down payment of 17.5% of the cost of their house. If they have 18 months to save for the down payment, how much do they need to invest into an monthly so that they can reach their goal? account earning 4.518% compoundedarrow_forwardMr. Russ T. Steele sels his old vehicle for $5000 (you get more if you private sale!) and pays cash for a used (but newer vehicle) that costs $10.000. He also understands that he needs to allow for maintenance and operation costs of his vehicle. He estimates that these costs will be approximately $2000 a year and estimates that the costs will increase by $100 per year. He hopes to keep the vehicle for five years and then sell it for an estimated value of $2000. Mr. Steele has an MARR of 8%. The equivalent annual cost of the cash flow associated with his purchase is most nearly: $-1,850 $-3,100 $3,000 $3,800arrow_forwardThe Rite family wishes to insulate the attic of their home to prevent heat loss. They are considering R-11 and R-19 insulation. They can install R-11 for $1,600 and R-19 for $2,400. They expect to save $125 per year in heating and cooling expenses if R-11 is installed. How much extra must they save in utility expenses per year in order to justify the R-19 insulation if they expect to recover the extra cost in 6 years at an interest rate of 6% per year? The extra savings from the utility expenses per year in order to justify the R-19 insulation must be $( per year.arrow_forward

- Robert Jones and his wife Suzie recently opened an investment account with the intention of saving enough to purchase the house of their dreams, a beautiful, little white house on the corner of Michigan Avenue and Maple Street. Their goal is to have $45,000 down in five years. Their account will guarantee them a return of 8% compounded annually. How much do they need to put into the account right now to reach their objective? $46,778.96 $39,546.09 $51,214.75 $30,626.24arrow_forwardGive me right solutionarrow_forwardWhen Gustavo and Serrana bought their home, they had a 5.9% loan with monthly payments of $870.60 for 30 years. After making 78 monthly payments, they plan to refinance for an amount that includes an additional $35,000 to remodel their kitchen. They can refinance at 4.2% compounded monthly for 25 years with refinancing costs of $625 included with the amount refinanced. How long will it take to pay off this new loan if they pay $1200 each month?arrow_forward

- After two years in business selling donuts in a local office building, Lisa wants to move on. Zeke wants to buy out the last two years of Lisa's four-year contract. He estimates he can make $6,400 in the first year and $7,200 in the second year. If the discount rate is 6%, the most Zeke should be willing to pay is Click here to access the TVM Factor Table Calculator O $12,707.07 O $12,756.85 O $12,445.71 O $12,201.68arrow_forwardKaleo has made up his mind—he wants a pool in the family’s backyard! He figures his kids and spouse will be thrilled. However, to cover the cost of the pool, they’ll have to pack up and live away from home for a few weeks during the summer to rent their home to vacationers. He crunched the numbers based on the following estimates. 1. Cost of pool/installation $50,000 2. Life of the pool (no salvage value) 20 years 3. Annual net cash inflows from renting (net of cash expenses for renting and pool maintenance) $6,500 4. Tax rate 23% 5. Average rate of return 8% Kaleo’s daughter, Sarah, found the above information written on a sheet of paper in his office, along with the following notes. “This is a no-brainer! We’ll recover the cost of this pool in just 7 years, even though we plan to live here until we’re old and gray, or at least as long as the pool hangs on. If we can rent our house out for just 3 weeks each year, it’ll be almost pure profit that we can put toward paying off…arrow_forward--you live in the mobile home for four years, but your roommate also pays you $3,000 a year, paid to you at the beginning of each year. The cost of the mobile home is $15,000, paid immediately. At the end of four years, you can sell the mobile home for $9,000. You have no maintenance on the home because you were such a smart manager Using Present Value, what is the cost of your college housing (positive or negative), assuming an interest rate of 8%?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education