FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Expense Report

SA

$

+A

$

$

Budget

SA

SA

+A

$

Actual

Year-to-Date

LA

$

SA

Difference

$

Unfavorable

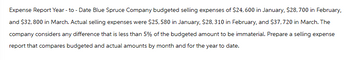

Transcribed Image Text:Expense Report Year-to-Date Blue Spruce Company budgeted selling expenses of $24,600 in January, $28,700 in February,

and $32,800 in March. Actual selling expenses were $25,580 in January, $28, 310 in February, and $37,720 in March. The

company considers any difference that is less than 5% of the budgeted amount to be immaterial. Prepare a selling expense

report that compares budgeted and actual amounts by month and for the year to date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Production Budget Direct Mtls Budget Sales Budget Direct Lbr Budget Factory OH Selling Exp Admin Exp Budget Cost of Goods Sold Income Budget Budget Statement Requirement Prepare the Direct Materials Budget for Wisniewski Inc. Company. Company policy calls for a given quarter's ending raw materials inventory to equal 50% of next quarter's expected materials needed for production. The prior year-end inventory is 5,796 lbs of materials, which complies with the policy. The company expects to have 10,080 lbs. of materials in inventory at year-end. The product's manufacturing cost is $211 per unit, including per unit costs of $84 for materials (6 lbs. at $14 per Ib.), $96 for direct labor (4 hours x $24 direct labor rate per hour), $19 for variable overhead, and $12 for fixed overhead. Show less A Wisniewski Inc. Direct Materials Budget For the year ended December 31, 2018 First Qtr. Second Qtr. Third Qtr. Fourth Qtr. Total Budgeted production (units) Materials requirements per unit 1,932…arrow_forwardFlounder Company budgeted selling expenses of $27,000 in January, $31,500 in February, and $36,000 in March. Actual selling expenses were $28,060 in January, $31,070 in February, and $41,400 in March. The company considers any difference that is less than 5% of the budgeted amount to be immaterial. Prepare a selling expense report that compares budgeted and actual amounts by month and for the year to date. NDER COMPANY g Expense Report iarter Ending March 31 SA $ Budget +A $ Year-to-Date Actual Difference $ +A $ $ $ $ tA $ +A $arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forwardFlexible Budgets and Standard Cost Systems 1317 > Problems Group B P23-30B Preparing a flexible budget performance report Learning Objective 1 Cell Plus Technologies manufactures capacitors for cellular base stations and other communication applications. The company's July 2018 flexible budget shows output levels of 8,500, 10,000, and 12,000 units. The static budget was based on expected sales of 10,000 units. 3. Static Bud, Var, for Op. Inc. $22,900 F CELL ONE TECHNOLOGIES Flexible Budget For the Month Ended July 31, 2018 Budget Amounts per Unit Units 8,500 10,000 12,000 Sales Revenue $ 24 $ 204,000 $ 240,000 $ 288,000 Variable Expenses 13 110,500 130,000 156,000 Contribution Margin 93,500 110,000 132,000 Fixed Expenses 57,000 57,000 57,000 Operating Income $ 36,500 $ 53,000 $ 75,000 The company sold 12,000 units during July, and its actual operating income was as follows: CELL ONE TECHNOLOGIES Income Statement For the Month Ended July 31, 2018 Sales Revenue $ 295,000 Variable…arrow_forward

- Please do not give solution in image format thankuarrow_forwardTrevorrow Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During June, the company budgeted for 6,200 units, but its actual level of activity was 6,160 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for June: Data used in budgeting: Fixed element Variable element per month per unit Revenue $ 0 $ 0 $ 27.80 $ 3.10 Direct labor Direct materials 10.20 Manufacturing overhead 37,200 1.10 Selling and administrative expenses 22,800 0.30 Total expenses $ 60,000 $ 14.70 Actual results for June: Revenue $ 178,318 $ 18,606 $ 60,652 $ 43,896 $ 24,688 Direct labor Direct materials Manufacturing overhead Selling and administrative expenses The activity variance for net operating income in June would be closest to:arrow_forwardHow do I prepare the selling and administrative expense budget for the quarter ended March 31, 20X1?arrow_forward

- Phoenix Company reports the following fixed budget. It is based on an expected production and sales volume of 15,500 units. PHOENIX COMPANY Fixed Budget For Year Ended December 31 Sales $ 3,255,000 Costs Direct materials 1,007,500 Direct labor 232,500 Sales staff commissions 77,500 Depreciation—Machinery 300,000 Supervisory salaries 199,000 Shipping 217,000 Sales staff salaries (fixed annual amount) 251,000 Administrative salaries 611,750 Depreciation—Office equipment 196,000 Income $ 162,750 Required:1&2. Prepare flexible budgets at sales volumes of 14,500 and 16,500 units.3. The company’s business conditions are improving. One possible result is a sales volume of 18,500 units. Prepare a simple budgeted income statement if 18,500 units are sold.arrow_forwardRequired information Use the following information for the Problems below. (Algo) Skip to question [The following information applies to the questions displayed below.] Phoenix Company reports the following fixed budget. It is based on an expected production and sales volume of 15,300 units. PHOENIX COMPANY Fixed Budget For Year Ended December 31 Sales $ 3,213,000 Costs Direct materials 1,009,800 Direct labor 244,800 Sales staff commissions 61,200 Depreciation—Machinery 300,000 Supervisory salaries 197,000 Shipping 229,500 Sales staff salaries (fixed annual amount) 245,000 Administrative salaries 534,920 Depreciation—Office equipment 198,000 Income $ 192,780 Problem 21-1A (Algo) Preparing and analyzing a flexible budget LO P1 Required:1&2. Prepare flexible budgets at sales volumes of 14,300 and 16,300 units.3. The company’s business conditions are improving. One possible result is a sales volume of 18,300 units. Prepare a simple budgeted…arrow_forwardPhoenix Company reports the following fixed budget. It is based on an expected production and sales volume of 15,400 units. Sales Costa PHOENIX COMPANY Fixed Budget For Year Ended December 31 Direct materials Direct labor Sales staff commissions Depreciation-Machinery Supervisory salaries Shipping Sales staff salaries (fixed annual amount) Administrative salaries Depreciation-office equipment Income $ 3,234,000 1,001,000 246,400 46,200 295,000 198,000 231,000 251,000 610,700 193,000 $ 161,700arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education