FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Exercises: Set A

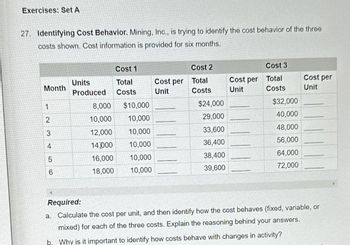

27. Identifying Cost Behavior. Mining, Inc., is trying to identify the cost behavior of the three

costs shown. Cost information is provided for six months.

Cost 1

Cost 2

Cost 3

Units

Total

Cost per

Total

Cost per

Total

Cost per

Month

Produced

Costs

Unit

Costs

Unit

Costs

Unit

1

8,000

$10,000

$24,000

$32,000

2

10,000

10,000

29,000

40,000

3

12,000

10,000

33,600

48,000

4

14,000

10,000

36,400

56,000

5

16,000

10,000

38,400

64,000

6

18,000

10,000

39,600

72,000

Required:

a. Calculate the cost per unit, and then identify how the cost behaves (fixed, variable, or

mixed) for each of the three costs. Explain the reasoning behind your answers.

b. Why is it important to identify how costs behave with changes in activity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Glencoe, Inc., costs products using a normal costing system. The following data is available for last year: Budgeted: 4.1 4.2 4.3 Overhead Machine hours Direct labour hours 4.4 Actual: Overhead Machine hours Direct labour hours Prime cost Number of units R476 000 140 000 17 000 Overhead is applied on the basis of direct labour hours. Required: R475 000 137 000 16 550 R1 750 000 250 000 Calculate the predetermined overhead rate. Calculate the applied overhead for last year. Was the overhead over- or under-applied, and by how much? Calculate the total cost per unit produced (to 2 decimal places).arrow_forward1. COMPUTE THE UNIT PRODUCT COST UNDER ABSORPTION COSTING 2. COMPUTE THE UNIT PRODUCT COST UNDER VARIABLE COSTINGarrow_forwardGiven the following data, calculate product cost per unit under absorption costing. Direct labor Direct materials Variable overhead Fixed overhead Units produced per year Multiple Choice $28.00 per unit $28.60 per unit $30.00 per unit $30.90 per unit $ 17.00 per unit $ 11.00 per unit $ 0.90 per unit $ 100,000 50,000 unitsarrow_forward

- 1. What was Product J's unit cost under cost absorption costing? 2. What was Product J's unit cost under variable costing?arrow_forwardQuestion: Pat Company uses activity-based costing. The company has two products: A and B. The annual production and sales for Product A is 1,800 units and for Product B it's 1,050 units. There are three activity cost pools, with estimated costs and expected activity as follows: Activities Estimated Expected Activity Overhead Cost Product A Product Total B Activity 1 $46,775 1,300 1,200 2,500 Activity 2 $68,277 2,300 1,000 3,300 Activity 3 $82,502 The overhead cost per unit of Product A under activity-based costing is closest to: 720 700 1,420 A. $139.12 B. $68.28 C. $32.88 D. $63.19arrow_forwardCosting information for Emily Elephant Limited is as follows:Direct material cost per unitDirect labour cost per unitVariable manufacturing overhead cost per unitVariable selling and administrative overhead cost per unitFixed manufacturing overhead for the year£41 £43£6£4£44,000Budgeted production for the year was 4,000 units. What is the budgeted unit product cost according to an absorption costing system? a. £90 b. £101 c. £105d. £94arrow_forward

- A department of Alpha Co. incurred the following costs for the month of September. Variable costs, and the variable portion of mixed costs, are a function of the number of units of activity: Activity level in units 4,500 Variable costs $ 7,875 Fixed costs 29,000 Mixed costs 24,600 Total costs $ 61,475 During October, the activity level was 7,600 units, and the total costs incurred were $68,000.Required:a. Calculate the variable costs, fixed costs, and mixed costs incurred during October. b. Use the high–low method to calculate the cost formula for mixed cost. (Do not round intermediate calculations and round your answers to 2 decimal places.)arrow_forwardbharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education