FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

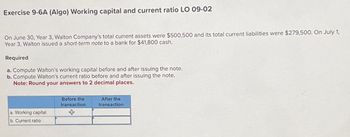

Transcribed Image Text:Exercise 9-6A (Algo) Working capital and current ratio LO 09-02

On June 30, Year 3, Walton Company's total current assets were $500,500 and its total current liabilities were $279,500. On July 1,

Year 3, Walton issued a short-term note to a bank for $41,800 cash.

Required

a. Compute Walton's working capital before and after issuing the note.

b. Compute Walton's current ratio before and after issuing the note.

Note: Round your answers to 2 decimal places.

a. Working capital

b. Current ratio

Before the

transaction

After the

transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A28arrow_forward#9 Item Prior year Current year Accounts payable 8,123.00 7,716.00 Accounts receivable 6,048.00 6,607.00 Accruals 997.00 1,500.00 Cash ??? ??? Common Stock 10,094.00 11,603.00 COGS 12,653.00 18,393.00 Current portion long-term debt 4,911.00 5,090.00 Depreciation expense 2,500 2,763.00 Interest expense 733 417 Inventories 4,245.00 4,824.00 Long-term debt 14,141.00 13,226.00 Net fixed assets 51,826.00 54,004.00 Notes payable 4,339.00 9,940.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,688.00 30,532.00 Sales 35,119 45,044.00 Taxes 2,084 2,775 What is the firm's cash flow from financing? Answer format: Number: Round to: 0 decimal places.arrow_forwardq. 10 A company has net working capital of $687. Long term debt is $4,078, total assets are $6,201, and fixed assets are $3,948. What is the amount of total liabilities? $8,026 $6,888 $4,765 $5,514 $5,644arrow_forward

- Problem 4-15 Lloyd Inc. has sales of $200,000, a net income of $15,000, and the following balance sheet: ASSETS Cash Receivables Inventories Total Current assets Net fixed assets Total assets AMOUNT LIABILITIES & EQUITY $10,000 Accounts Payables 50,000 Notes Payable to bank 150,000 Total current liabilities $210,000 Long-term debt 90,000 Common Equity $300,000 Total Liabilities and Equity AMOUNT $30,000 20,000 $50,000 50,000 200,000 $300,000 The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 2.53, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 2.53), if the funds generated are used to reduce common equity (stock can be repurchased at book value), and if no other changes occur, by how much will the ROE change? What will be the firm's new quick ratio? Problem 4-1 Baxley Brothers has a DSO of 23 days, and its annual sales are…arrow_forwardAccounts payable $509,000Notes payable $244,000Current liabilities $753,000Long-term debt $1,246,000Common equity $4,751,000Total liabilities and equity $6,750,000 What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm's new debt ratio?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education