FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

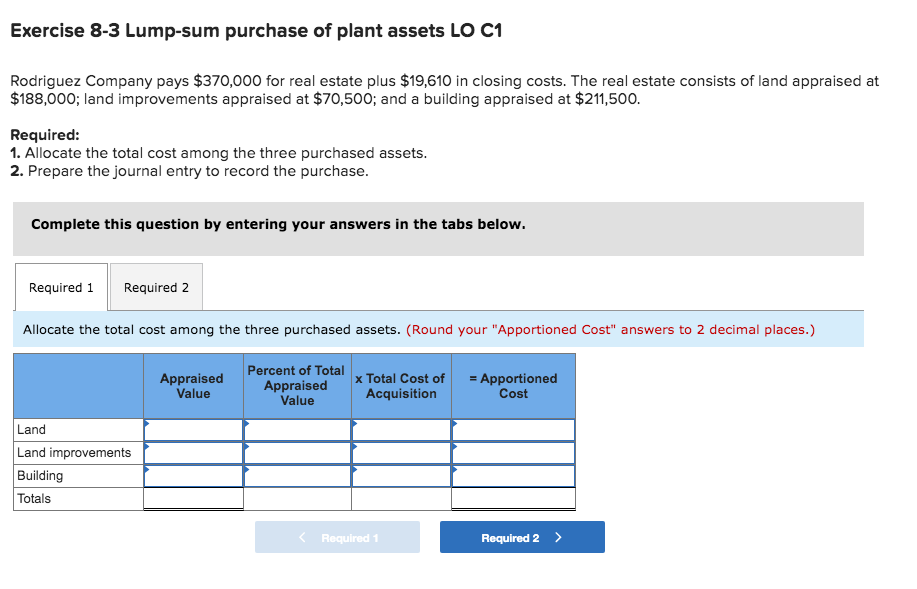

Transcribed Image Text:Exercise 8-3 Lump-sum purchase of plant assets LO C1

Rodriguez Company pays $370,000 for real estate plus $19,610 in closing costs. The real estate consists of land appraised at

$188,000; land improvements appraised at $70,500; and a building appraised at $211,500.

Required:

1. Allocate the total cost among the three purchased assets.

2. Prepare the journal entry to record the purchase.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Allocate the total cost among the three purchased assets. (Round your "Apportioned Cost" answers to 2 decimal places.)

Percent of Total

Appraised

Value

Appraised

Value

x Total Cost of

Acquisition

= Apportioned

Cost

Land

Land improvements

Building

Totals

< Required 1

Required 2>

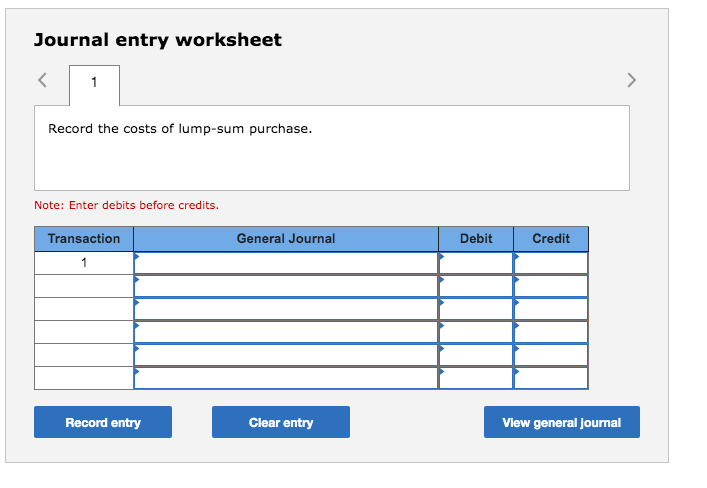

Transcribed Image Text:Journal entry worksheet

Record the costs of lump-sum purchase.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Similar questions

- Problem 11 Digimon Company owned three properties which are classified as investment properties. Details of the properties are as follows: Property 1 Property 2 Property 3 Initial cost 2,700,000 a. The cost model b. The fair value model 3,450,000 3,300,000 Fair value Dec. 31, 2022 3,200,000 3,050,000 3,850,000 Fair value Dec. 31, 2023 3,500,000 2,850,000 3,600,000 Each property was acquired at the beginning of 2017 with a useful life of 25 years. Compute for the total carrying amount to be reported as investment property on December 31, 2023 assuming the policy is to use:arrow_forwardanswer plsarrow_forwardNEED ASSISTANCE WITH REQUIRED 4 LESSEE, REQUIRED 4 LESSOR, REQUIRED 5 LESSEEarrow_forward

- X Transactions for CCA Class 8 assets. Date Item Activity Amount March 11, 2002 Machine 1 Purchase $50,000 April 24, 2002 Machine 2 Purchase $150,000 November 3, 2005 Machine 3 Purchase $230,000 November 22, 2005 Machine 1 Sale $10,000 May 20, 2009 Machine 4 Purchase $50,000 August 3, 2014 Machine 5 Purchase $345,000 September 12, 2015 Machine 3 Sale $50,000 Churchill Metal Products opened for business in 2002. Its transactions for CCA Class 8 assets over the years are shown in the accompanying table. What CCA amount did Churchill Metal Products claim for the 20 percent UCC account in 2016? Click on the icon to view the transactions for CCA Class 8 assets. Churchill Metal Products claimed a CCA of $ in 2016. (Do not round until the final answer. Then round to the nearest dollar as needed.)arrow_forwardOnly typed solutionarrow_forwardUsing completed-contract method: Record the journal entries for ACE corporation for 2001, 2002, and 2003 Record the partial balance sheet for 2003 for just the Asset section in a A. В. suitable format ACE Construction Corporation Contract Price: $1,500,000 2001 2002 2003 Costs incurred during the current year Estimated costs to complete at year-end 1,000,000 Progress billings during year Collections on billings during the year $1,350,000 $1,360,000 460,000 575,000 555,000 $1,365,000 300,000 270,000 625,000 675,000arrow_forward

- Brief Exercise 7-37Cost and Amortization of Intangible Assets On January 2, 2019, Frazier Company purchased a restaurant franchise for $85,000. The terms of the franchise agreement allowed Frazier to have exclusive rights to operate a restaurant under the "Simply Fried" brand name for the next 10 years. Required: Prepare any journal entries related to the franchise that Frazier should make during 2019. Jan. 2 fill in the blank 2 fill in the blank 4 (Record purchase of franchise) Dec. 31 fill in the blank 6 fill in the blank 8 (Record amortization of franchise)arrow_forwardQuestion Content Area A building with an appraisal value of $130,876 is made available at an offer price of $155,610. The purchaser acquires the property for $39,936 in cash, a 90-day note payable for $25,942, and a mortgage amounting to $59,561. The cost of the building to be reported on the balance sheet is a. $115,674 b. $125,439 c. $155,610 d. $130,876arrow_forwardMaterials used in research and development projects $4,500 Equipment acquired that will have alternative future uses in future R&D projects for five years 1,500 Personnel costs of employees involved in R&D projects 5,500 Consulting fees paid to outsiders for R&D projects 2,800 Indirect costs reasonably allocable to R&D projects 250 Legal fees associated with registration of a patent resulting from a 2020 R&D project 2,500 Required: Compute the amount of R&D costs that should be classified as expenses in determining 2020 net income.$fill in the blank 1arrow_forward

- devuarrow_forwardQUESTION 1 Scott Industries had the following transactions during 2022: 1. Acquired an office building on three acres of land for a lump-sum price of $2,000,000. According to independent appraisals, the fair values were $1,325,000 and $790,000 for the building and land, respectively. A cash down payment of $500,000 20-Jan was made with the remainder financed. 2. Purchased equipment paying $19,000 at the date of purchase and signing a noninterest-bearing note requiring the balance to be paid in five annual installments of $19,000 on the anniversary date of the contract. Based on Cool Globe's 8% borrowing rate for such transactions, the implicit interest cost is $19,139. 3-Feb 3. Received a gift of land and building in Twin Pines Park as an inducement to 15-Mar relocate. The land and buildings have fair values of $39,000 and $395,000. Required: Pepare the journal entries for the transactions above. Round journal entry amounts to the nearest whole dollar. Date Accounts Debit Credit…arrow_forwardBasket purchase allocation Dorsey Co. has expanded its operations by purchasing a parcel of land with a building on it from Bibb Co. for $255,000. The appraised value of the land is $60,000, and the appraised value of the building is $240,000.Page 215Required:a. Assuming that the building is to be used in Dorsey Co.’s business activities, what cost should be recorded for the land?b. Explain why, for income tax purposes, management of Dorsey Co. would want as little of the purchase price as possible allocated to land.c. Explain why Dorsey Co. allocated the cost of assets acquired based on appraised values at the purchase date rather than on the original cost of the land and building to Bibb Co. d. Assuming that the building is demolished at a cost of $20,000 so that the land can be used for employee parking, what cost should Dorsey Co. record for the land?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education