FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

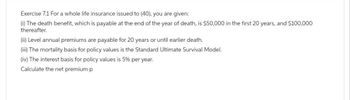

Transcribed Image Text:Exercise 7.1 For a whole life insurance issued to (40), you are given:

(i) The death benefit, which is payable at the end of the year of death, is $50,000 in the first 20 years, and $100,000

thereafter.

(ii) Level annual premiums are payable for 20 years or until earlier death.

(iii) The mortality basis for policy values is the Standard Ultimate Survival Model.

(iv) The interest basis for policy values is 5% per year.

Calculate the net premium p

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- For life insurance policies, some of the premium pays for the cost of the insurance, and the remainder goes toward the cash value of the policy and earns interest like a savings account. Consider the following insurance company options. Company 1: pays 4.2% compounded monthly on the cash value of their policies Company 2: pays 4.21% compounded semiannually on the cash value of their policies What is the APY offered by each company? (Round your answers to the nearest hundredth.) Company 1 % Company 2 %arrow_forwardhe future value of an ordinary annuity with $200 annual deposits into an account paying 6% interest over the next 10 years will be a. $1,987.56 b. $2,636.16 c. $2,794.37 d. $2,120arrow_forward9. Define out of pocket maximum. a. A flat-rate fee you must pay when receiving any kind of health care service. b. The maximum amount of money your insurance will cover of a certain health care service. c. The maximum amount you will have to pay out of pocket in one year for the benefits your insurance covers. d. The maximum amount of money the insured party will pay toward prescription medications.arrow_forward

- Yarianny wants to withdraw $25199 annually starting today for the next 20 years and will increase the withdrawals by 3.5% each year. If the annuity can earn 6% compounded semi-annually, how much money needs to be invested in the fund today? Select the closest answer choice. Select one: Oa. $402571.57 Ob. $427770.57 O c. $478168.57 d. $452969.57 Checkarrow_forwardWhich one of the following statements regarding annuities is NOT true? OA) A joint and full survivor annuity guarantees a level payment as long as either annuitant is alive OB) A single-premium variable deferred annuity generally permits additions to the invested amount once each year C) A flexible premium variable annuity generally limits changes in the investment mixto some extent. D) A life annuity with ten years certain and continuous will pay benefits for at least ten years if the annuitant dies six years after the initial distribution is madearrow_forwardUsing Table 19-1 and Table 19-2 find the following premiums for a 10-year term life insurance policy with a face value of $30,000 for a 28-year-old male. A. Annual premium B. Semiannual premium C. Quarterly premium D. Monthly premium Life Insurance—Premium FactorsPremium Paid Percent of Annual PremiumSemiannually 52%Quarterly 26%Monthly 9%arrow_forward

- Suppose a life insurance company sells a $250,000 one-year term life insurance policy to a 24-year-old female for $360. The probability that the female survives the year is 0.999477. Compute and interpret the expected value of this policy to the insurance company. The expected value is $ (Round to two decimal places as needed.) Which of the following interpretation of the expected value is correct? O A. The insurance company expects to make an average profit of $32.71 on every 24-year-old female it insures for 1 month. O B. The insurance company expects to make an average profit of $359.81 on every 24-year-old female it insures for 1 year. O C. The insurance company expects to make an average profit of $20.84 on every 24-year-old female it insures for 1 month. O D. The insurance company expects to make an average profit of $229.25 on every 24-year-old female it insures for 1 year.arrow_forwardFind the expected net profit of an insurance company on a life-insurance policy whose death benefit is $1,000,000 if the annual premium for the policy is $2000 and the chance of the customer dying within the next year is 0.002. Interpret. (show work)arrow_forward7. A net premium of $41 payable for life will provide (x) with either $5,000 n-year term insurance followed by $1,000 whole life insurance after age x + n, or $3,000 n-year term insurance followed by $2,000 whole life insurance after age x + n. What is 1000 · Px ? A) 17.37 B) 17.47 C) 17.57 D) 17.67 E) 17.77arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education