Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

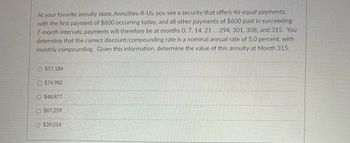

Transcribed Image Text:At your favorite annuity store. Annuities-R-Us, you see a security that offers 46 equal payments,

with the first payment of $600 occurring today, and all other payments of $600 paid in succeeding

7-month intervals: payments will therefore be at months 0, 7, 14, 21 ... 294, 301, 308, and 315. You

determine that the correct discount/compounding rate is a nominal annual rate of 5.0 percent, with

monthly compounding. Given this information, determine the value of this annuity at Month 315.

O $57,184

O $74.982

O $48,877

$67,259

O $39.014

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Two annuities are available for purchase that your client has identified. The first annuity pays $7,000 each six-month period over a 5-years period, at a nominal rate of 9% p.a. The annuity has an annual fee of $300, paid at the beginning of each year. The second annuity pays $1,000 each month, again over 5 years at a nominal rate of 10% p.a. and does not have an annual fee. If each of the annuities cost $50,000, identify which of the annuities you would recommend to your client.arrow_forwardTABLE 13.2 Present value of an annuity of $1 ½% 8% 1% 0.9901 2% 0.9804 3% 0.9709 4% 0.9615 5% 0.9524 1.8594 6% 7% 0.9434 0.9346 0.9259 9% 10% 11% 12% 0.9174 0.9091 0.9009 0.8929 0.9950 1.9851 1.9704 1.9416 1.9135 1.8861 2.9702 2.9410 2.8839 2.8286 2.7751 2.7232 3.9505 3.9020 3.8077 3.7171 3.6299 3.5459 1.7591 1.7355 1.7125 1.6901 2.5313 2.4869 2.4437 2.4018 3.2397 3.1699 3.1024 3.0373 3.8897 3.7908 3.6959 3.6048 4.4859 4.3553 4.2305 4.1114 4.9259 4.8534 4.7134 4.5797 4.4518 1.8334 1.8080 1.7833 2.6730 2.6243 2.5771 3.4651 3.3872 3.3121 4.1002 3.9927 4.6229 5.2064 5.7466 4.3295 4.2124 5.8964 5.7955 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 6.8621 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 5.3893 5.0330 4.8684 7.8230 7.6517 7.3255 7.0197 6.7327 6.4632 6.2098 5.9713 8.7791 8.5660 8.1622 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 4.7122 4.5638 5.5348 5.3349 5.1461 4.9676 5.9952 5.7590 5.5370 5.3282 6.4177 6.1446 5.8892 5.6502 6.8052 7.1607 8.9826 8.5302 8.1109 7.7217 7.3601 7.0236 6.7101…arrow_forwardGive typing answer with explanation and conclusionarrow_forward

- A 6-year term insurance policy has an annual premium of $500, and at the end of 6 years, all payments and interest are refunded. What lump-sum deposit is necessary to equal this amount if you assume an interest rate of 2.5% compounded annually? (a) State the type. future value present value of an annuity sinking fund amortization ordinary annuity (b) Answer the question. (Round your answer to the nearest cent.) $arrow_forwardAmerican General offers a 10-year annuity with a guaranteed rate of 9.39% compounded annually. How much should you pay for one of these annuities if you want to receive payments of $1400 annually over the 10 year period? How much should a customer pay for this annuity? (Round to the nearest cent.) Incorrect ti, 14earrow_forwardEstimating the annual interest rate with an ordinary annuity. Fill in the missing annual interest rates in the following table for an ordinary annuity stream: Number of Payments or Years 10 19 25 80 Annual Interest Rate % (Round to two decimal places.) % (Round to two decimal places.) % (Round to two decimal places.) % (Round to two decimal places.) Future Value $0.00 $12,286.30 $0.00 $1,435,078.21 C Annuity Present Value $580.00 $444.01 $1,985.57 $450.00 $2,298.49 $0.00 $37,000.00 $0.00arrow_forward

- please show the step by step solution. Do not skips steps. Explain your steps Please write on paperarrow_forwardcalculate the future value (in $) of the annuity due. (Round your answer to the nearest cent.) AnnuityPayment PaymentFrequency TimePeriod (years) NominalRate (%) InterestCompounded Future Valueof the Annuity $80 every month 2 1 2 6 monthly $arrow_forwardFind the future value (FV) of the annuity due. (Round your answer to the nearest cent.) $165 monthly payment, 7% interest, 11 yearsarrow_forward

- Find the term of the following ordinary general annuity. State your answer in years and months (from 0 to 11 months). Present Periodic Payment Interval Interest Compounding Period Value Payment Rate $10,300 $330 month 3% semi-annually The term of the annuity is year(s) and month(s).arrow_forwardConstruct an annuity table showing the deposits, interests, and balances for the saving plan below (compulsory to show the working steps to get the interest value): a) $350 is invested in an increasing annuity at the end of every 6 months for 3 years. The account pays 10.25% interest rate compounded semiannually. Period Beginning Interest Deposit Ending balance (Every 6 months) Balance 1 $0.00 $0.00 $350.00 $350.00 3 4 (Copy this table to your answer script)arrow_forwardAn annuity-immediate has 21 payments of $800 per period. The effective rate of interest per period is 7% for the first 9 periods and 4% for the following 12 periods. (A) Find the accumulated value of the annuity. Round your answer to 2 decimal places.(B) Find the present value of the annuity. Round your answer to 2 decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education