Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

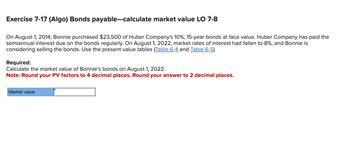

Transcribed Image Text:Exercise 7-17 (Algo) Bonds payable-calculate market value LO 7-8

On August 1, 2014, Bonnie purchased $23,500 of Huber Company's 10%, 15-year bonds at face value. Huber Company has paid the

semiannual interest due on the bonds regularly. On August 1, 2022, market rates of interest had fallen to 8%, and Bonnie is

considering selling the bonds. Use the present value tables (Table 6-4 and Table 6-5)

Required:

Calculate the market value of Bonnie's bonds on August 1, 2022.

Note: Round your PV factors to 4 decimal places. Round your answer to 2 decimal places.

Market value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Cornerstone Exercise 9-46 (Appendix 9A) Bond Issue Price On December 31, 2014, Callahan Auto issued $900,000 of 9%, 10-year bonds. Interest is payable semiannually on June 30 and December 31. Required: What is the issue price if the bonds are sold to yield 8%? Follow the format shown in Present Value tables as you complete the requirement. If required, round your calculations and final answer to the nearest whole dollar.$arrow_forwardaj.7arrow_forwardNonearrow_forward

- PROBLEM 1 On December 31, 2018, Edmand Inc. issued $750,000of 11% five-year bonds for $722,400, yielding an effective interest rate of 12%. Semi annual interest is payable on June 30 and December 31 each year. The firm uses effective interest method to amortize the discount. a) Prepare Amortization schedule showing the necessary information for the first two interest periods. Round amounts to the nearest dollar. b) Prepare the journal entry for the bond issuance on December 31, 2018. c) Prepare the journal entry to record bond interest expense and discount amortization at June 30 2019. d) Prepare the journal entry to record the bond interest expense and discount amortization at December 31, 2019arrow_forwardQuestion 1 Bonds (23 marks) Terra Company issued a $300,000, 7.50%, 10-year bond on June 1, 2015. Additional information on the bond follows: Bond Date: January 1, 2015 December 31, 2024 Maturity Date: Yield (Market) Rate: Interest Payment Date: Terra's year end: Required: Round calculations to the nearest dollar a) Calculate the present value of the bond assuming that it had been issued on January 1, 2015. Show calculations/keystrokes. (1 mark) 8% Interest is paid annually on December 31 of each year September 30 b) Prepare a bond amortization table from January 1, 2015 until December 31, 2018. Show each annual interest payment. (3 marks) c) Calculate the total amount of cash received by Terra on June 1, 2015, reflecting the fact the bond was issued on June 1, 2015. Make the journal entry to record the bond issue on June 1, 2015. (4 marks) d) Prepare the adjusting entry required at Terra's year end, Sept 30, 2017. (2 marks) e) Prepare the journal entry on Terra's books to make the…arrow_forwardView Policies On January 2, 2015, Monty Corporation issued $ 1,950,000 of 10% bonds at 98 due December 31, 2024. Interest on the bonds is payable annually each December 31. The discount on the bonds is also being amortized on a straight-line basis over the 10 years. (Straight-line is not materially different in effect from the preferable "interest method.") Current Attempt in Progress The bonds are callable at 101 (i.e., at 101% of face amount), and on January 2, 2020, Monty called $ 1,170,000 face amount of the bonds and redeemed them. Ignoring income taxes, compute the amount of loss, if any, to be recognized by Monty as a result of retiring the $ 1,170,000 of bonds in 2020. (Round answer to O decimal places, eg. 38,548.) Loss on redemption Prepare the journal entry to record the redemption. (Round answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented…arrow_forward

- Sh21arrow_forwardDon't give answer in imagearrow_forwardDetermining Selling Prices of Bonds Under Different Interest Assumptions Olay Inc. issues $50,000, 8%, 10-year bonds payable on January 1, 2020. Calculate the selling price of the bonds under the following separate assumptions. • Round your answer to the nearest whole number. • Do not use negative signs with your answers. a. The bonds pay cash interest annually ($4.000) and the market rate of interest on similar bonds is 10%. b. The bonds pay cash interest annually (54.000) and the market rate of interest on similar bonds is 8%. c. The bonds pay cash interest annually ($4.000) and the market rate of interest on similar bonds is 6%. d. The bonds pay cash interest semiannually ($2.000) and the market rate of interest on similar bonds is 10%. S e. The bonds pay cash interest semiannually ($2.000) and the market rate of interest on similar bonds is 8%, s f. The bonds pay cash interest semiannually ($2.000) and the market rate of interest on similar bonds is 6%. %24 47,738 x 50.000 v 52,600…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education