FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

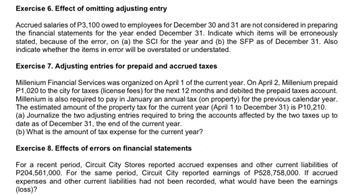

Transcribed Image Text:Exercise 6. Effect of omitting adjusting entry

Accrued salaries of P3,100 owed to employees for December 30 and 31 are not considered in preparing

the financial statements for the year ended December 31. Indicate which items will be erroneously

stated, because of the error, on (a) the SCI for the year and (b) the SFP as of December 31. Also

indicate whether the items in error will be overstated or understated.

Exercise 7. Adjusting entries for prepaid and accrued taxes

Millenium Financial Services was organized on April 1 of the current year. On April 2, Millenium prepaid

P1,020 to the city for taxes (license fees) for the next 12 months and debited the prepaid taxes account.

Millenium is also required to pay in January an annual tax (on property) for the previous calendar year.

The estimated amount of the property tax for the current year (April 1 to December 31) is P10,210.

(a) Journalize the two adjusting entries required to bring the accounts affected by the two taxes up to

date as of December 31, the end of the current year.

(b) What is the amount of tax expense for the current year?

Exercise 8. Effects of errors on financial statements

For a recent period, Circuit City Stores reported accrued expenses and other current liabilities of

P204,561,000. For the same period, Circuit City reported earnings of P528,758,000. If accrued

expenses and other current liabilities had not been recorded, what would have been the earnings

(loss)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For the year ended December 31, Beard Clinical Supplies Co. mistakenly omitted adjusting entries for (1) $8,060 of unearned revenue that was earned, (2) earned revenue that was not billed of $10,320, and (3) accrued wages of $6,420. Indicate the combined effect of the errors on (a) revenues, (b) expenses, and (c) net income. a. Revenues were b. Expenses were c. Net income was by $ by $ by $arrow_forwardHow should accounting errors discovered in the same accounting period they relate be correct. For example, during year 2021, ABC corporation discovered an error in March of 2021 where an expense was debited instead of a fixed asset. How should the error be corrected O Wait until following year to correct the error O Correct the error using prior year in this case 2020. O Reverse the erroneous entry and post the correct entry as soon as the error is discovered, in this this case in the year 2021 O Do nothing, it will self correctarrow_forwardEffects of Omitting Adjustments For the year ending April 30, Safeguard Medical Services Co. mistakenly omitted adjusting entries for (1) $1,700 of supplies that were used, (2) unearned revenue of $8,000 that was earned, and (3) insurance of $10,900 that expired. Indicate the effect of the errors on (a) revenues, (b) expenses, and (c) net income for the year ended April 30. (a) Revenues understated understated (b) Expenses (c) Net income overstated ✓ ✓ $arrow_forward

- Effects of Errors on Financial Statements The accountant for Healthy Life Company, a medical services consulting firm, mistakenly omitted adjusting entries for (a) unearned revenue earned during the year ($27,780) and (b) accrued wages ($7,780). If the net income for the current year had been $537,000, what would have been the correct net income if the proper adjusting entries had been made?$fill in the blankarrow_forwardThe following are independent events. For each change or error select how it would be accounted for. a. Changed remaining serVice life from 8 years to 10 years b. Change from an unacceptable accounting method to an acceptable C. Received money won in a law suit d. Inventory write down due to obsolescence e. Change in rate used to calculate warranty costs f. Change from FIFO to average costs inventory method g. Discovered errors in unrecorded expenses from a prior period h. Purchased another company which now requires the financial statements to be consolidatedarrow_forwardCertain adjusting entries made at the end of an accounting period are reversed at the beginning of the following period. Required: Analyze the following four adjusting entries made on December 31, and determine whether a reversing entry is needed. Date Description Reversing entry Reversing entry Debit Credit necessary not necessary Dec. 31 Interest Receivable 1,200 Interest Revenue 1,200 31 Deferred Insurance 965 Insurance Revenue 965 31 Salaries Expense 150 Salaries Payable 150 31 Deferred Rent Revenue 1,550 Rent Revenue 1,550 Garrow_forward

- Nonearrow_forwardPlease dont provide solution image based thanxarrow_forwardExercise 9. Effects of errors on financial statements The accountant for Maxim Medical Co., a medical services consulting firm, mistakenly omitted adjusting entries for (a) unearned revenue, P10,390 and (b) accrued wages, P2,440. Indicate the effect of each error, considered individually, on the SCI for the current year ended December 31. Also indicate the effect of each error on the December 31 SFP. Record your answers by inserting the P amount in the appropriate spaces. Insert a zero if the error does not affect the item. Error (a) Error (b) Over- Over- Under- stated stated stated 1. Revenue for the year would be 2. Expenses for the year would be 3. Net income for the year would be 4. Assets at December 31 would be 5. Liabilities at December 31 would be 6. Owner's equity at December 31 would be Under- statedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education