FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

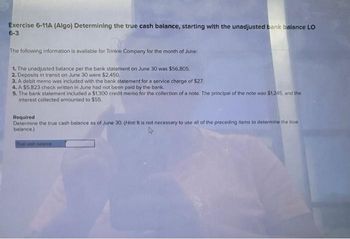

Transcribed Image Text:Exercise 6-11A (Algo) Determining the true cash balance, starting with the unadjusted bank balance LO

6-3

The following information is available for Trinkle Company for the month of June:

1. The unadjusted balance per the bank statement on June 30 was $56,805.

2. Deposits in transit on June 30 were $2,450.

3. A debit memo was included with the bank statement for a service charge of $27.

4. A $5,823 check written in June had not been paid by the bank.

5. The bank statement included a $1,300 credit memo for the collection of a note. The principal of the note was $1,245, and the

interest collected amounted to $55.

Required

Determine the true cash balance as of June 30. (Hint: It is not necessary to use all of the preceding items to determine the true

balance.)

True cash balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash Over and Short Miller Enterprises deposits the cash received during each day at the end of the day. Miller deposited $48,287 on October 3 and $50,116 on October 4. Cash register records and other documents supporting the deposits are summarized as follows: 10/3 10/4 Cash sales $36,690 $40,310 Collections on account 10,875 9,813 Total receipts $47,565 $50,123 Required: 1. Calculate the amount of cash over or cash short for each day. Enter negative values as negative numbers. 2. Prepare the journal entry to record the receipt and deposit of cash on October 3. For those boxes in which no entry is required 3. Prepare the journal entry to record the receipt and deposit of cash on October 4. For those boxes in which no entry is required 4. CONCEPTUAL CONNECTION: If you were the manager with responsibility over the cash registers, how would you use this information?arrow_forwardaj.8arrow_forwardQuestion Content Area Bank Reconciliation and Entries The cash account for Norwegian Medical Co. at April 30 indicated a balance of $12,480. The bank statement indicated a balance of $14,430 on April 30. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: Checks outstanding totaled $5,190. A deposit of $5,410, representing receipts of April 30, had been made too late to appear on the bank statement. The bank collected $2,810 on a $2,670 note, including interest of $140. A check for $550 returned with the statement had been incorrectly recorded by Norwegian Medical Co. as $500. The check was for the payment of an obligation to Universal Supply Co. for a purchase on account. A check drawn for $60 had been erroneously charged by the bank as $600. Bank service charges for April amounted to $50.arrow_forward

- Required Information Problem 6-4A (Algo) Preparing a bank reconciliation and recording entries LO P3 [The following information applies to the questions displayed below.] The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,296 debit balance, but its July bank statement shows a $27,253 cash balance. b. Check Number 3031 for $1,350, Check Number 3065 for $451, and Check Number 3069 for $2,118 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,210 but was erroneously entered in the accounting records as $1,200. d. The July bank statement shows the bank collected $10,000 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet…arrow_forwardDo not provide answer in image formatarrow_forwardQUESTION 9 The Gatedown Company's bank statement has an ending cash balance of $14,110.00. The cash account in the general ledger has a balance of $12,477.00. Based on the following reconciling items, prepare a bank reconciliation. a) Bank service charge of $20.00 b) Deposit in transit $3,190.00 c) A check was returned NSF $645.00 d) Outstanding check $688.00 e) Note collected by the bank, credit memoranda, $4,800.00 What is the total of subtractions to arrive at the book balance? A) 645.00 B) 555.00arrow_forward

- Problem 3-9 (IAA) Harris Company provided the following data concerning the cash records for the months of September and October: Book balance Total cash receipts per book Total cash disbursements per book Bank balance Total charges in bank statement Total credits in bank statement September 30 1,900,000 in 2,100,000 cmuntatges 60,000 30,000 vilgter NSF check Collections of accounts receivable not recorded by entity and corrected in subsequent month Overstatement of check in payment of salaries corrected in subsequent month Deposit in transit Outstanding checks Required: a. Prepare a four-column reconciliation showing adjusted balances. 90,000 130,000 had 270,000 dinon onge ni dru 94 October 31 ? b. Prepare adjusting entries on October 31. 1,400,000 2,400,000 2,500,000 1,200,000 40,000 50,000 doost amules por nga e-onelad 120,000 260,000 30,000 sing voilasibe sacomuse Galaxy S21+5Garrow_forward18 The May 31 balance per bank statement was $12,400. The cash balance per books was $17,000. Outstanding checks amounted to $1,700, and deposits in transit were $4,800. The bank statement contained an NSF check for $1,100, a service charge for $50, and a debit memo for direct payment of the telephone bill of $350. Required: a. Prepare a bank reconciliation to determine the true cash balance at May 31. b. Indicate how each of the required adjusting entries impact the financial statements. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Indicate how each of the required adjusting entries impact the financial statements. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Outstanding checks Horizontal Statements Model Balance Sheet Income Statement Item Assets Liabilities Cash Accounts Receivables Stockholders' Equity Revenue Expenses Net Income Statement of Cash Flows (1.700)…arrow_forwardDhapa rakesharrow_forward

- Hills Company’s June 30 bank statement and the June ledger account for cash are summarized here: BANK STATEMENT Checks Deposits Other Balance Balance, June 1 $ 7,320 Deposits during June $ 18,600 25,920 Checks cleared during June $ 19,700 6,220 Bank service charges $ 31 6,189 Balance, June 30 6,189 Cash (A) Debit Credit June 1 Balance 7,320 June Deposits 20,200 20,000 Checks written June June 30 Balance 7,520 E5-5 (Algo) Part 1 Required:1. Prepare a bank reconciliation. A comparison of the checks written with the checks that have cleared the bank shows outstanding checks of $300. Some of the checks that cleared in June were written prior to June. No deposits in transit were noted in May, but a deposit is in transit at the end of June.arrow_forwardNo image plejarrow_forwardExercise 7-24 Barbara Lansbury Company deposits all receipts and makes all payments by check. The following information is available from the cash records. June 30 Bank Reconciliation Balance per bank $12,600 Add: Deposits in transit 2,772 Deduct: Outstanding checks (3,600 ) Balance per books $11,772 Month of July Results Per Bank Per Books Balance July 31 $15,570 $16,650 July deposits 8,100 10,458 July checks 7,200 5,580 July note collected (not included in July deposits) 2,700 July bank service charge 27 July NSF check from a customer, returned by the bank (recorded by bank as a charge) 603 Your answer is partially correct. Try again. Prepare a bank reconciliation going from balance per bank and balance per book to correct cash balance. BARBARA LANSBURY COMPANYBank ReconciliationJuly 31…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education