FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

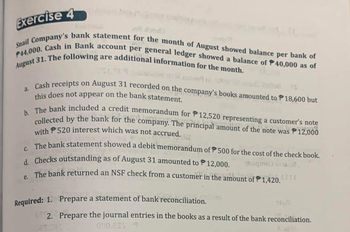

Transcribed Image Text:Exercise 4

Snail Company's bank statement for the month of August showed balance per bank of

P44,000. Cash in Bank account per general ledger showed a balance of P40,000 as of

August 31. The following are additional information for the month.

a.

7251,589

M auto o

es

on August 31 recorded on the company's books amounted to 18,600 but

Cash receipts

this does not appear on the bank statement.

b. The bank included a credit memorandum for 12,520 representing a customer's note

collected by the bank for the company. The principal amount of the note was 12,000

with 520 interest which was not accrued.

222579

112

C. The bank statement showed a debit memorandum of 500 for the cost of the check book.

d. Checks outstanding as of August 31 amounted to 12,000.

(2qmo) 16.02.

doo LILL

e. The bank returned an NSF check from a customer in the amount of 1,420.

Required: 1. Prepare a statement of bank reconciliation.

2. Prepare the journal entries in the books as a result of the bank reconciliation.

085.28%

000,20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Refer to the information given below: a. The August 31 balance shown on the bank statement is $9,050. b. There is a deposit in transit of $1,300 at August 31. c. Outstanding checks at August 31 totaled $1,620. d. Interest credited to the account during August but not recorded on the company's books amounted to $68. e. A bank charge of $44 for checks was made to the account during August. Although the company was expecting a charge, the amount was not known until the bank statement arrived. f. In the process of reviewing the canceled checks, it was determined that a check issued to a supplier in payment of accounts payable of $142 had been recorded as a disbursement of $412. g. The August 31 balance in the general ledger Cash account, before reconciliation, is $8,436. Required: a-1. Show the reconciling items in a horizontal model that should be prepared to reflect the reconciling items as on August 31. (Use amounts with + for increases and amounts with for decreases.) Cash Assets…arrow_forwardAccounting please answer asap? John Corporation's bank statement for April 30 showed an ending cash balance of $1,350. The company's Cash account in its general ledger showed a $995 debit balance. The following information was also available as of April 30: • The bank deducted $125 for an NSF check from a customer deposited on April 15. • The April 30 cash receipts, $1,250, were placed in the bank's night depository after banking hours on that date and this amount did not appear on the April 30 bank statement. • A$15 debit memorandum (service charges) for checks printed by the bank was included with the canceled checks. • Outstanding checks amounted to $1,145. • Included with the bank statement was a credit memo in the amount of $875 for an EFT in payment of a customer's account. • Included with the canceled checks was a check for $275, drawn on the account of another company by error. Required: 1. Prepare a bank reconciliation as of April 30. 2. Prepare the journal entries for the…arrow_forwardThe bank statement for Jeffrey Co. indicates a balance of $8,785 on October 31. After the journals for October had been posted, the cash account had a balance of $8,998. a. Cash sales of $945 had been erroneously recorded in the cash receipts journal as $495. b. Deposits in transit not recorded by bank, $778. c. Bank debit memo for service charges, $40. d. Bank credit memo for note collected by bank, $23,985 plus $885 interest. e. Bank debit memo for $756 NSF (not sufficient funds) check from Calin Sams, a customer. f. Checks outstanding, $1,860. Record the appropriate journal entries that would be necessary for Jeffrey Co. Record the entry that increases cash first. If an amount box does not require an entry, leave it blank.arrow_forward

- Beverly Hills, Inc. developed the following information in recording its bank statement for the month of November. Balance per books November 30 $22,014 Balance per bank statement November 30 $24,635 1. Checks written in November but still outstanding $1,450. 2. Checks written in October but still outstanding $1,107. 3. Deposits of November 29th and 30th not yet recorded by bank $5,496. 4. NSF check of customer, A. Lincoln, returned by bank, $704. 5. The bank statement contained an electronic funds transfer received from customer Theodora Company for $6,150 plus interest for $150. 6. Check No. 151 for $562 was correctly issued and paid by bank, but incorrectly entered in the Cash Payments Journal as $526. It was a payment made to vendor, Smith Concrete. A. Prepare a Bank Reconciliation Statement at November 30. B. For Beverly Hills, Inc. prepare the next journal entry from the bank reconciliation. C. For Beverly Hills, Inc. prepare the final journal entry from the bank…arrow_forwardBrown Company's bank statement for Septermber 30 showed: Bank statement balance Book balance of cash $4,210 $6,560 The following information was also available as of September 30: a. A customer's check for $950 marked NSF was returned to Brown Company by the bank. In addition, the bank charged the company's account a $30 processing fee. b. The September 30 cash receipts, $6,000 were placed in the bank's night depository after banking hours on that date and this amount did not appear on the September 30 bank statement. c. Outstanding checks amounted to $3,910. d. A check for rent expense was written for $2,198 but by mistake was recorded in the accounting records as $2,918. Required: Prepare bank reconciliation as of September 30. Your Answer should be in the following format:arrow_forwardThe cash account for Pala Medical Co. at June 30, 20Y1, indicated a balance of $146,035. The bank statement indicated a balance of $181,965 on June 30, 20Y1. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: A. Checks outstanding totaled $16,445. B. A deposit of $9,900, representing receipts of June 30, had been made too late to appear on the bank statement. C. The bank collected $31,800 on a $30,000 note, including interest of $1,800. D. A check for $2,000 returned with the statement had been incorrectly recorded by Pala Medical Co. as $200. The check was for the payment of an obligation to Skyline Supply Co. for a purchase on account. E. A check drawn for $170 had been erroneously charged by the bank as $710. F. Bank service charges for June amounted to $75. 1. Prepare a bank reconciliation. Refer to the Amount Descriptions list provided for the exact wording of the answer…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education