FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Exercise 4-9 Recording purchases, sales, returns, and shipping LO P1, P2

Following are the merchandising transactions of Dollar Store.

1 Dollar Store purchases merchandise for $1,500 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1.

5 Dollar Store pays cash for the November 1 purchase.

7 Dollar Store discovers and returns $150 of defective merchandise purchased on November 1, and paid for on November 5, for a

Nov.

cash refund.

10 Dollar Store pays $75 cash for transportation costs for the November 1 purchase.

13 Dollar Store sells merchandise for $1,620 with terms n/30. The cost of the merchandise is $810.

16 Merchandise is returned to the Dollar Store from the November 13 transaction. The returned items are priced at $205 and

cost $103; the items were not damaged and were returned to inventory.

Journalize the above merchandising transactions for the Dollar Store assuming it uses a perpetual inventory system and the gross

ces

method.

View transaction list

Journal entry worksheet

1

2

3 4

8

<>

Dollar Store purchases merchandise for $1,500 on terms of 2/5, n/30, FOB

shipping point, invoice dated November 1.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Nov 01

< Prev

2 of 5

Next >

aw

100%

Type here to search

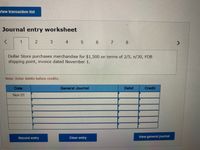

Transcribed Image Text:View transaction list

Journal entry worksheet

1

4

Dollar Store purchases merchandise for $1,500 on terms of 2/5, n/30, FOB

shipping point, invoice dated November 1.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Nov 01

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QS 9-1 (Algo) Credit card sales LO C1 Prepare journal entries for the following credit card sales transactions (the company uses the perpetual inventory system). Sold $21,000 of merchandise, which cost $15,800, on Mastercard credit cards. Mastercard charges a 5% fee. Sold $5,100 of merchandise, which cost $3,050, on an assortment of bank credit cards. These cards charge a 4% fee.arrow_forwardRequlred Information Trey Monson starts a merchandising business on December 1 and enters Into the following three Inventory purchases. Also, on December 15, Monson sells 30 units for $35 each. Purchases on December 7 20 units @ $14.ee cost 36 units e $21.00 cost 30 units e $25.00 cost Purchases on December 14 Purchases on December 21 Requlred: Monson sells 30 units for $35 each on December 15. Monson uses a perpetual inventory system. Determine the costs assigne the December 31 ending Inventory when costs are assigned based on LIFO. Perpetual LIFO: Goods purchased Cost of Goods Sold Inventory Balance Cost of Goods Available for Sale # of units sold Cost per # of units Cost per Cost of Goods unit # of units Cost per unit Inventory Balance Date unit Sold December 7 0.00 December 14 0.00 0.00 December 15 December 21 0.00 Totalsarrow_forwardChapter 13-14-15 Homework еBook Show Me How Print Item Cost of Goods Sold Section, Multiple-Step Income Statement Instructions Amount Descriptions and Accounts Income Statement Instructions Based on the information that follows: Merchandise Inventory, January 1, 20-- $14,000 Estimated Returns Inventory, January 1, 20-- 700 Purchases 71,400 Purchases Returns and Allowances 3,189 Purchases Discounts 1,460 Freight-in Merchandise Inventory, December 31, 20- 390 21,000 Estimated Returns Inventory, December 31, 20-- 1,300 Required: Prepare the cost of goods sold section of a multiple-step income statement.arrow_forward

- sarrow_forwardA noninterest-bearing note is issued on February 12 of a non-leap year in the amount of $14,250. It has a term of 10 months. It is sold on September 22 with a negotiated interest rate of 2%. Determine the proceeds of the sale. Add 3 days grace period. Select one: a. $14184.71 b. $12193.87 c. none d. $13189.29 Checkarrow_forwardPlease help me correctarrow_forward

- vishu Subject-Accountingarrow_forwardExercise 7-2 (Static) Accounting for credit card sales LO C1 Levine Company uses the perpetual inventory system. April 8 Sold merchandise for $8,400 (that had cost $6,000) and accepted the customer's Suntrust Bank Card. Suntrust charges a 4 fee. April 12 Sold merchandise for $5,600 (that had cost $3,500) and accepted the customer's Continental Card. Continental- charges a 2.5t fee. Prepare journal entries to record the above credit card transactions of Levine Company. View transaction list View journal entry worksheet No Date General Journal 1 April 08 Credit card expense 2 April 08 Cost of goods sold Merchandise inventory 3 April 12 Cash Credit card expense Sales Debit Credit 336 6,000 6,000 140 4 April 12 Cost of goods sold 3,500 Merchandise inventory 3,500arrow_forwardEntries for Uncollectible Receivables, using Alowance Method 1. EX.08.01 Journalize the following transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of 2 EX 08.02 ALGO accounting for uncollectible recelvables: 3. EX.08.03 ALGO May 24 Sold merdchandise on account to Old Town Cafe, $10,200. The cost of goods sold was $7,300. Sept. 30 Received $3,000 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible. 4. EX.08.04 ALGO Dec. 7 Reinstated the account of Old Town Cafe that had been written off on September 30 and received $7,200 cash in full payment. 5. EX.08.06 ALGO If an amount box does not require an entry, leave it blank. Accounts Receivable-old Town Cafe 6. EX 08.07 May 24-sale 7. EX.08.20 ALGO Sales v 8. PRO8.02A BLANKSHEET Cost of Goods Sold v Inventory v May 24-cost Sept. 30 Cash Allowance for Doubtful Accounts Accounts Receivable-old Town Cafe v Dec. 7-reinstate Accounts…arrow_forward

- Prepare journal entries to record the following merchandising transactions of Cabela's, which uses the perpetual Inventory system and the gross method. July 1 Purchased merchandise from Boden Company for $6,000 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Creek Company for $900 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $500. July 3 Paid $125 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $1,300 for $1,700 cash. July 9 Purchased merchandise from Leight Company for $2,200 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. July 11 Returned $200 of merchandise purchased on July 9 from Leight Company and debited its account payable for that amount. July 12 Received the balance due from Creek Company for the invoice dated July 2, net of the discount. July 16 Paid the balance due to Boden Company within the…arrow_forward7arrow_forwardChapter 12 Homework eBook Show Me How Print Item Journalizing Sales Transactions Enter the following transactions in a sales journal. Use a 6% sales tax rate. Sept. 1 Sold merchandise on account to K. Smith, $1,700, plus sales tax. Sale No. 228. 3 Sold merchandise on account to J. Arnes, $2,900, plus sales tax. Sale No. 229. 5 Sold merchandise on account to M. Denison, $2,700, plus sales tax. Sale No. 230. 7 Sold merchandise on account to B. Marshall, $1,500, plus sales tax. Sale No. 231. ACCOUNTS RECEIVABLE DEBIT Page: 1 SALES TAX PAYABLE CREDIT > SALE NO. POST. REF. SALES CREDIT DATE TO WHOM SOLD М.d 1 1 М. d 2 2 М.d М.d 4 4 3.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education