FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

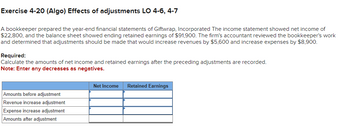

Transcribed Image Text:Exercise 4-20 (Algo) Effects of adjustments LO 4-6, 4-7

A bookkeeper prepared the year-end financial statements of Giftwrap, Incorporated The income statement showed net income of

$22,800, and the balance sheet showed ending retained earnings of $91,900. The firm's accountant reviewed the bookkeeper's work

and determined that adjustments should be made that would increase revenues by $5,600 and increase expenses by $8,900.

Required:

Calculate the amounts of net income and retained earnings after the preceding adjustments are recorded.

Note: Enter any decreases as negatives.

Amounts before adjustment

Revenue increase adjustment

Expense increase adjustment

Amounts after adjustment

Net Income Retained Earnings

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Question attached thanks for the help 4602o4063o eroge fo03 303fefearrow_forwardPlease Include June 23 transaction on page 11arrow_forwardPAGE 11 ACCOUNTING FOUATION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Widmer Company had gross wages of $200,000 during the week ended June 17. The amount of wages subject to social security tax was $200,000, while the amount of wages subject to federal and state unemployment taxes was $30,000. Tax rates are as follows: General Journal a. Journalize the entry to record the payroll for the week of June 17. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $40,500. General Journal Instructions Required: a. Journalize the entry to record the payroll for the week of June 17. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17 1 2 4 DATE DESCRIPTION 5 9 7 B 9 10 JOURNALarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education