FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

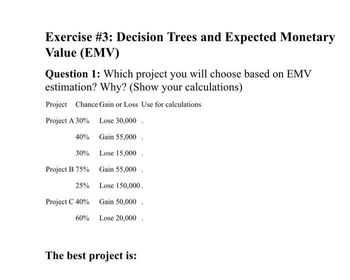

Transcribed Image Text:Exercise #3: Decision Trees and Expected Monetary

Value (EMV)

Question 1: Which project you will choose based on EMV

estimation? Why? (Show your calculations)

Project Chance Gain or Loss Use for calculations

Project A 30%

Lose 30,000.

40%

Gain 55,000.

30%

Lose 15,000.

Project B 75%

Gain 55,000

25%

Lose 150,000.

Project C 40%

Gain 50,000.

60%

Lose 20,000.

The best project is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- need step by step answerarrow_forwardBased on the information below which projects will we choose based on weighted average profitabiltity Index if we only have OMR500,000 to invest? Project NPV Investment PI A 130,000 200,000 B 241,250 225,000 C 294,250 275,000 D 262,000 250,000 Select one: a. WAPI AD b. WAPI AB c. WAPI BD d. WAPI BCarrow_forwardConsider the following two projects: Cash flows Project A Project B C0�0 −$ 240 −$ 240 C1�1 100 123 C2�2 100 123 C3�3 100 123 C4�4 100 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h. If the opportunity cost of capital is 8%, what is the profitability index for each project? i. Is the project with the highest profitability index also the one with the highest NPV? j. Which measure should you use to choose between the projects?arrow_forward

- enj ers en ers exc sen pers OO 1 maximum precision can be obtained. (Unless indicated otherwise, enter your answers rounded to the nearest whole dollar/input code: 0). Investment Option "North" This potential investment is a little more risky and longer term, so it has a minimum rate of return of 15.30%. This investment would require an initial outlay of cash to purchase a piece equipment for $171,500, and at the end of the 8-year life of this investment is expected to have a salvage value of $77,175. For each year of this investment, net annual cash inflows are expected to be $32,500. 1. How much is the present value of the purchase of equipment? 2. How much is the present value of the salvage value? 3. How much is the present value of the annual cash inflows? 4. How much is the Net Present Value? 5. What is the value of the Present Value Index? (round to the nearest thousandths LA $ tA $ $ tA $ tAarrow_forwardKLA Cost Ziege Systems is considering the following independent projects for the coming year Project Required Investorent Rate of Return Risk A $4 million 12.25% Hish High $5 million Low B C DEFGH $3 million $2 million $6 million $5 million $6 million $3 million 500 14.75 10.25 9.75 13.25 13.25 7.75 12.25 million Average High Average Low Low } If Ziege con only invest a total of $13 million what would be the dollar size of its capital budget? $ million What would be the dollar size of its capital budget? $arrow_forward8. NPV profiles An NPV profile plots a project's NPV at various costs of capital. An example NPV profile is shown below: Identify the range of costs of capital that a firm would use to accept and reject this project, and answer the questions that follow. NPV (Dollars) 600 500 400 300 200 100 0 ← -100 -200 -300 A 2 4 6 8 10 12 14 16 DISCOUNT (REQUIRED) RATE (Percent) The project represented by triangle A should be B 18 20 This NPV profile demonstrates that as the cost of capital increases, the project's NPV ?arrow_forward

- Project A: IRR = 4%, Initial cost =100, NPV = 200 Project B: IRR = 14%, Initial cost =200, NPV = 230 Project C: IRR = 6%, Initial cost = 300, NPV = 300 Project D: IRR = 22%, Initial cost = 100, NPV = 260 If you can only choose 1 of the above projects above, which one should you choose? Project A Project B Project C Project D Not enough information to determine which project is preferredarrow_forwardData Using Incremental with EUAW analysis find the best alternative, MARR = %10. You should use Excel and show your equations separately, see below example: [A Benefit - [IC (A/P, i%, n) - Salvage (A/F, i, n)] + A Cost+ G Cost (A/G, i, n)] First Cost Salvage Value Annual Benefit M&O M&O Gradient Useful Life, Years A $2,300,000 $85,000 $580,000 $65,000 $10,000 10 B $2,750,000 $125,000 $670,000 $78,000 $15,000 10 с $2,550,000 $95,000 $650,000 $72,000 $12,500 10arrow_forwardJust answer last question (what is npv for the project if the required rate of return is 26%)arrow_forward

- Typed plz and asap please provide a quality solution take care of plagiarismarrow_forwardGiven the financial data for four mutually exclusive alternatives in the table below, determine the best alternative using the incremental rate of return (∆RoR) analysis. MARR =10%.arrow_forwardPut answer in table format Yokam Company is considering two alternative projects. Project 1 requires an initial investment of $560,000 and has a present value of cash flows of $2,200,000.0. Project 2 requires an initial investment of $5,000,000 and has a present value of cash flows of $7,000,000. 1. Compute the profitability index for each project.2. Based on the profitability index, which project should the company prefer?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education