FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Chapter 3- Budgeting - Microsoft PowerPoint (Product Activation Failed)

Slide Show

Review

View

A A 三、证、请一机。

Aal

IlA Text Direction-

4.

A

Shape Fill -

pe AV- Aa

Align Text -

Shape Outline -

M - Arrange Quick

Styles-

Convert to SmartArt-

Shape Effects -

Paragraph

Drawing

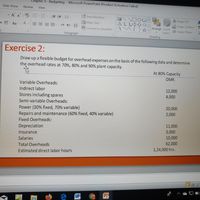

Exercise 2:

Draw up a flexible budget for overhead expenses on the basis of the following data and determine

the overhead rates at 70%, 80% and 90% plant capacity.

At 80% Capacity

OMR.

Variable Overheads:

Indirect labor

12,000

4,000

Stores including spares

Semi-variable Overheads:

Power (30% fixed, 70% variable)

20,000

Repairs and maintenance (60% fixed, 40% variable)

2,000

Fixed Overheads:

11,000

Depreciation

3,000

Insurance

10,000

Salaries

62,000

Total Overheads

1,24,000 hrs.

Estimated direct labor hours

W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 0 Required information [The following information applies to the questions displayed below] Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct materials: 5 pounds at $11 per pound Direct labor: 3 hours at $12 per hour $ 55 36 Variable overhead: 3 hours at $7 per hour 21 Total standard cost per unit $ 112 The planning budget for March was based on producing and selling 21,000 units. However, during March the company actually produced and sold 26,600 units and incurred the following costs: a. Purchased 154,000 pounds of raw materials at a cost of $9.50 per pound. All of this material was used in production. b. Direct laborers worked 63,000 hours at a rate of $13 per hour. c. Total variable manufacturing overhead for the month was $510,930. 5. If Preble had purchased 178,000 pounds of materials at $9.50 per pound and used 154,000 pounds in production,…arrow_forwardParagraph Styles Question 1: WPC Company's Budget and actual costs per unit are provided below for the most recent period. During this period, 700 units were actually produced. Product Product Standard Cost Actual Cost Materials Unit Price Per Metre $2.00 $2.20 Metres Standard $10.00 Actual 5.2 $11.44 Direct labour Hours Hourly Rate $50 $5.50 Standard 3. $15.00 Actual 3.2 $17.60 Variable overhead Hours Hourly Rate Standard 4 $3.00 $12.00 $3.10 $13.02 Actual 4.2 Total unit cost $37.00 $42.06 Required: Given the information above, compute the following variances. Also indicate if the variances are favorable or unfavorable.arrow_forwardQuestion Content Area Skagit Company manufactures Hooks and Nooks. The following shows the activities per product and total activity information: Line Item Description Units Setups Inspections Assembly (dlh) Hooks 4,000 1 3 1 Nooks 8,000 2 2 1 Activity Total Activity - Base Usage Budgeted Activity Cost Setups 20,000 $60,000 Inspections 24,000 120, 000 Assembly (dlh) 28,000 420,000 The total factory overhead to be allocated to Nooks is a. $600, 000 b. $488,000 c. $400, 000 d. $300,000arrow_forward

- Budgeted variable factory overhead costs: $354,000 Budgeted production in units: 60,000 units Budgeted time: 2 direct labor hours per unit Allocation base: direct labor hours Actual production in units: 58,600 units Actual variable factory overhead costs incurred: $338,500 Actual direct labor hours used: 119,000 hours CALCULATE VARIABLE FACTORY OVERHEAD ALLOCATED: Allocated: $__________ CALCULATE VARIABLE FACTORY OVERHEAD SPENDING (PRICE) VARIANCE :…arrow_forwardSh1 Please help me. Thankyou.arrow_forwardDhapaarrow_forward

- Mi.2arrow_forwardUse the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Manuel Company predicts it will operate at 80% of its productive capacity. Its overhead allocation base is DLH and its standard amount per allocation base is 0.5 DLH per unit. The company reports the following for this period. Production (in units) Overhead Variable overhead Fixed overhead Total overhead Flexible Budget at 80% Capacity 50,250 Required 1 Required 2 $ 276,375 50, 250 $ 326,625 Exercise 21-18 (Algo) Volume and controllable variances LO P4 Actual Results 44,400 (1) Compute the overhead volume variance. Indicate variance as favorable or unfavorable. (2) Compute the overhead controllable variance. Indicate variance as favorable or unfavorable. Budgeted (flexible) overhead Standard overhead applied Volume variance $ 308,300 Complete this question by entering your answers in the tabs below. Volume Variance Compute the overhead volume variance.…arrow_forwardPresented below is a flexible manufacturing overhead budget for Ayayai Manufacturing, which manufactures fine timepieces: ✓ Activity Index: Standard direct labor hours 2,820 3,220 3,620 4,020 Variable costs Indirect materials $ 5,640 $ 6,440 $ 7,240 $ 8,040 Indirect labor 3,243 3,703 4,163 4,623 Utilities 7,332 8,372 9,412 10,452 Total variable 16,215 18,515 20,815 23,115 Fixed costs Supervisory salaries 1,210 1,210 1,210 1,210 Rent 2,815 2,815 2,815 2,815 Total fixed 4,025 4,025 4,025 4,025 Total costs $ 20,240 $ 22,540 $ 24,840 $ 27,140 The company applies the overhead on the basis of direct labor hours at $7.00 per direct labor hour and the standard hours per timepiece is 1/2 hour each. The company's actual production was 5,440 timepieces with 2,720 actual hours of direct labor. Normal capacity is 3,220 hours. Actual overhead was $20,400. (a) Compute the controllable and volume overhead variances. Identify whether each variance is favorable or unfavorable. (Round rate values to 2…arrow_forward

- 3arrow_forwardQ1. Prepare a Flexible budget for overheads on the basis of the following data. Ascertain the overhead rates at 70% and 80% capacity. Variable Overheads (60% capacity) Indirect Material = Rs. 6,000 Labour Rs. 18,000 Semi-variable overheads: Electricity (40% fixed) = Rs. 40,000 Repairs (80% fixed) = Rs. 2,400 Fixed Overheads: Depreciation Rs. 16,500 = Insurance = Rs. 4,500 Salaries= Rs. 20,000 Estimated Labour Hours 15,000 hrs = Earrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education