Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

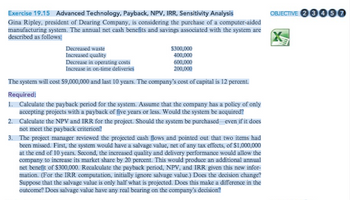

Transcribed Image Text:Exercise 19.15 Advanced Technology, Payback, NPV, IRR, Sensitivity Analysis

Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided

manufacturing system. The annual net cash benefits and savings associated with the system are

described as follows:

Decreased waste

Increased quality

Decrease in operating costs

600,000

Increase in on-time deliveries

200,000

The system will cost $9,000,000 and last 10 years. The company's cost of capital is 12 percent.

Required:

1. Calculate the payback period for the system. Assume that the company has a policy of only

accepting projects with a payback of five years or less. Would the system be acquired?

Calculate the NPV and IRR for the project. Should the system be purchased even if it does

not meet the payback criterion?

2.

$300,000

400,000

3.

The project manager reviewed the projected cash flows and pointed out that two items had

been missed. First, the system would have a salvage value, net of any tax effects, of $1,000,000

at the end of 10 years. Second, the increased quality and delivery performance would allow the

company to increase its market share by 20 percent. This would produce an additional annual

net benefit of $300,000. Recalculate the payback period, NPV, and IRR given this new infor-

mation. (For the IRR computation, initially ignore salvage value.) Does the decision change?

Suppose that the salvage value is only half what is projected. Does this make a difference in the

outcome? Does salvage value have any real bearing on the company's decision?

OBJECTIVE 23460

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- sac.3arrow_forward18arrow_forwardA manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forward

- Question 2 A firm is considering an investment project that has a cost of $1 million and is expected to generate an annual after-tax cash flow of $250,000 for five years. It has already spent $25,000 in research and development (R&D) costs for the project. If the firm's required rate of return is 14 percent and consider R&D a sunck cost, what is the NPV of this project? A $25,000 B -$141,750 C +141,750 D $858,250arrow_forward# 30 Investment Criteria A new furnace for a small factory will cost $27,00 a year to install and will require ongoing maintenance expenditures of $1,500 a year. But it is far more fuel efficient than the old one and will reduce the compounding of heating oil by 2400 gallons per year. Heating oil this year will cost $3.00 per gallon; the price per gallon is expected to increase by .50 per year for the next 3 years and stabilize for the foreseeable future. The furnace will last for 20 years at which point it will need to be replaced and will have no salvage value. The discount rate id 8 %. What is the NPV of the investment in the furnace? What is the IRR? What is the payback period?arrow_forward#27 * Finding the Internal Rate of Return (IRR) of an Investment: A company is considering buying a new piece of machinery that costs $8M and has a salvage value of $1.5M at the end of its 10-year useful life. The machinery nets $2.3M per year in annual revenues. MARR = 10%. The internal rate of return (IRR) on this investment is approximately _____________. A. 26% B. 31% C. 19% D. 16%arrow_forward

- Question 21 Petram is a company that manufactures aircraft parts. The company is considering various investment projects that may improve operational efficiency, and has already spent £30,000 gathering relevant data. It has now shortlisted three projects and asked you to recommend the best option. You have been provided with the following information about the projects: - Project I will last for 4 years. The initial outlay is £950,000 and the forecast operating cash inflow from the project is £350,000 for the first 2 years, £425,000 in year 3 and £150,000 in the last year. Annual depreciation expense associated with this project is £237,500. - Project II will last for 4 years. The initial outlay is £1,150,000 and the forecast operating cash inflow from the project is £550,000 in the first year and £350,000 for the following three years. Annual interest expense associated with this project is £45,000. - Project III will last for 4 years. The initial outlay is £850,000 and the forecast…arrow_forwardProblem #4: Budgets "UMPI Inc. is considering the purchase of a street paver machine for $225,000. The expected life of the machine will be three years, and it will have a salvage value of $25,000. Annual maintenance costs will total $7,500. Annual savings are predicted to be $92,500. The company's required rate of return is 8%. Ignoring the TVM, calculate the net cash inflow or outflow resulting from this investment opportunity. Be sure to prepare a schedule that clearly depicts the time frame of the cash flows. 1) Using the Present Value Factors for $1 at 8% noted above (table provided for reference), calculate the net present value of this investment (ignoring taxes) 2) Based on your answer in requirement 1: should UMPI purchase the street paver machine. Factors: Present Value of $1 (r=8%) Year 0 1.0000 Year 1 0.9259 Year 2 0.8573 Year 3 0.7938arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education