FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Need assistance in preparing the entry for the issuance os stocks under the following assumptions

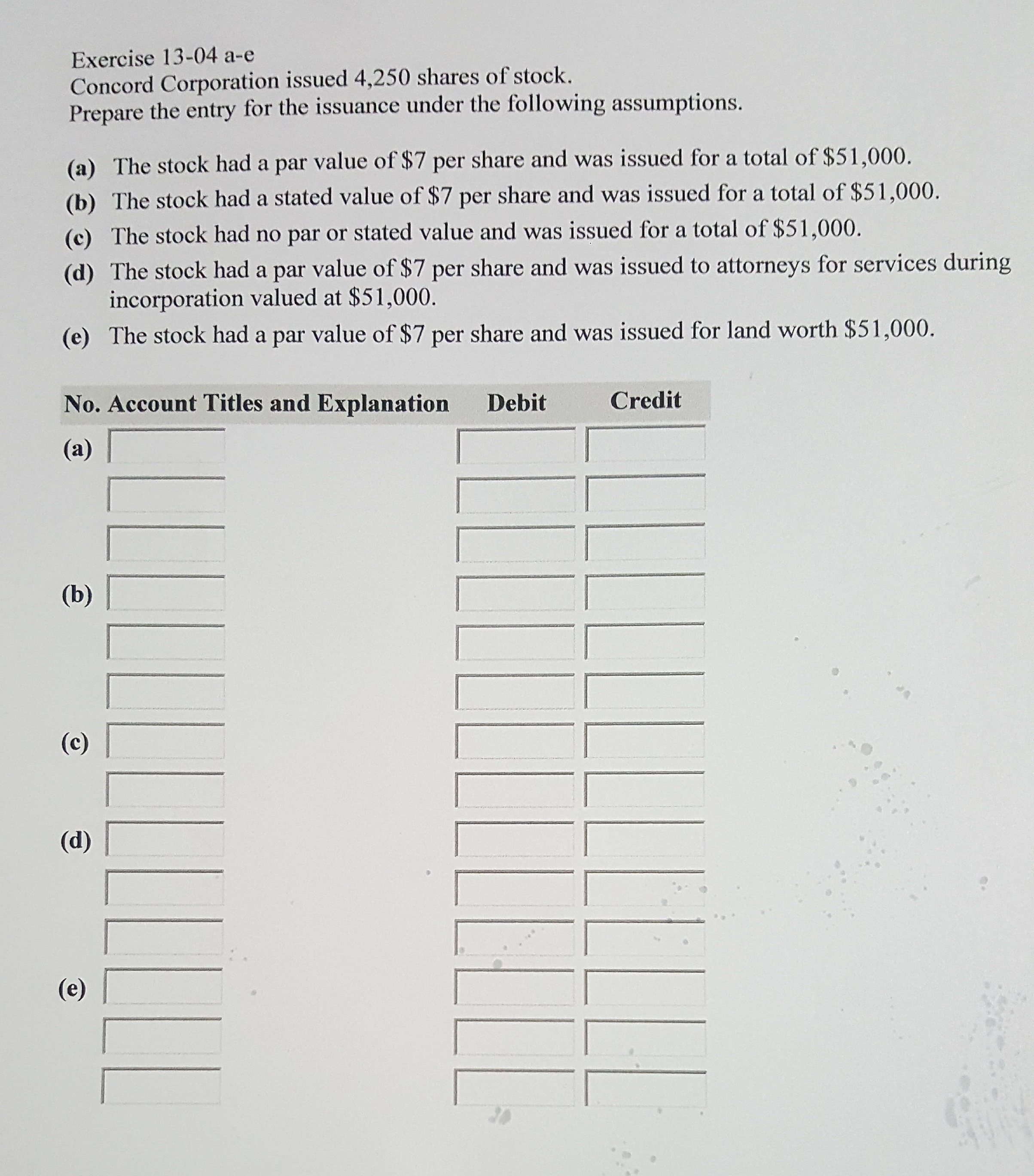

Exercise 13-04 a-e

Concord Corporation issued 4,250 shares of stock.

Prepare the entry for the issuance under the following assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,650.)

Prepare the entry for the issuance under the following assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,650.)

| (a) | The stock had a par value of $7 per share and was issued for a total of $51,000. | |

| (b) | The stock had a stated value of $7 per share and was issued for a total of $51,000. | |

| (c) | The stock had no par or stated value and was issued for a total of $51,000. | |

| (d) | The stock had a par value of $7 per share and was issued to attorneys for services during incorporation valued at $51,000. | |

| (e) | The stock had a par value of $7 per share and was issued for land worth $51,000. |

Transcribed Image Text:Exercise 13-04 a-e

Concord Corporation issued 4,250 shares of stock.

Prepare the entry for the issuance under the following assumptions.

(a) The stock had a par value of $7 per share and was issued for a total of $51,000.

(b) The stock had a stated value of $7 per share and was issued for a total of $51,000.

(c) The stock had no par or stated value and was issued for a total of $51,000.

(d) The stock had a par value of $7 per share and was issued to attorneys for services during

incorporation valued at $51,000.

(e) The stock had a par value of $7 per share and was issued for land worth $51,000.

No. Account Titles and Explanation

Debit

Credit

(a)

(b)

(c)

(d)

(e)

LLL!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress Concord Corporation has 43,500 shares of $12 par value common stock outstanding. It declares a 15% stock dividend on December 1 when the market price per share is $19. The dividend shares are issued on December 31. • Prepare the entries for the declaration and issuance of the stock dividend. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation ◆ Debit Credit 1000arrow_forwardQuestion Pharoah Inc. issued 12900 shares of no-par common stock with a stated value of $5 per share. The market price of the stock on the date of issuance was $15 per share. The entry to record this transaction includes a O credit to Common Stock for $64500. O debit to Paid-in Capital in Excess of Par for $193500. O debit to Cash for $64500. O credit to Common Stock for $193500. eTextbook and Media Ⓒ⠀arrow_forwardPrepare the journal entry to record Autumn Company’s issuance of 63,000 shares of no-par value common stock assuming the shares a. Sell for $29 cash per share. b. Are exchanged for land valued at $1,827,000.arrow_forward

- Please answer competelyarrow_forwardZen Aerospace Corporation reported the following equity account balances on December 31, 2022: Preferred shares, $3.60 cumulative, unlimited shares authorized Common shares, unlimited shares authorized, 23,500 shares issued and outstanding Retained earnings 648,600 331,000 In 2023, the company had the following transactions affecting shareholders and the shareholders' equity accounts: Jan. 1 Purchased and retired 2,700 common shares at $36 per share. 14 The directors declared an 9% share dividend distributable on February 5 to the January 30 shareholders of record. The shares were trading at $46.30 per share. 30 Date of record regarding the 9% share dividend. 5 Date of distribution regarding the 9% share dividend. Feb. July 6 Sold 5,700 preferred shares at $67 per share. Sept. 5 The directors declared a total cash dividend of $48,006 payable on October 5 to the September 20 shareholders of record. Oct. 5 The cash dividend declared on September 5 was paid. Dec. 31 Closed the $472,600…arrow_forwardA9arrow_forward

- Urmilabenarrow_forwardPrior to June 30, a company has never had any treasury stock transactions. The company repurchased 100 shares of its $1 par common stock on June 30 for $40 per share. On July 20, it reissued 50 of these shares at $46 per share. On August 1, it reissued 20 of the shares at $38 per share. What is the journal entry necessary to record the repurchase of stock on June 30? Mutiple Choice Debit Common Stock $4,000; credit Cash $4,000. Debit Common Stock $100; debit Treasury Stock $3,900; credit Cash $4,000. Debit Treasury Stock $3,900; debit Paid-in Capital, Treasury Stock $100; credit Cash $4,000. Debit Treasury Stock, Common $4,000; credit Cash $4,000. Debit Cash $4,000; credit Treasury Stock $4,000.arrow_forwardHaresharrow_forward

- Prepare the journal entry to record Autumn Company's issuance of 71,000 shares of no-par value common stock assuming the shares: a. Sell for $34 cash per share. b. Are exchanged for land valued at $2,414,000. View transaction list Journal entry worksheet 1 Record the issuance of 71,000 shares of no-par value common stock assuming the shares sell for $34 cash per share. 2 Note: Enter debits before credits. Transaction a. General Journal Debit Credit >arrow_forwardFinancial Statements from the End-of-Period Spreadsheet Demo Consulting is a consulting firm owned and operated by Jesse Flatt. The following end-of-period spreadsheet was prepared for the year ended August 31, 20V9: Demo Consulting End-of-Period Spreadsheet For the Year Ended August 31, 20Y9 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 10,710 10,710 Accounts Receivable 25,500 25,500 Supplies 2,700 2,270 430 Land 22,190 22,190 Office Equipment 20,910 20,910 Accumulated Depreciation 2,830 1,350 4,180 Accounts Payable 6,890 6,890 Salaries Payable 330 330 Common Stock 8,600 8,600 Retained Earnings 17,410 17,410 Dividends 3,320 3,320 Fees Earned 70,770 70,770 Salary Expense 19,130 330 19,460 Supplies Expense 2,270 2,270 Depreciation Expense 1,350 1,350 Miscellaneous Expense 2,040 2,040 106,500 106,500 3,950 3,950 108,180 108,180 Based on the preceding spreadsheet, prepare an income statement for Demo Consulting. Demo Consulting…arrow_forwardRiverbed Inc's $10 par value common stock is actively traded at a market price of $16 per share. Riverbed issues 6,000 shares to purchase land advertised for sale at $77,500. Journalize the issuance of the stock in acquiring the land. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education