FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

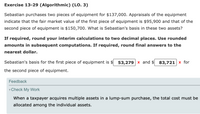

Transcribed Image Text:Exercise 13-29 (Algorithmic) (LO. 3)

Sebastian purchases two pieces of equipment for $137,000. Appraisals of the equipment

indicate that the fair market value of the first piece of equipment is $95,900 and that of the

second piece of equipment is $150,700. What is Sebastian's basis in these two assets?

If required, round your interim calculations to two decimal places. Use rounded

amounts in subsequent computations. If required, round final answers to the

nearest dollar.

Sebastian's basis for the first piece of equipment is $ 53,279 x and

$ 83,721 x for

the second piece of equipment.

Feedback

vCheck My Work

When a taxpayer acquires multiple assets in a lump-sum purchase, the total cost must be

allocated among the individual assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- pare.23arrow_forwardJulia currently is considering the purchase of some land to be held as an investment. She and the seller have agreed on a contract under which Julia would pay $1,000 per month for 60 months, or $60,000 total. The seller, not in the real estate business, acquired the land several years ago by paying $10,000 in cash. Two alternative interpretations of this transaction are (1) a price of $51,726 with 6 percent interest and (2) a price of $39,380 with 18 percent interest. Which interpretation would you expect each party to prefer? Why?arrow_forward1) Kristine sold one asset on March 20th of 2023. It was a computer with an original basis of $10,000, purchased in May of 2021 and depreciated under the half-year convention. What is Kristine's depreciation deduction for 2023? Note: Round final answer to the nearest whole number. Blank] Blank 1 Add your answerarrow_forward

- LO.2 During the year, Eugene had the four property transactions summarized below. Eugene is a collector of antique glassware and occasionally sells a piece to get funds to buy another. What are the amount and nature of the gain or loss from each of these transactions? Property Antique vase Date Date Adjusted Sales Acquired Sold Basis Price 06/18/12 05/23/23 $37,000 $42,000 Blue Growth Fund 12/23/14 11/22/23 22,000 38,000 (100 shares) Orange bonds 02/12/15 04/11/23 34,000 42,000 Green stock (100 02/14/23 11/23/23 11,000 13,000 shares)arrow_forward(a) Your answer is partially correct. Journalize the admission of Terrell under each of the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to O decimal places, e.g. 5,275.) (1) Terrell purchases 50% of Pinkston's ownership interest by paying Pinkston $16,960 in cash. (2) Terrell purchases 33¹/3% of Lamar's ownership interest by paying Lamar $15,900 in cash. (3) Terrell invests $65,720 for a 30% ownership interest, and bonuses are given to the old partners. (4) Terrell invests $44,520 for a 30% ownership interest, which includes a bonus to the new partner. No. Account Titles and Explanation 1. J. Pinkston, Capital 2. J. Terrell, Capital C. Lamar, Drawings 3. Cash J. Terrell, Capital G. Donley, Capital C. Lamar, Capital J. Pinkston, Capital 4. G. Donley, Capital C. Lamar, Capital J. Pinkston, Capital J. Terrell, Capital eTextbook and Media Debit Creditarrow_forwardRiker receives $43,000 from Troy as payment for a vehicle that has a fair value of $54,300. The $43,000 constitutes full payment for the vehicle as specified in the sales contract. Assume that the time value of money is viewed as significant for this contract. Required: (a) Did Troy pay Riker before or after delivery of the vehicle? (b) Prepare the journal entry Riker would make to record receipt of Troy’s payment, assuming no interest revenue or interest expense had been recorded previously. (c) Prepare the journal entry Riker would make to record delivery of the vehicle, assuming no interest revenue or interest expense had been recorded previously.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education