FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

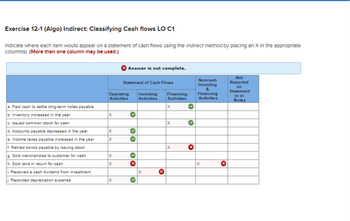

Transcribed Image Text:Exercise 12-1 (Algo) Indirect: Classifying Cash flows LO C1

Indicate where each item would appear on a statement of cash flows using the Indirect method by placing an X In the appropriate

column(s). (More than one column may be used.)

a. Paid cash to settle long-term notes payable

b. Inventory increased in the year

c. Issued common stock for cash

d. Accounts payable decreased in the year

e. Income taxes payable increased in the year

f. Retired bonds payable by issuing stock

g. Sold merchandise to customer for cash

h. Sold land in return for cash

i. Received a cash dividend from investment

j. Recorded depreciation expense

X

Operating Investing

Activities Activities

X

X

X

X

Answer is not complete.

X

Statement of Cash Flows

>

X

Financing

Activities

X

X

X

x

Noncash

Investing

&

Financing

Activities

X

x

Not

Reported

on

Statement

or in

Notes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject :- Accountingarrow_forward1 2:01:48 look int rences Exercise 12-1 (Algo) Indirect: Classifying Cash flows LO C1 Indicate where each item would appear on a statement of cash flows using the indirect method by placing an X in the a column(s). Note: More than one column may be used. a. Purchased treasury stock with cash b. Accounts receivable decreased in the year c. Issued bonds in return for cash d. Inventory increased in the year e. Recorded depreciation expense 1. Purchased land by issuing common stock g. Prepaid expenses increased in the year h. Purchased a building with cash 1. Sold merchandise to customer for cash j. Received a cash dividend from investment Operating Investing Activities Activities X Statement of Cash Flows [x Financing Activities Noncash Investing & Financing Activities Not Reported on Statement or in Notesarrow_forwardTB MC Qu. 12-133 In preparing a company's statement... In preparing a company's statement of cash flows using the Indirect method, the following information is available: Net income Accounts payable increased by Accounts receivable decreased by Inventories increased by Depreciation expense Net cash provided by operating activities was: Multiple Choice $120,000. $60,000. $70,000. $80,000. $130,000. $52,000 18,000 25,000 5,000 30,000arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 A Required: a. b. C. B What was the consolidated cash balance at January 1, 20X2? Note: Use cell A2 from the given information to complete this question. Balance at December 31, 20X2 Decrease in cash balance during 20X2: Cash flows from operations Cash outflows for investment activities In its consolidated cash flow statement for the year ended December 31, 20X2, Durango Corporation reported operating cash inflows of $284,000, financing cash outflows of $230,000, investing cash outflows of $80,000, and an ending cash balance of $57,000. Durango purchased 70 percent of Steam Company's common stock on March 12, 20X1, at book value. Steam reported net income of $30,000, paid dividends of $10,000 in 20X2, and is included in Durango's consolidated statements. Durango paid dividends of $45,000 in 20X2. The indirect method is used in computing cash flow from operations. Cash outflow for financing activities Net cash…arrow_forward7arrow_forward

- Please do not give solution in image format thankuarrow_forwardMC Qu. 12-124 The net cash flow provided by.. The net cash flow provided by operating activitles is an Inflow of $37,042, the net cash flow used in Investing activities is $16,831, and the net cash flow used in financing activities is $26,397. If the beginning cash account balance is $11,283, what is the ending cash account balance? Multiple Choice $27.476 ($6.186) $38,759 $5,097arrow_forwardLO 1, 3, 4 Problem 12-17B Preparing a statement of cash flows The following information can be obtained by examining a company's balance sheet and income statement information. a. Gains recognized on the sale of noncurrent assets. b. Cash outflows to pay dividends. c. Cash inflows from the issue of common stock. d. Cash inflows from the sale of noncurrent assets. e. Increases in current liability account balances. f. Cash inflows from the issue of noncurrent debt. g. Losses incurred from the sale of noncurrent assets. h. Decreases in noncash current asset account balances. i. Cash outflows to repay noncurrent debt. j. Increases in noncash current asset account balances. k. Cash outflows made to purchase noncurrent assets. 1. Decreases in current liability account balances. m. Noncash expenses (e.g., depreciation). n. Cash outflows to purchase treasury stock. Required Construct a table like the one shown below. For each item, indicate whether it would be used in the computation of net…arrow_forward

- refer to the photoarrow_forward5 Required information Exercise 12-10A (Algo) Determining cash flows from investing activities LO 12-3 [The following information applies to the questions displayed below.] The following accounts and corresponding balances were drawn from Delsey Company's Year 2 and Year 1 year-end balance sheets: Account Title Investment securities Machinery Land Year 2 $ 103,400 521,300 145, 100 Year 1 $ 114,400 425, 100 91,800 Other information drawn from the accounting records: 1. Delsey incurred a $1,330 loss on the sale of investment securities during Year 2. 2. Old machinery with a book value of $4,130 (cost of $25,010 minus accumulated depreciation of $20,880) was sold. The income statement showed a gain on the sale of machinery of $4,980, 3. Delsey did not sell land during the year.arrow_forwardDive In Company was started several years ago by two diving instructors. The company's comparative balance sheets and income statement, as well as additional information, are presented below. Balance Sheet at December 31 Cash Accounts Receivable. Prepaid Rent Total Assets Salaries and Wages Payable Common Stock Retained Earnings Total Liabilities and Stockholders' Equity Income Statement Service Revenue Salaries and Wages Expense Rent and Office Expenses Net In Current Year $ 3,340 1,100 110 $ 4,550 $ 400 1,300 2,850 $ 4,550 $ 35,050 31,000 3,700 $ 350 Previous Year Additional Data: a. Rent is paid in advance each month, and Office Expenses are paid in cash as incurred. b. An owner contributed capital by paying $250 cash in exchange for the company's stock. $ 4,145 550 55 $4,750 $ 1,200 1,050 2,500 $4,750arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education