FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

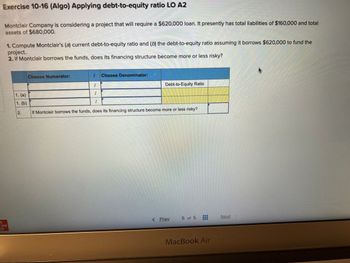

Transcribed Image Text:**Exercise 10-16 (Algo) Applying Debt-to-Equity Ratio LO A2**

Montclair Company is considering a project that will require a $620,000 loan. It presently has total liabilities of $160,000 and total assets of $680,000.

1. Compute Montclair’s (a) current debt-to-equity ratio and (b) the debt-to-equity ratio assuming it borrows $620,000 to fund the project.

2. If Montclair borrows the funds, does its financing structure become more or less risky?

**Table: Calculation of Debt-to-Equity Ratio**

| Choose Numerator: | Choose Denominator: | Debt-to-Equity Ratio |

|-------------------|---------------------|----------------------|

| 1. (a) | | |

| 1. (b) | | |

| 2. If Montclair borrows the funds, does its financing structure become more or less risky? | |

(Note: The table includes fields to calculate the debt-to-equity ratio before and after borrowing. The first row is for current calculation, and the second row assumes after borrowing. The last row asks about the risk assessment.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- QS 11-17 (Algo) Net present value of annuity and salvage value LO P3 Pablo Company is considering buying a machine that will yield income of $3,100 and net cash flow of $14,700 per year for three years. The machine costs $45,900 and has an estimated $11,100 salvage value. Pablo requires a 10% return on its investments. Compute the net present value of this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your present value factor to 4 decimals.) Years 1-3 Year 3 salvage Totals [Initial investment Net present value Net Cash Flows X PV Factor 14,700 x 11,100 x $ S = = Present Value of Net Cash Flows $ 0 0arrow_forwardAssignment: Chapter 11 Cost of Capital Attempts 2. An overview of a firm's cost of debt Keep the Highest/3 To calculate the after-tax cost of debt, multiply the before-tax cost of debt by Three Waters Company (TWC) can borrow funds at an interest rate of 12.50% (2+T)od of four years. Its marginal federal-plus-state tax rate is 40%. TWC's after-tax cost of debt is (rounded to two decimal(1-T) At the present time, Three Waters Company (TWC) has 10-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,278.41 per bond, carry a coupon rate of 11%, and distribute annual coupon payments. The company incurs a federal- plus-state tax rate of 40%. If TWC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to tw decimal places)? O4.22% O 3.80 % O 5.06% 4.85%arrow_forwardDomesticarrow_forward

- Problem 8-23 Profitability Index (LO3) Consider the following projects: Co C₁ -$ 2,450 +$ 2,350 -2,450 +1,790 Project A B a. Calculate the profitability index for A and B assuming a 23% opportunity cost of capital. Note: Do not round intermediate calculations. Round your answers to 4 decimal places. Project A B C₂ +$ 1,550 +1,798 Profitability index ооо b. According to the profitability index rule, which project(s) should you accept? Project A Project B Both ONeitherarrow_forward28 cton 1 Lawrence Corporation is considering the purchase of a new piece of equipment. When discounted at the cost of capital of 17%, the project has a net present va $24,670. When discounted at rate of 21%, the project has a net present value of $(29,010). The Internal rate of return of the project is: О zero Multiple Choice between 17% and 21% greater than % between zero and 17%arrow_forwardI need help with thisarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education