FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

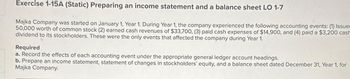

Transcribed Image Text:Exercise 1-15A (Static) Preparing an income statement and a balance sheet LO 1-7

Majka Company was started on January 1, Year 1. During Year 1, the company experienced the following accounting events: (1) Issues

50,000 worth of common stock (2) earned cash revenues of $33,700, (3) paid cash expenses of $14,900, and (4) paid a $3,200 cash

dividend to its stockholders. These were the only events that affected the company during Year 1.

Required

a. Record the effects of each accounting event under the appropriate general ledger account headings.

b. Prepare an income statement, statement of changes in stockholders' equity, and a balance sheet dated December 31, Year 1, for

Majka Company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determining Retained Earnings and Net Income The following information appears in the records of Bock Corporation at year-end: Accounts Receivable $23,000 Retained Earnings ? Accounts Payable 00 Supplies Cash Common Stock 110,000 9,000 8,000 Equipment, net 154,000 a. Calculate the balance in Retained Earnings at year-end $ 0 b. If the amount of the retained earnings at the beginning of the year was $30,000 and $12,000 in dividends is paid during the year, calculate net income for the year. $42,000arrow_forwardVipul barrow_forwardDetermining Cash Paid to Stockholders The board of directors declared cash dividends totaling $585,000 during the current year. The comparative balance sheet indicates dívidends payable of $167,625 at the beginning of the year and $146,250 at the end of the year. What was the amount of cash paid to stockholders during the year? %$4 %24arrow_forward

- PURRFECT PETS, INC. Balance Sheet at June 30, Year 1 Assets Liabilities Cash $ 732,700 Accounts Payable $ 349,100 Accounts Receivable 419,300 Notes Payable due June 30, Year 3 268,900 Supplies 58,410 Total Liabilities 618,000 Equipment 118,600 Other Assets 69,410 Stockholders' Equity Common Stock 662,000 Retained Earnings 118,420 Total Stockholders' Equity 780,420 Total Assets $ 1,398,420 Total Liabilities & Stockholders’ Equity $ 1,398,420 How much financing did the stockholders of Purrfect Pets, Inc., directly contribute to the company?arrow_forwardSubject: accountingarrow_forwardJesse and Mason Fabricating, Inc. general ledger has the following account balances at the end of the year: What is the total ending balance as reported on the company’s Statement of Stockholder’s Equity?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education