FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:EXERC

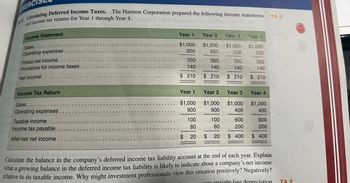

13 Calculating Deferred Income Taxes.

The Harmon Corporation prepared the following income statements TA 2

and income tax returns for Year 1 through Year 4.

Income Statement

Sales...

Operating expenses

..

Pretax net income.

Provisions for income taxes.

Net income..

Income Tax Return

Sales....

Operating expenses...

Taxable income

Income tax payable ...

After-tax net income....

I

..

..

Year 1

$1,000

650

350

140

$ 210

Year 1

$1,000

900

SA

$

100

80

20

Year 2

$1,000

650

350

140

$ 210

Year 2

$1,000

900

100

Hoy 80

$20

Year 3

$1,000

650

350

140

$ 210

Year 3

$1,000

400

$1,000

650

$

350

140

|

210

Year 4

$1,000

400

600

600

200

200

$ 400 $ 400

von Wand Insol a

Calculate the balance in the company's deferred income tax liability account at the end of each year. Explain

what a growing balance in the deferred income tax liability is likely to indicate about a company's net income

relative to its taxable income. Why might investment professionals view this situation positively? Negatively?

uses straight-line depreciation

TA 2

Homework

MBO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required Answer each of the following questions by providing supporting computations. 1. Assume that the company’s income tax rate is 30% for all items. Identify the tax effects and after-tax amounts of the three items labeled pretax. 2. Compute the amount of income from continuing operations before income taxes. What is the amount of the income tax expense? What is the amount of income from continuing operations? 3. What is the total amount of after-tax income (loss) associated with the discontinued segment? 4. What is the amount of net income for the year?arrow_forwardOn January 1, 2016, Pilsner Company acquired an 80% interest in Smalley Company for $3,600,000. On that date, Smalley Company had retained earnings of $800,000 and common stock of $2,800,000. The book values of assets and liabilities were equal to fair values except for the following: Book Value Fair Value Inventory $ 50,000 $ 85,000 Equipment (net) 540,000 720,000 Land 300,000 660,000 The equipment had an estimated remaining useful life of 8 years. One-half of the inventory was sold in 2016 and the remaining half was sold in 2017. Smalley Company reported net income of $240,000 in 2016 and $300,000 in 2017. No dividends were declared or paid in either year. Pilsner Company uses the cost method to record its investment in Smalley Company. Required: Prepare, in general journal form, the workpaper eliminating entries necessary in the consolidated statements workpaper for the year ending December 31, 2017.arrow_forwardHELLO KINDLY HELP ME TO ANSWER THE QUESTIONS. THANK YOU :)arrow_forward

- d cion The table given below shows the absolute tax amounts under five different tax policies for respective income levels. Table 19.2 Annual Pretax Income Tax Policy Alpha O Gamma. Alpha. SO $0 $0 $0 $0 $10,000 $1,000 $1,000 $1,000 $1,000 $1,000 $50,000 $5,000 $6,000 $4,000 $1,000 $900 $100,000 $10,000 $15,000 $6,000 $1,000 $800 Beta. O Eta. Refer to Table 19.2. The tax structure which leads to maximum income inequality is: Delta. Tax Policy Beta Question 18 Tax Policy Gamma 27 Tax Policy Delta Tax Policy Eta $0 tv 9 N 4.nts. Narrow_forwardPlease only type answer Explain step by steparrow_forwardMarginal tax rates Using the tax rate schedule given here, perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $14,700; $59,500; $89,600; $156,000; $247,000; $456,600; and $1 million. b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis).arrow_forward

- Required information Exercise 9-4A (Algo) Recognizing sales tax payable LO 9-2 [The following information applies to the questions displayed below.] The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,500 plus sales tax of 8 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $81,500 plus sales tax of 8 percent. Exercise 9-4A (Algo) Part e e. On which financial statement will the sales tax liability appear? The liability is shown on thearrow_forwardExample 4-9 From the above example, if you indicate separately on Robinson’s paycheck stub the amount of each payment, the amount of federal income tax to be withheld is computed as follows: Taxes Withheld Regular monthly earnings $2,400 $ 37.00 (from wage-bracket tax tables*) Quarterly bonus 4,600 1,012.00 ($4,600 × 22%) Totals $7,000 $ 1,049.00 The calculation of Robinson’s federal income tax for the quarter would be computed as follows: Taxes Withheld Regular monthly earnings $2,400 $37.00 × 3 months = $ 111.00 (from wage-bracket tables*) Quarterly bonus 4,600 1,012.00 ($4,600 × 22%) $1,123.00 *The percentage table could also be used. Note: OASDI and HI withholdings are calculated on total earnings per pay period multiplied by number of pay periods and then added together to arrive at a quarter’s total withholding. Quarterly and year-to-date information would appear on Robinson’s employee earnings record. The…arrow_forwardNonearrow_forward

- Accounting income or loss for Aberdeen Corporation, following IFRS, is below: Year Accounting income/(loss) Tax rate percent Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 $160,000 250,000 80,000 (160,000) (380,000) 130,000 145,000 30 30 25 25 25 25 25 Assume that there were no permanent or temporary differences between accounting and taxable income. Required Prepare the tax-related journal entries for Year 3 to Year 7. Aberdeen Corporation believes that it will be able to use any loss carryforward in future years. Aberdeen Corporation will apply the available carryback provisions to the earliest years first. Include your calculations.arrow_forwardMarginal tax rates Using the tax rate schedule attached Perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $16,800; $59,500; $89,600; $151,000; $245,000; $451,200; $1,000,000 b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis).arrow_forward1. Given the following information, calculate the tax liability for year 1. The Net Operating Income is $97,200. Capital Expenditure is $8,500. Interest is $51,219. Principal is $8,852. Depreciation $21,662. Amortized Financing Costs is 792. Ordinary tax rate is 35%. $26,059 $9,488 $11,209 $27,640arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education