Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Marginal tax rates Using the tax rate schedule given here, perform the following:

a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $14,700; $59,500;

$89,600; $156,000; $247,000; $456,600; and $1 million.

b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis).

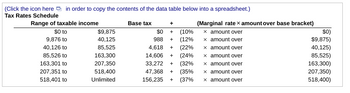

Transcribed Image Text:(Click the icon here in order to copy the contents of the data table below into a spreadsheet.)

Tax Rates Schedule

Base tax

Range of taxable income

$0 to

9,876 to

40,126 to

85,526 to

163,301 to

207,351 to

518,401 to

$9,875

40,125

85,525

163,300

207,350

518,400

Unlimited

+

$0 + (10%

988 + (12%

+ (22%

(24%

(32%

(35%

(37%

4,618

14,606 +

33,272 +

47,368 +

156,235 +

(Marginal rate x amount over base bracket)

x amount over

x amount over

x amount over

x amount over

x amount over

x amount over

x amount over

$0)

$9,875)

40,125)

85,525)

163,300)

207,350)

518,400)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Show detailed solutionarrow_forward(Corporate income tax) Boisjoly Productions had taxable income of $19.9 million. a. Calculate Boisjoly's federal income taxes by using the corporate tax rate structure in the popup window, b. Now calculate Boisjoly's average and marginal tax rates. c. What would Boisjoly's federal income taxes be if its taxable income was $29.3 million? d. Now calculate Boisjoly's average and marginal tax rates with taxable income of $29.3 million. a. Calculate Boisjoly's federal income taxes. The total tax due is $. (Round to the nearest dollar.)arrow_forwardTable 1.4 Use the following tax rates and income brackets to answer the following question(s). Tax Rate Individual Returns 10% $0 to $8,350 15% $8,351 to $33,950 $33,951 to $82,250 $82,251 to $171,550 $171,551 to $372,950 Over $372,951 25% 28% 33% 35% Joint Returns $0 to $16,700 $16,701 to $67,900 $67,901 to $137,050 $137,051 to $208,850 $208,851 to $372,950 $16,750 $18,836 $22,425 $25,116 Over $372,951 Josh earned $89,700 in taxable income and files an individual tax return. What is the amount of Josh's taxes for the year?arrow_forward

- Using the tax rate schedule given here LOADING..., perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $ 15 000; $ 60 000; $ 90 000; $ 150 000; $ 250 000; $ 450 000; and $1 million. b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis) $0 to $9,875 $0 (10% amount over $0) 9,876 to 40, 125 988 + (12% amount over 9, 876) 40, 126 to 85, 525 4,618 + (22% amount over 40, 126) 85,526 to 163, 300 14, 606 + (24% amount over 85, 526) 163, 301 to 207, 350 33, 272 + (32% amount over 163, 301) 207, 351 to 518, 400 47,368 (35% amount over 207, 351) 518,401 to Unlimited 156, 235 (37% amount over 518, 401)arrow_forwardWhat is the tax on a property with an assessed value of $88,700 if the tax rate is 4.5% of the assessed value? Property tax = $(Round to the nearest cent.)arrow_forwardwhich of these two has a higher after-tax yield, assuming a 21% income tax bracket? a. 4.00% taxable b. 3.25% tax-free bandarrow_forward

- I am working on creating an excel sheet using tax brackets. Can you please assist me with an excel formula that would automatically calculate the tax with the following bracket: Cumulative Tax Income Less than 22,000 22,000 89,450 190,750 364,200 462,500 693,750 Rate 10% 12% 22% 24% 32% 35% 37% $2,200 10,294 32,580 74,208 105,664 186,602 My objective is to determine net income after taxes. I need to determine the formula so I can automatically calculate tax based on the respective tax rates when typing in their income. I have figured out the other part, but am not sure with the IF/Then formula. Thank you! Taxable Income 72,300 Federal Income Tax ??????arrow_forwardFirst, explain the difference between marginal and average tax rates. Looking at a recent statement for Nvidia what is their marginal tax bracket? Provide a link to a recent income statement and current tax rates that you used.arrow_forwardCalculate the federal income tax liability, marginal tax rate, and average tax rate for each of the following scenarios. Assume the following for all scenarios: all income is traditionally earned, the maximum allowable standard deduction is taken, and no other deductions/credits are appliedarrow_forward

- . What is the 'low income tax offset' (LITO)? What is the maximum LITO amount payable toeligible taxpayers? PLEASE PUT 3 REFERENCESarrow_forwardA tax that requires a higher-income person to pay a higher percentage of his or her income in taxes is called a ____ tax. a. proportional b. progressive c.marginal d. regressivearrow_forwardThe equivalent after-tax return for an investment is computed a O ● Pretax return / (1 - tax rate) O Pretax return / tax rate Pretax return * tax rate O Pretax return * (1 - tax rate)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education