FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Executive officers of Adams Company are wrestling with their budget for the next year. The following are two different sales estimates provided by two difference sources.

| Source of Estimate | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | ||||||||

| Sales manager | $ | 378,000 | $ | 316,000 | $ | 271,000 | $ | 480,000 | ||||

| Marketing consultant | 512,000 | 469,000 | 403,000 | 648,000 | ||||||||

Adams’s past experience indicates that cost of goods sold is about 60 percent of sales revenue. The company tries to maintain 15 percent of the next quarter’s expected cost of goods sold as the current quarter’s ending inventory. This year’s ending inventory is $30,000. Next year’s ending inventory is budgeted to be $31,000.

Required

-

Prepare an inventory purchases budget using the sales manager’s estimate.

-

Prepare an inventory purchases budget using the marketing consultant’s estimate.

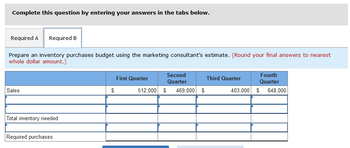

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A Required B

Prepare an inventory purchases budget using the marketing consultant's estimate. (Round your final answers to nearest

whole dollar amount.)

Sales

Total inventory needed

Required purchases

$

Second

Quarter

512,000 $ 469,000 $

First Quarter

Fourth

Quarter

403,000 $648,000

Third Quarter

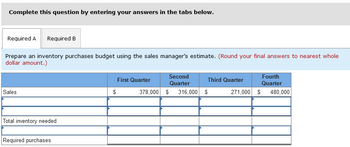

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A Required B

Prepare an inventory purchases budget using the sales manager's estimate. (Round your final answers to nearest whole

dollar amount.)

Sales

Total inventory needed

Required purchases

$

Second

Quarter

378,000 $ 316,000 $

First Quarter

Fourth

Quarter

271,000 $ 480,000

Third Quarter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The South Division of Novak Company reported the following data for the current year. Sales $3,050,000 Variable costs 2,013,000 Controllable fixed costs 610,000 Average operating assets 5,000,000 Top management is unhappy with the investment center’s return on investment (ROI). It asks the manager of the South Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action. 1. Increase sales by $300,000 with no change in the contribution margin percentage. 2. Reduce variable costs by $150,000. 3. Reduce average operating assets by 4.00%. (a) Compute the return on investment (ROI) for the current year. (Round ROI to 2 decimal places, e.g. 1.57%.) Return on Investment enter the return on investment in percentages % (b) Using the ROI equation, compute the ROI under each of the proposed courses of action. (Round ROI to 2 decimal places, e.g. 1.57%.)…arrow_forwardAs sales manager, Joe Batista was given the following static budget report for selling expenses in the Clothing Department of Soria Company for the month of October. Sales in units Variable expenses Sales commissions Advertising expense Travel expense Free samples given out Total variable Fixed expenses Rent Sales salaries Office salaries Depreciation-autos (sales staff) Total fixed SORIA COMPANY Clothing Department Budget Report For the Month Ended October 31, 2020 Total expenses Budget 7,500 $1,950 975 3,600 1,200 7,725 1,500 1,300 900 600 4,300 $12,025 Actual 11,000 1,210 3,850 1,540 $2,970 $1,020 Unfavorable 9,570 1,500 1,300 900 600 4,300 Difference Favorable Unfavorable Neither Favorable nor Unfavorable 3,500 Favorable 235 Unfavorable 250 Unfavorable 340 Unfavorable -0- 1,845 Unfavorable -0- Neither Favorable nor Unfavorable Neither Favorable nor Unfavorable -0- Neither Favorable nor Unfavorable -0- Neither Favorable nor Unfavorable -0- Neither Favorable nor Unfavorable $13,870…arrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month’s budget appear below: Selling price per unit $ 23 Variable expense per unit $ 13 Fixed expense per month $ 8,300 Unit sales per month 980 Required: 1. What is the company’s margin of safety? (Do not round intermediate calculations.) 2. What is the company’s margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. .1234 should be entered as 12.34).)arrow_forward

- PLEASE ANSWER WITH A STEP BY STEP SOLUTIONarrow_forwardMolander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ $ $ 7,920 1,030 27 18 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) 1. Margin of safety (in dollars) 2. Margin of safety percentage %arrow_forwardMunabhaiarrow_forward

- olander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month’s budget appear below: Selling price per unit $ 30 Variable expense per unit $ 13 Fixed expense per month $ 14,110 Unit sales per month 980 Required: 1. What is the company’s margin of safety? (Do not round intermediate calculations.) 2. What is the company’s margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places (i.e. .1234 should be entered as 12.34).)arrow_forwardTwo businesses, P Ltd. and Q Ltd. sell the same type of product in the same type of market. Their budgeted profit and loss accounts for the coming year are as under: P Ltd. (Rs.) Q. Ltd. (Rs.) Sales 150000 150000 Variable Cost 120000 100000 Fixed cost 15000 35000 Budgeted Net profit 15000 15000 You are required to: Calculate the break-even point for each business Calculate the sales volume at which each business will earn Rs.5,000 Profit. State which business is likely to earn greater profit in conditions of: Heavy demand for the product Low demand for the product,and,briefly give your argument as well.arrow_forwardPlease explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forward

- Executive officers of Munoz Company are wrestling with their budget for the next year. The following are two different sales estimates provided by two different sources. Source of Estimate Sales manager Marketing consultant First Quarter $ 388,000 517,000 Complete this question by entering your answers in the tabs below. Sales Munoz's past experience indicates that cost of goods sold is about 60 percent of sales revenue. The company tries to maintain 20 percent of the next quarter's expected cost of goods sold as the current quarter's ending Inventory. This year's ending Inventory is $35,000. Next year's ending Inventory is budgeted to be $36,000. Required a. Prepare an Inventory purchases budget using the sales manager's estimate. b. Prepare an Inventory purchases budget using the marketing consultant's estimate. Required A Required B Prepare an inventory purchases budget using the sales manager's estimate. Note: Round your final answers to nearest whole dollar amount. Total inventory…arrow_forwardPlease answer in text form without imagearrow_forwardBramble Company manufactures a variety of tools and industrial equipment. The company operates through three divisions. Each division is an investment center. Operating data for the Home Division for the year ended December 31, 2022, and relevant budget data are as follows. Actual Comparison with Budget Sales $1,400,000 $101,000 favorable Variable cost of goods sold 680,000 56,000 unfavorable Variable selling and administrative expenses 124,000 24,000 unfavorable Controllable fixed cost of goods sold 171,000 On target Controllable fixed selling and administrative expenses 81,000 On target Average operating assets for the year for the Home Division were $2,000,000, which was also the budgeted amount. Prepare a responsibility report for the home division.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education